Swaggy's Top Stonks - Why earnings season is unpredictable

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with... Miso Robotics

November 17, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

Today's edition is short and sweet with the earnings debrief. A quick look at earnings hits, misses, and what to keep an eye on.

Today's Letter

Morgan Stanley likes Swaggy's Metaverse ideas

Why earnings SZN is unpredictable

Earnings Debrief

Upcoming Earnings

Trending Tickers

Morgan Stanley uses Swaggy's Metaverse ideas

This morning I came across this Forbes article that displays Morgan Stanley's top "Metaverse" plays. To summarize for you, here's the list:

Facebook (FB)

Roblox (RBLX)

Alphabet (GOOGL)

Snap (SNAP)

Unity (U)

Coincidently enough, these are all stocks Swaggy highlighted from the letter over the weekend. Is this truly just a weird coincidence or is Morgan Stanley keeping close tabs on Swaggy? Either way, MS you're welcome!

Final days to invest in the robots taking over the $273B food service industry.

Miso Robotics uses a cloud-connected AI platform that enables autonomous robotic kitchen assistants to perform tasks such as frying and grilling alongside chefs in a commercial kitchen.

Miso’s latest commercial partnership with Inspire Brands, parent company of Buffalo Wild Wings, is called Flippy Wings. This robotic frying solution is forecasted to increase food production speeds by 10-20%.

And if that’s not enough, here are a few more reasons to invest:

Nearly $38M raised via equity crowdfunding

Signed an $11M contract with CaliBurger

Entered into an agreement with White Castle for a North American rollout

Working with 10 of the top 25 QSRs

Achieved 2 granted patents and 10 more pending

Don’t miss out. Invest in Miso Robotics before the opportunity closes Nov. 18.

*This is promoted content.

Why earnings SZN is unpredictable

Just a quick reminder, SZN = season, and is a term all the cool kids are saying. Today I want to touch up on how the market can be an extremely unpredictable place and why short-term traders often-times get taken to the ringer.

If you believe the price action in Rivian (RIVN) is normal then it would be hard for you to argue that any other company is over-valued, but sometimes the market do be like that.

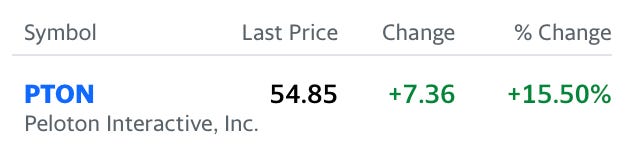

Two market events I'll be comparing right now are between Peloton (PTON) and recent IPO/hot-stock, Riskified (RSKD), who just reported earnings yesterday. I've put together a story, in two parts, and their market reactions.

Part 1

Peloton raising capital after the company said they wouldn't need to be doing so, not even less than 1 week ago. Here's a snippet of the Peloton earnings transcript, courtesy of a brand new feature coming to SwaggyStocks VERY soon. The new earnings transcript feature is based off a machine-learning model and AI to emphasize key sentences, reducing transcript read/skimming time by ~ 50%.

5 days later... What happened next will shock you!

How it all ended with yesterday's price action

Part 2

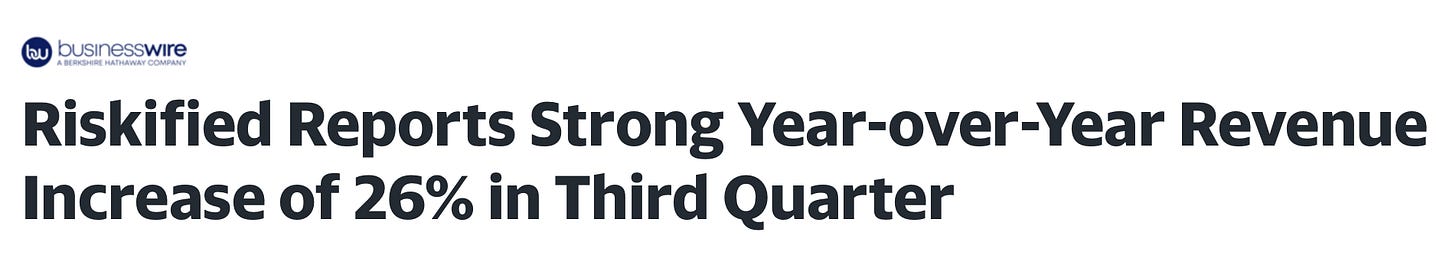

Next is a look at Riskified (RSKD). This company was on the IPO-Briefing back in August as one to keep an eye on. I believe it priced around $25 per share and quickly shot up to $40 within the next few weeks. Fast-forward two months and we come to the company's second earnings report as a public company.

Riskified (RSKD) - How it started (Hint: they beat on revenues and raised guidance)

Nothing like an earnings beat and raise followed by a drop in share price of 27%.

How it ended

This is a prime example of why short-term valuations and price action can be extremely volatile during earnings season and sometimes things don't make sense. Is a short-term compression in margins and slight miss on bottom line worth a 27% decline? That's up to investors to decide.

Moving along, even after Peloton's +15% move, if you've been holding this stock from near the highs you've been having a rough summer. Here's a meme to help you get through these difficult times.

Earnings Debrief

Here's what reported today.

Target (TGT) - BMO

EPS of $3.03 vs $2.83 est. (beat)

Revenue $25.3b vs $24.78b est. (beat)

Third quarter comp sales grew 12.7% on top of 20.7% from last quarter. Stock is trading down 5% in trading today.

Baidu (BIDU) - BMO

EPS $2.28 vs $2.01 est. (beat)

Revenue $4.95b vs $4.97b est. (miss)

Shares are down 5% in trading today.

IQIYI (IQ) - BMO

EPS -$0.34 vs -$0.33 est. (miss)

Revenue $1.2b vs 1.19b (in-line)

Revises slightly lower guidance for Q4. Stock is down 15% in trading today.

Nvidia (NVDA) - AMC

EPS $1.17 vs $1.11 est. (beat)

Revenue $7.1b vs $6.83b est. (beat)

Beat and raise with a very strong outlook. NVDA has been the biggest name to report this weak and their recent run-up in share price (almost 40% in the last month) has been justified. Great quarter from them.

Upcoming Earnings

A lot of post-earnings weakness across the board. Numbers have been solid, but that doesn't seem to matter as stocks continue go down. All eyes on China stocks tomorrow.

Thursday

Alibaba (BABA) - BMO

JD (JD) - BMO

Applied Materials (AMAT) - AMC

WallStreetBets - Most Mentioned Equities

Today has been all about NVDA and a continuation of EVs. Another notable name is somewhat "penny stock" PROG that has been on the list for several days now. The stock is up huge over the last few weeks and is slowly shifting from a micro-cap to a small-cap name.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.