Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

Let's go through some market events from last week with earnings and where the volatile price action was.

Today's Letter

Market Update

Earnings SZN

Trending Crypto

WallStreetBets Trending Tickers

https://investingtrends.com/wp-content/uploads/2021/11/li-treasure.jpg

Nevada: A Lithium "Treasure Trove"?

Nevada may be known as the "Silver State," but it's also the hot spot for North American lithium. With China controlling 80% of the world's lithium supply, the defense industry and electric vehicle manufacturers are scrambling for more domestic sources of the valuable metal.

Show Me What's Going on With Nevada Lithium – And Who Could Benefit

This is sponsored content*

Market Update

Big news from last week has the market on edge (yet again). This time around, whispers of a Fed emergency rate hike coming as soon as next week. Markets remain volatile with all the uncertainty, but I say rip the band-aid off and let's just deal with it. I'll be waiting in the bread-line with the rest of you after my portfolio gets obliterated from a 50 bps interest rate hike. "Please sir, can I have some more?" /end sarcasm.

The good news is that as stocks make lower lows the down days are (for the moment) less severe. Are we close to a bottom for growth stocks?

Not only that, but we've got the Russia/Ukraine situation escalating. Somewhere on WallStreetBets you can hear a YOLOer ask "which stocks should I buy for WW3?". This newsletter always steers away from anything political, but this is potentially market moving news and is a unique moment in history for many of us born in the last several decades. I plan on paying close attention to what lies ahead in the coming weeks.

Earnings SZN

We are in the trenches of earnings season and we have had some pretty mixed results. Here are the highlights from last week, based on how the shares traded and not actual earnings misses or beats.

Earnings Misses

Peloton (PTON) - No surprise here after what's been going on.

Affirm (AFRM) - The company accidentally tweeted their earnings during market hours before deleting the post. Shares traded down 25%!

Uber (UBER) - Earnings beat, but the stock traded down 10%.

Twilio (TWLO) - Earnings beat with shares rocketing higher only to finish the week in the red. Tough times out there.

Cloudfare (NET) - A slight beat on earnings, but shares traded down 10% following the report.

Cleveland Cliffs (CLF) - A strong report with a record year from the steel producer. Shares traded down on Friday's report.

Earnings Beats

Chipotle (CMG) - Stock traded up 5% last week.

Corsair Gaming (CRSR) - Stock traded roughly flat.

Disney (DIS) - Beat and shares up for the week.

Twitter (TWTR) - Inline earnings while announcing share buybacks. Shares traded higher for the week.

Datadog (DDOG) - Solid report for everyone's favorite SaaS. Shares traded up 15% for the week.

Here's what I'm watching for the week ahead

Tuesday

Roblox (RBLX) - AMC

Upstart (UPST) - AMC

AirBnB (ABNB) - AMC

Wednesday

Shopify (SHOP) - BMO

Nvidia (NVDA) - AMC

Fastly (FSLY) - AMC

Thursday

Palantir (PLTR) - BMO

Fiverr (FVRR) - BMO

Yeti (YETI) - BMO

Roku (ROKU) - AMC

Shake Shack (SHAK) - AMC

Friday

DraftKings (DKNG) - BMO

The market moves fast, but GRIT moves faster. The new Daily Market Update is a short & sweet, to the point, no bull$&!% snapshot of the stock market (and ONLY the stock market). Subscribe to get your daily finance edge in <1 minute straight to your inbox every Mon-Fri!

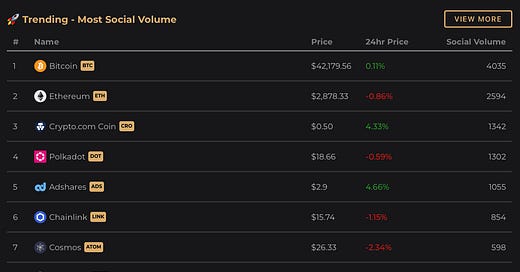

Trending Crypto

Crypto prices have finally stabilized after a few weeks of getting their backs blown out, and not in the way we like. After a 30% decline, we've seen a sharp 30-40% bounce in most names and are sitting at the plateau. Here are the top 10 most popular crypto currencies in terms of social volume.

Trending Tickers

Some familiar names making headlines on the retail trade and WallStreetBets. What do we have?

Facebook/Meta platforms: FB is making headlines on social volume after the company has traded down 35% since their less-than-stellar earnings report.

CPI: This is not a ticker, but is rather tracking the mentions of the CPI print which came in last week.

Peloton (PTON): Either love it or hate it, Peloton is making the top of this list after buy-out rumors have ignited a sharp bounce in the share price. Shares were trading roughly 30% higher by Wednesday, but ended the week +15% after getting sucked into the rest of the market weakness.

Some names flying under the radar at the moment are: NVDA/AMD, AFRM, RBLX, and NET.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.