Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with... VIG

December 5, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

Today's edition will go through a complete overview of last week's madness as well as some highlights from the Credit Suisse tech conference.

Today's Letter

US Equity Market

News Stories Moving the Markets

Summary from Credit Suisse Tech Conference

Earnings Calendar

Notable Upgrades/Downgrades

Trending Tickers

US Equity Market

Stocks posted a strong relief rally on Monday as many investors took the view that Friday’s moves were overdone; However S&P500 and Nasdaq closed just ~1% from ATHs on Monday

Tech the standout performer on Monday driven by Semis (+4%), TSLA (+5%), and FANG+ (+2%). From a factor perspective, Momo led, Inflation/Value lagged; Cyclicals performed better over Defensives

However overnight on Monday an FT story with the Moderna CEO Stephane Bancel led to markets trading sharply lower overnight and into Tuesday’s trading session following his sobering comments on the topic of the Omicron COVID variant.

Bancel suggested that

Existing vaccines may be less effective at tackling Omicron than earlier variants

It could take months to scale up a vaccine to the new variant (pointing to 1bn doses by summer '22)

Bancel’s comments on lowered vaccine efficacy is consistent with comments from WHO/scientific community given the c. 32 mutations on the spike protein.

Stocks then gapped lower again on Tuesday following hawkish comments from Fed Chair Powell. Powell said it's time to retire the word "transitory" when describing inflation and that it's appropriate to discuss at the next policy meeting about wrapping up the taper more quickly. Investors were caught off guard because there was a thought that the Omicron variant would presumably encourage the Fed to be more patient with tapering. Instead, the Fed chair suggested he was more concerned about tailoring policy to keep inflation pressures in check. Of course, a speedier taper plan means the Fed could hike rates sooner than previously expected. The CME FedWatch Tool increased the probabilities for a rate hike in May 2022 (44.4%) and June 2022 (69.2%). Regarding government funding and debt ceiling, there were positive comments from McConnell on having discussions with Schumer and McConnell says that the US will not default.

The S&P 500 (-1.9%), Dow Jones Industrial Average (-1.9%), and Russell 2000 (-1.9%) each declined 1.9% while the Nasdaq Composite lost 1.6% on Tuesday

All 11 S&P 500 sectors closed lower with losses ranging from 1.0% (information technology) to 3.0% (communication services). The relative outperformance of the tech sector was due to a 3% gain in Apple (+3.2%) amid some defensive positioning, which was further evident in a nine-basis-point decline in the 10-yr yield (1.44%).

On Wednesday S&P was 1.1% lower on the day (4,513).

The announcement of the first US Omicron case, negated the positive ADP and ISM, caused the sell off. Overall volumes tracked 27% above the 30 dma as treasuries rallied.

Communication services, industrials and consumer discretionary were the worst performing sectors with defensive sectors like healthcare and utilities the best.

Thee VIX has more than doubled in the last 3 weeks.

On Thursday The S&P 500 rose 1.4% on Thursday, bouncing back from two days of sharp losses. The Dow Jones Industrial Average (+1.8%) and Russell 2000 (+2.7%) outperformed the benchmark index, while the Nasdaq Composite underperformed on a relative basis with a 0.8% gain.

Supportive factors included 1) a bargain-hunting mindset amid an increasing number of stocks trading near 52-week lows, 2) a view that the Omicron variant might not be as bad as feared after the second reported case in the U.S. produced mild symptoms in a vaccinated person like the first case, and 3) a recognition that the S&P 500 reclaimed its 50-day moving average (4543).

The week ended on a negative turn with S&P down -0.84% and nasdaq -1.92%. Unprofitable tech was a major casualty on Friday as extremely elevated multiples continue to compress aggressively.

Before we get into the rest of the letter here's a message from our sponsor, VIG.

Ride Momentum Trades with VIG

When it comes to momo stocks a must-have are the premium analytics behind VIG. They have an extensive list of tools that can be used with almost any kind of investing style. Whether you are day-trading or a long-term investor VIG has you covered with top-class charting, gamma exposure, alerts, and their most powerful feature of unusual options activity combined with the sentiment behind the tape.

The platform offers advanced analytics based on real-time market data in a way that’s easy to understand. VIG is a great way to get an edge in an already volatile market, so stop guessing and start winning.

Download the free app today or take the platform for a spin on the 7-day free trial.

News Stories Moving the Markets

Omicron Variant

WHO announced this week that a new COVID variant “Omicorn” is being categorised as a variant of concern. Two aspects of the virus are concerning:

The apparent speed of transmission in South Africa

The highly unusual combination of mutations including novel ones not seen before

However, cases of patients that have contracted Omicron have exhibited very mild symptoms compared to prior COVID variants. Reformulated vaccines will also work but will take time to create (estimated 3 month timeline) Existing oral treatments (eg Pfizer drug Paxlovid) likely to still work. It is likely that double vaxxed and boostered individuals will have some protection vs severe disease. BioNTech CEO was quoted in the WSJ as saying he believes vaccinated people will still have high level of protection against severe disease caused by Omicron variant

Key next milestones will be the data from both Moderna, Pfizer and others on how well current antibodies/immunity protects against Omicron with results expected in the next 1-2 weeks.

