Swaggy's Top Stonks - Why SPACs r kill

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

September 19, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. Today I'll be looking into why the SPAC trade is currently dormant. Where did we go wrong on this play that was so popular earlier this year.

This Week's Letter

Is the SPAC trade over?

Upcoming Earnings & Events

Sentiment Overview

Trending Tickers

Before we begin, here's a message from our sponsor on the lithium industry

https://investingtrends.com/wp-content/uploads/2021/08/cash-lithium.jpg

US Govt. Injects $100's of Millions Into Lithium

The government's cash infusion could send lithium exploration companies soaring. They're desperate for new lithium mines to end China's Lithium Monopoly. See how you could take advantage of this enormous cash infusion.

Click Here To Read The Full Story Before It Gets To Wall Street

Is the SPAC trade over?

SPACs had huge momentum in early 2021, but since April they've somewhat become dormant. Many of the names that were previously very popular, such as SPCE, BARK, SOFI, STEM, LCID, and PSTH have majorly cooled off. Here's a look at some of those names YTD performance.

IF you had bought into these names in January or February before the SPAC craze, you are still up quite handsomely on your position. If you ended up getting in near the peak in March, then you are most likely down roughly 30% on any of your SPAC positions.

That's not to say that these (the ones that have merged, at least) are bad companies, but rather bad timing on the play. A lot of the growth in stock price was simply due to the hype of the SPAC trade, which quickly became crowded. I did notice that many of these now-merged SPACs have a few similar qualities between each other. Here they are:

Many SPACs/mergers/targets that are focused on the EV or battery industry (LCID or DCRC, for example) are pre-product and/or pre-revenues. Meaning they have a team with a strategy, but currently are not generating any revenues by means of selling a product.

The ones that are generating revenue are more often than not in the high-growth (80%+ YoY) stage of the business cycle and continue to operate at a loss.

Price-to-sales ratios of greater than 10, which means while they are not profitable they are still trading at a premium on their TTM revenue.

I'm not saying SPAC plays are a hot mess, but they're price action will be more similar to a small-cap growth stock than to any kind of stable blue-chip company you can invest your money in stress-free.

There are still so many SPACs looking for acquisition targets, and only so many companies that would make the short-list for a potential merger. Looking at Bill Ackman's PSTH, one of the most hyped SPACs, is still acquisition-less after over a year.

Upcoming Earnings & Events

Earnings season is coming to a close, but there are still a few late ones reporting next week. Some of the most anticipated ones include:

Fedex (FDX): Tuesday AMC

Adobe (ADBE): Tuesday AMC

StitchFix (SFIX): Tuesday AMC

BlackBerry (BB): Wednesday AMC

Nike (NKE): Thursday AMC

Costco (COST): Thursday AMC

Other market-moving economic events to keep an eye on are:

Home Sales - Wed 10am

FOMC Statement / Interest Rate Decision - Wed 2pm

Powell Speaks - Fri 10am

New Home Sales - Fri 10am

FOMC will be the biggest market-mover. Keep an eye on news headlines regarding the direction they are going in terms of monetary policy and interest rates.

