Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with... VIG

January 2, 2022

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

Today I'll go through some of the most mentioned meme-stocks, SPACs, and crypto-currencies from around the Internet in all of 2021.

Today's Letter

Market Update

Top SPACs of 2021

Top Meme Stocks of 2021

Top Cryptos of 2021

Trending Tickers

Market Update

Another exciting year of investing has gone by. We experienced the WallStreetBets and Gamestop Saga, the resurgence in relevancy of cryptocurrencies, and an NFT boom after the summer months.

Surely 2022 will be just as exciting, but only time will tell what's in store for us. What I can tell you for certain though is SwaggyStocks will be dropping some HOT features in the coming days. How hot? Hotter than your sister after her recent divorce so keep an eye on the site and newsletter for these important updates.

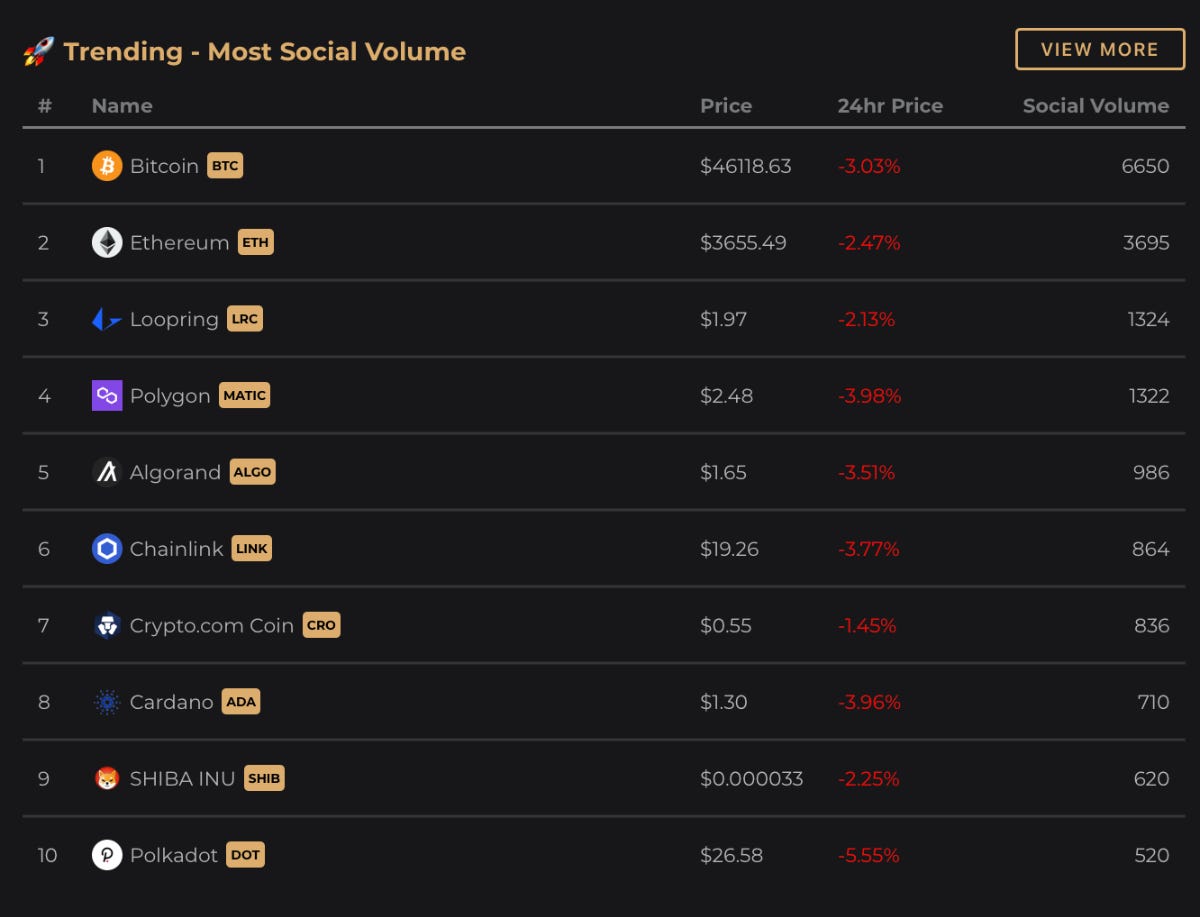

Here's a sneak peak into our enhanced social crypto sentiment that will launch later this week. You'll be able to spot crypto currencies that are moving with social volume and we'll begin to roll out similar features among the other categories.