Another key data point will be the hospitalization data. If this doesn't materially rise, then it would be reassuring sign

Powell's hawkish shift unnerves markets

Fed Chair Powell's congressional testimony on Tuesday leaned hawkish after he noted risk of persistently higher inflation has increased and it is time to retire term "transitory."

Comments were seen as indicative of an increasingly hawkish policy pivot from the deliberative messaging and predictability that has been a hallmark of his speeches since he turned dovish at the end of December 2018 - Bloomberg

Futures priced in ~60bp of Fed rate hikes by end of 2022. Still, while an earlier end to tapering could pave way for a sooner-than-expected liftoff in rates, no clarity yet on how fast the Fed will tighten and how this will play out on equity markets

Jack Dorsey Steps down as Twitter CEO

Jack Dorsey is stepping down as Twitter CEO effective immediately

Dorsey co-founded Twitter in 2006 and was ousted 2 years later in 2008. He came back in 2015 after the CEO at the time, Dick Costolo stepped down.

This now leaves Dorsey solely as CEO of Square having been CEO of Square and Twitter companies simultaneously since 2015

Parag Agrawal, Twitter’s CTO, is promoted to Group CEO.

Tesla says production goal of making 500K vehicles this year in Shanghai is inaccurate -Reuters

The article says Chinese think tank EV100reported earlier that Tesla was on track to make 500K vehicles this year.

The Tesla representative confirms the company's plan to localize more than 90% of its supply chain in Shanghai.

Salesforce Name Bret Taylor as new Co-CEO to work with Marc Benioff

The promotion comes as Bret Taylor was also appointed as Chairman of the Twitter Board at the start of the week

Microsoft CEO Satya Nadella sold about half of his shares in MSFT last week -WSJ

Square is changing its name to Block, effective 10-Dec -CNBC

US consumers spent $10.7B online on Cyber Mon., down 1.4% Y/Y -CNBC

Summary from Credit Suisse Tech Conference this week

MSFT / Microsoft - David O’Hara, CFO

o While still in the early stage of adoption, CFO noted industry cloud has started to generate significant traction. Future build outs will identify specific customer needs and will become more value-add.

o Teams is an additional monetization strategy for the company, building out on top of it with areas such as Phone (currently 80 million users), industry clouds, and third-party ISVs tapping into Teams as a platform.

o Azure in particular continues to evolve, with additional flexibility being built into customer contracts rather than locking in users long term. Recent customer conversations have revolved around data center expansion, with the need to add incremental capacity within international geographies.

o CFO called out Power platform becoming an anchor and “hidden treasure” in some deals, with users becoming the ultimate change agent, dictating the evolutionary path using their own applications.

o As the pandemic has accelerated initiatives, the E5 SKU has seen better penetration, and Microsoft is providing additional functionality to SMBs and frontline workers. Furthermore, providing mini SKUs has allowed customers to consume what they need when they need it.

o Regarding recruitment and retention, CFO noted the talent pool remains robust and feels Microsoft is well-positioned to compete with other enterprises for high-skilled labor

NVDA / NVIDIA Corporation – Collett Kress, CFO

o Largest issue they are dealing with is demand is greater than supply.

o Been working through the last 18 months focusing on supply, but really understanding what the locals changed in terms of how they need to think about procuring supply.

o Supply constraints - Operating on demand levels so seasonality has no preschool itself, and it's not very clear in terms of when it will restore itself.

o Not only are they exceeding the overall gaming market as a whole, they are continuing to expand new use case

o Software approach is to really help enterprises.

o Chosen to focus on large overall industries that they know would benefit quite quickly from an accelerated compute Choice of adding software separate by adding an licensing software to enterprises separately is there favorite topic in terms of Omniverse.

o Software is not new to what they have been providing. They have talked about it for many years, but success has been really about system software.

o CUDA, 30 million downloads, to 3 million developers are out there, all free, but it's a development of software

o Work with VMware is very important because most enterprises use VMware inside their data centers

o Ominverse - brings together all of the different pieces that they have already from the simulation and do it collectively.

o When they think about gaming RTX is a very important technology. The first architecture that they had, was that setting strong for the ecosystem to begin to work in building up the games.

o Almost all new games important higher types of games will be RTX

o Provides them the ability to grow not only on desktops, but also within notebooks.

o Have the ability to upgrade a large install base. It's not just upgrading the last architecture, but thinking about two architectures before when they did not have ray tracing.

o Being able to upgrade to RTX saves tremendous amount of time.

o Autonomous driving - creating autonomous robot taxis, trucking or just the passive house such as that market size is about 8 billion

NOW - Service Now – Bill McDermott, CEO

o CEO believes that NOW is the most deflationary tool you can put into an enterprise because it takes out a lot of complexity and cleans up all these business processes to allow everything to run smoothly.

o CEO sees a giant universe in ERP universe, whether its supply chain optimization or procurement.

o NOW have built deep machine learning AI operations into the platform – and will have a major realize coming in March to incorporate all this new tech.