Option Flow & Swaggy Sentiment

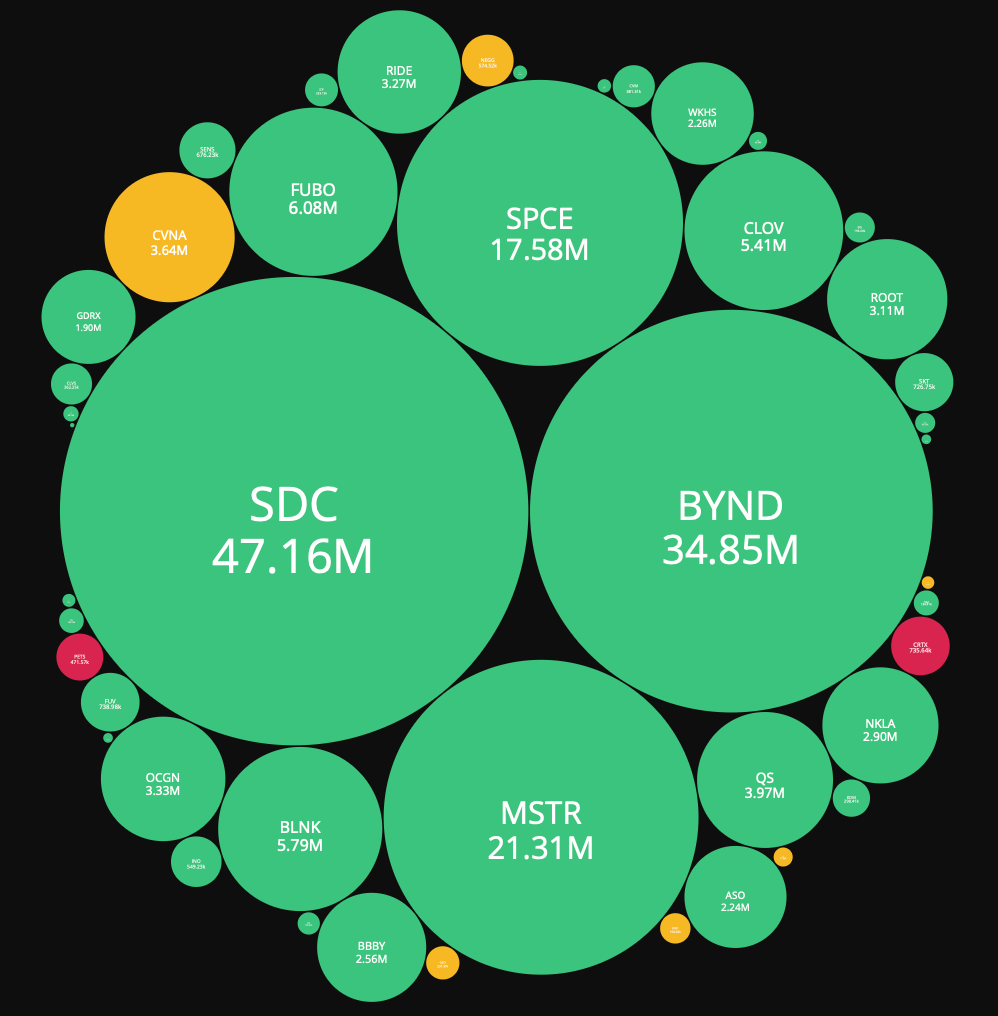

The two clear winners from last week, and by a good margin, were SmileDirectClub (SDC) and Palantir (PLTR).

If you remember from several months ago I emphasized how the Palantir trade was beginning to lose popularity after months of consolidation. In fact, Palantir even fell out of the top 25 most mentioned stocks on WallStreetBets for a short period. I highlighted how the price action, close to $25 at the time, was nearing the shelf of the volume profile for potential lift-off. Palantir has been steadily climbing over the last month and is now sitting at a 20% gain in this short period.

Let's look at the sentiment chart for PLTR and how it compares to previous hype.

It's amazing that after this recent strong performance hype is still nowhere near the previous levels back in November of last year and February/March of 2021.

Moving along to SmileDirectClub. Here's another ticker I highlighted in the newsletter just 3 weeks ago of potential lift-off. Remember, I refer to these high "short-interest" stocks as a new asset class category in 2021. These stocks are/can be extremely cyclical and volatile, but the best time to get into them is before the squeeze when they are in somewhat of a market lull.

Of course, they are very unpredictable and would be more of a YOLO type of play. Personally, when I take a risk on a stock like this I'm almost always invested in shares instead of options and have an appropriately-sized position.

Let's look at the SDC sentiment chart.

WSB ticker mentions for SDC spiked to roughly 25% of all ticker mentions. The amazing thing is that SDC is still trading nowhere near levels from earlier this year.

Next, I took a look at some unusual options activity scans from Friday. Here were the results of some of the biggest plays. Amazing to see stocks like Palantir and SDC (2b market cap!) competing with companies like AAPL and TSLA in terms of options volume.

Lastly, if you are interested in other high short-interest names. Here's a scan of my custom short-interest watchlist from Friday. Quite a few names that have been hammered recently are picking up in bullish sentiment unusual option activity.

Shameless Plug: If you guys enjoy the content in the Swaggy newsletter or utilize the site frequently we have a Patreon that helps support our servers. SwaggyStocks will always attempt to remain free, so we appreciate everyone that has supported us over the months.

There's also a couple things in the Swaggy pipeline that will be added to the site in the coming months. I'll start dropping some spoilers when we get a bit closer to release. Stay tuned!

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.