Most Mentioned SPACs of 2021

Without further ado, let's begin with the most mentioned SPACs of 2021.

THCB - Merger with Microvast (MVST): Microvast is an electric vehicle charging company that picked up a lot of social momentum after the share price rocketed from $15 per share to $24 during the Gamestop squeeze. The stock is currently sitting at an all-time low of $5 per share.

CCIV - Merger with Lucid Motors (LCID): This name was hyped for good reason as another EV player came to the market. CCIV started 2021 at their NAV value of $10 per share. It spiked close to $60 multiple times before falling back down and currently sits at $38 per share.

PSTH - Merger Pending, No Rumors: Bill Ackman's SPAC is still on the lookout for an acquisition target. A short stint of rumors and an almost partial acquisition of UMG had the shares trade at $30 for a period of time. The stock is currently back down to $20 per share.

Barkbox (BARK) - Known as STIC pre-merger: BARK was riding hype earlier in the year, but like most SPACs and IPO's from 2021 they are sitting at all-time-lows. Barkbox is trading at $4 per share.

GIK - Gig3 Capital merger with Lightning eMotors (ZEV): Another EV play that could. Like others, ZEV is trading at the lows after having an extremely volatile year in 2021. Notably, in August of 2021, the share price rocketed from $6 to $11, an 80% gain, in just 2 trading days. ZEV is currently trading back at $6 per share.

Before we get into everyone's favorite categories, the meme-stocks and crypto, a message from today's sponsor VIG

Fantasy Stocks. Real Money™

Want to win REAL cash prizes for playing fantasy stocks? VIG is the king of fantasy stocks and their platform is the proof in the pudding. With these cash games all you need to do is lock and load your watchlist before the game starts and then finish in a "money position" by the end of the (usually daily) game. Here's a look at this week's 2022 Crypto Kickoff, and Stocks & ETFs games to win hundreds of dollars in prizes.

It's time to get your watchlists ready because these fantasy stocks games are free to enter, all you need is to sign up for a VIG account on the web or mobile app.

Still not convinced? Get on the free trial and check it out for yourself.

Most Mentioned Meme Stocks of 2021

Even though SwaggyStocks has been tracking social sentiment for years, the Gamestop saga was really the birth of it all as it finally became mainstream. Here's a breakdown of the most mentioned stocks on WallStreetBets from 2021.

Gamestop (GME): WSB's favorite stock. If you browse any social media that discusses this ticker it's not uncommon to see threads on why "GME can be a $1,000 stock". Do the apes live in a distorted reality or is that really a possibility? I am unsure.

AMC Entertainment (AMC): The second coming of the short-squeeze and the favorite from the squeeze back in May of 2021. AMC finished the year with a 1,250% return when all was said and done.

Tesla (TSLA): Due to Elon Tesla will always be a retail favorite. Elon's tweets along with TSLA's price action has won over retail traders and was almost just as popular as GME and AMC.

BlackBerry (BB) & Palantir (PLTR): I'm going to group these two stocks together because they are quite similar in the fact that they participated in the short-squeeze events without really having any short-interest. It's a mystery to me why these two names trade in parallel with other high-short-interest names.

Most Mentioned Crypto Currencies of 2021

Ahhh the crypto-currency category -the very misunderstood and under-educated asset class. SwaggyStocks started tracking social sentiment around cryptos in early 2021 and the category seems to be growing in interest explosively. For reference, Bitcoin (BTC) had 4x the amount of social mentions tracked by SwaggyStocks in comparison to Gamestop. Not only that, but the top 15 meme-stocks combined did nearly the same amount of social volume as Bitcoin alone. Is crypto the future? I don't know, but in terms of social sentiment the talk of the town is clearly in crypto and not so much in meme-stocks (anymore).

WallStreetBets - Most Mentioned Equities (this week)

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.