§ They have supply chain optimization and ESG components as well as many other elements being integrated already.

o ServiceNow have broadened their thinking on partnerships in general. Microsoft have integrated NOW into bot MS Dynamics and MS Teams. These companies are leaning into NOW as they know they want to drive integration into the NOW platform and become the standard for workflow automation tool within enterprise.

ADSK / Autodesk – Andrew Anagnost, CEO

o Net Revenue retention was really strong in Q3

o Fusion 360 driving growth – only professional grade cloud based tool that allows remote groups to work together and not only just about cloud based collaboration but also offline. Have invested a lot in automating a lot and that’s where they are beating competition away

o Real visibility with fusion comes in a few years’ time – but can already see the momentum in subs and MAU

o Great % of fusion is sold direct online and via their online channels

o Have been moving channel partner incentives from the front to back end meaning that they are moving away from Buy – Sell discounts to back end payments

SQ / Square – Amrita Ahuja, CFO

o Changed name from Square to Block

o Meaning of Blocks: Building blocks as each of these business are linked together and connect and integrate into the future, Some Blockchain there is segments of code there is block parties and neighborhood blocks and communities local that they serve. Square brand to the Seller business. No changing purpose, which is about expanding financial access and inclusion to our economy.

o Metrics: Both SQ Seller and Cash App shown stability y/y growth >+35% through October continuing into November as well. When you look on a two-year basis what we had shared about October was an expectation of greater than 90%. We expect some moderation on that two-year CAGR in November. Two years ago, they launched TABS redesign the redesign of the app and launched our investing product both of which drove strong engagement in our business, two years ago, but strong, continued growth on a year-over-year basis some moderation in the two-year CAGAR for cash app through November.

o Overall Strong SQ Seller trends; Gross Profit 2x vs. 1Q ’20.

o Focus on ROI and higher lifetime value and leaning in

o Mix shift towards brand and awareness that serves seller and broader group

o Mix shift towards international as well; 4 markets nearing payback and ROI

o Sales Team: Move up market and increasingly moving from generalist to product specific. Mid-market Sellers now the largest segment 2x GMV vs 2 years ago. Unified data across the platform.

o International Expansion: Close the gap on product parity and now at 80% parity Omnichannel & investing in go-to-market. Then winning sellers and indexing higher increasing ROI. TAM $85b SQ Seller in the US. 1% Address on the International and 2% penetrated of $100b TAM, fragmented international. Moving quickly to invest

o Cash App Pay is priority with Cash Card, Boost Cash Card bring 70% more to the ecosystem. Directing traffic from Cash Card and Boost. Seamlessly experience online and in-person, but still early days. Good traction thus far and bright future ahead.

o AfterPay brings 16mm consumer globally with Coastal higher-income cohort. Driving 1mm leads per-day and for some merchants more than Instagram. Marketing and discoverability inside of Cash App. See both side of the transaction and consumers to grow frequency. Merchants see 20-25% uplift in Average order volume.

o Enterprise: Afterpay has an Enterprise sales team with 100k relationships, which SQ can tap into to increase BNPL. On the Seller side can grow in to Enterprise seller in more bespoke ways and other cross-sell opportunities

o Cash App MAUs: 40mm monthly actives and +2x vs and Gross Profit +4x vs. 2yrs ago. Strategies: Marketing and reinforcing the foundation/health of the business. Ramping existing channels influencers, social and etc. In terms of health promoting positive behavior and root out negative behavior investors customer service, compliance, machine learning. Cash App Family and Teens is key vertical.

Earnings Calendar

Salesforce Q3 Earnings

-3Q Rev $6.86B above Consensus $6.80B

-EPS $1.27 above Cons $0.92

-4Q guidance:

Rev $7.224-7.234B below Cons $7.24B

EPS $0.72-0.73 below Cons $0.82

-FY22 guidance:

Rev $26.39-26.40B raised from $26.2-26.3B, above Cons $26.34B,

EPS $4.68-4.69 up from $4.36-4.38 and above Cons $4.42

-1Q22 guidance:

Rev $7.215-7.250B

ZScaler Q1 Earnings

-1Q Rev $230.5M above Cons $212.0M

-EPS $0.14 above Cons $0.12

-2Q guidance:

Rev $240-242M above Cons $224.8M

-FY guidance:

Rev $1B-1.01B above Cons $951.2M

Billings $1.300B to $1.305B

Notable Upgrades & Downgrades

Initiations

This week JPM published their outlook for US Equity markets for 2022. JPM expects S&P500 to reach 5050 on continued robust earnings growth as

Labor market recovery continues

Consumers remain flush with cash

Supply chain issues ease

Inventory cycle accelerates off of historic lows.

JPM estimate that most of the equity upside should be realized between now and 1H22

SoFi initiated with Market Perform at Keefe Bruyette with $21 target price

Oatly initiated at HSBC with “Reduce” rating from HSBC. Reached a new low in trading following publication of note

Beyond Meat initiated at HSBC with “Reduce” rating from HSBC. Reached a 52 week low in trading following publication of note

Upgrades

Square upgraded to Neutral from Sell at BofA. Target price $221. Believes CashApp deceleration trends more appropriately priced

ZoomInfo is promoted to Credit Suisse TMT specialist sales top idea

ZScaler price target raised from $285 to $365 at Piper Sandler

ZScaler price target raised from $295 to $380 at UBS. Remain Neutral

ZScaler price target raised from $275 to $330 at Morgan Stanley. Remain Neutral

ZScaler price target raised from $295 to $386 at GS. Remain Neutral

ZScaler price target remains at $390 at BofA. Reiterates Buy

Snowflake price target raised from $295 to $344 at Morgan Stanley. Remain Equal Weight

Snowflake price target raised from $325 to $340 at JPM. Remain Neutral

Snowflake price target remains at $400 at UBS. Reiterates Buy

Downgrades

StoneCo downgraded to underweight at Grupo Santander

Peloton price target lowered to $56 from $70 at Stifel

Twitter price target lowered to $47 from $60 at Citi

DocuSign downgraded to underweight at JPM. Target price $175 from $300

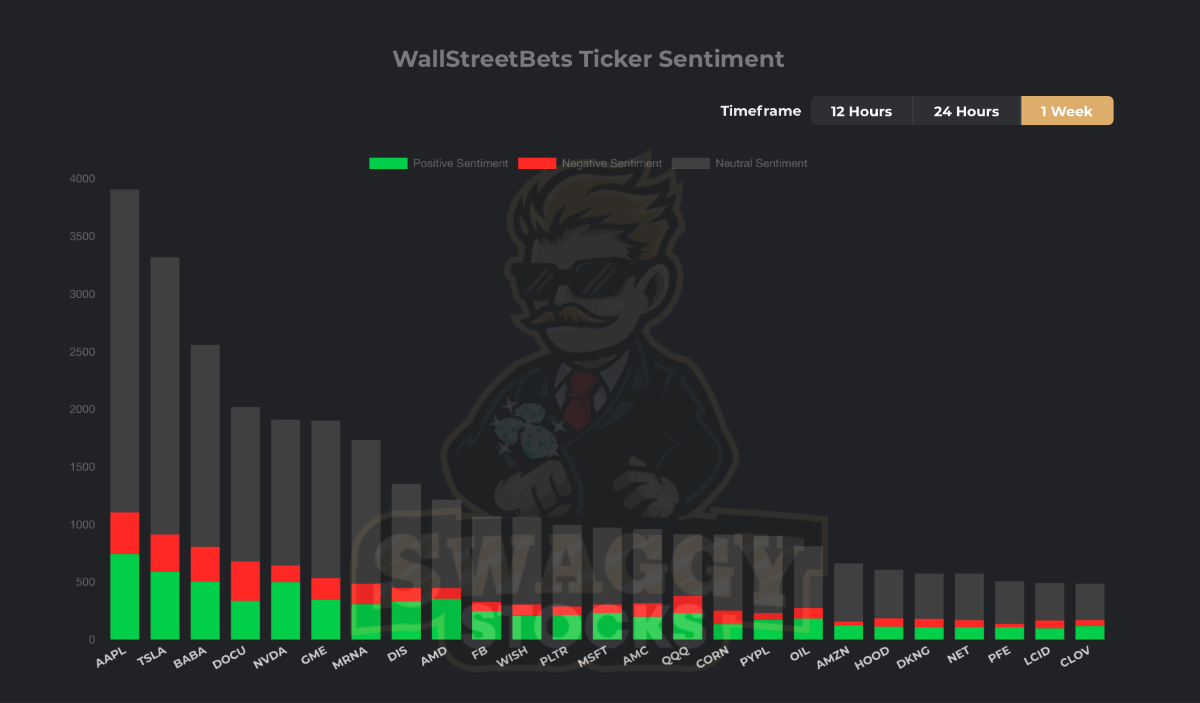

WallStreetBets - Most Mentioned Equities

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.