Swaggy's Top Stonks - What's moving the markets?

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with...Vig

September 12, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. We are back after the long weekend which I hope everyone enjoyed.

Quick reminder that the Vig raffle winners were sent out last week. There are still a couple people who didn't claim their free 90-day premium subscription so check your junk folders for my email that said you were a winner.

If you didn't win then not to worry, I'll be doing another premium Vig raffle in the next few weeks!

This Week's Letter

The Vig Platform

Market Update - What's moving the market?

Trending Tickers

The Vig Platform

As an affiliate with Vig I ran a raffle two weeks ago that offered 90 days worth of their premium subscription service. Not to worry though, I was given approval to run another one in about 3-4 weeks, so I will keep you all updated on that. Lately, I've been including screenshots from the platform, but here are some of the main features I like to check on during market hours.

Note: they have a completely free 7-day trial you can get started on if you want to get a feel for the platform. If you stay with the premium apply the code SWAGGY10, to make your subscription only $40/month, forever.

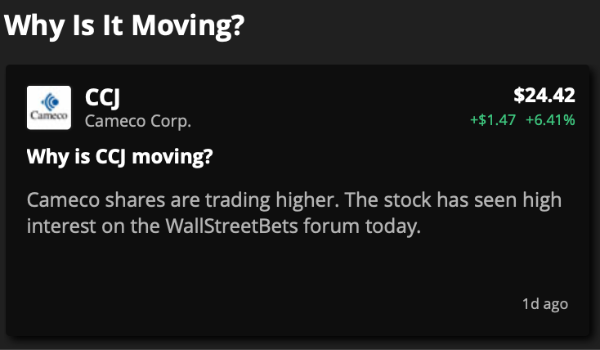

They've recently added a "why it's moving" section to the dashboard. This gives you a one-liner on why some popular names are moving. They also just added an impressive news/headlines search function as well as a robust scanner to filter through stocks by sector, market cap, financials, revenues, and even technicals.

Unusual options activity, custom scans, and options sentiment. This is by far my most used feature as I scan through names on my watchlist and stocks I'm interested in. Here's the sentiment from Friday's trading session for a custom scan I did based on my own criteria of longer-dated YOLO plays.

They already have their own set of pre-built scans (literally over 150 scans) to find unusual options activity based on volume, volume to open interest, for small caps, for large caps, YOLOs, the list is endless. Here's one of my favorite scans, the "Roaring Kitty Calls" that displays option blocks traded with 5x more daily volume relative to the 10-day average. A lot of PTON rolled through on Friday.

Market Update

The SPY is at all-time-highs.

The Nasdaq is at all-time-highs.

The Dow is pushing new highs.

Your portfolio = Down bad or flat YTD.

You might be wondering WTF is going on here. This, of course, is highly dependent on how diversified your porto-folio is. To simplify things what I really mean by diversified is how much of your portfolio is allocated to solid blue-chips and big tech, or higher-risk growth stocks, a la WallStreetBets-style.

Don't get me wrong, both strategies (if you want to call them that) have their advantages and dis-advantages. What it comes down to is mainly a trade-off between risk and reward, as the old stock market adage goes.

Blue-chips have:

Stability

Less down-side risk, but also less potential upside.

"Own it, don't trade it" mentality.

Growth stocks have:

A lot more risk

Higher volatility and are generally a lot more reactive to market fundamentals (economic data, interest rates, stimulus announcements)

Stomach-churning downside and life-changing upside.

It goes without saying that your portfolio should generally have a healthy balance of both, and even some dividend stocks, for stability.

I want to break down why some of these market indices have out-performed compared to those with portfolio's heavily weighted in growth (that are most likely flat or down YTD).

Let's look at a blue chip, Apple (AAPL), versus a growth stock like Palantir (PLTR).

AAPL, trading at roughly $155 per share is as fundamentally strong as it gets. The stock price usually doesn't dip too much because as you would expect, most dips get bought. However, at $155 per share where can we see this stock going in the next 6 months to 1 year? In my opinion, since this has already run up from $130 to $155 over the last several months there's a possibility it could remain flat for the rest of the year or even provide a small dip opportunity. Although AAPL always out-performs expectations, at 2.5 TRILLION market cap it takes a lot to move the needle. What's the catalyst to give it another 30% boost in share price? 30% in share price is roughly 750 BILLION in value.

On the other hand, let's look at Palantir (PLTR). The stock has been having pretty volatile swings in the ranges of 20% up or down within weeks. At $26 per share this high-growth and highly-speculative name can have significant downside risk in the next 6-12 months, OR it could double. We may even see this at $100 share in 4-5 years time which would be a 300% gain.

The difference between AAPL and PLTR is that AAPL will most likely provide a solid 25% return year in year out, while PLTR has the potential to double or even triple.

I bring up what's mentioned above because as many new investors have just entered the scene over the last 1 or 2 years, growth stocks have been predominantly what is being talked about. Due to their high-risk/high-reward WSB-esque nature they are what many of you are also investing in (myself included).

Going back to what I said about growth-stocks being more reactive to market events. Let's see what has changed from 2020 to 2021 and why some growth names have been on the struggle-bus recently.

In 2020 we saw:

Huge market crash and uncertainty which eventually led to the largest stimulus program ever seen.

Extremely loose monetary policy to help the economy rebound.

What we are seeing so far in 2021:

Since the beginning of the year the talk has been about tapering QE and raising rates. It's not an IF, but WHEN.

Inflation numbers coming in hotter than usual each time hasn't been helping the story behind QE and maintaining low rates.

In 2021 the uncertainty behind the taper has greatly affected small-cap growth stocks, which usually trade on the small cap ETF, the Russell (IWM).

Let's look at some of the indices that are pushing new highs and compare to what's been going on with the Russell, specifically since February as this is when all this market volatility came about.

The SPY

The S&P 500, also tracked by the SPY ETF, consists of large and mid-cap stocks that are generally the best in their class across different sectors. The top 10 holdings include FAAMG stocks (FB, AAPL, AMZN, MSFT, GOOGL), so it's no wonder the SPY keeps pushing new highs. Here's a look at how the FAAMG have performed YTD. Hint: They are single-handidly carrying the market to new highs.

The Dow Jones

The DOW consists of the 30 best blue-chip stocks and for that reason, as well as how it's weighted, is not a great representation of the market itself.

Nasdaq

Most companies that trade on the Nasdaq are tech and internet-related. I usually look at the Nasdaq to see relative performance of big tech. Nasdaq pushing new highs = a lot of tech stocks have been out-performing, which has been a general trend since covid lockdowns.

Lastly, the Russell 2000 (IWM)

The Russell tracks small-cap performance and has been either flat or down throughout 2021. A lot of growth stocks fall into this category and the uncertainty around monetary policy moving forward has hurt many of their share prices. You'll notice these stocks have been extremely reactive to whether the Fed will begin taper early or stay the course with late 2022 or 2023 taper.

Let's take a look at IWM chart since February. It's been extremely volatile, has had wide swings, and after all this time has gone nowhere fast. This is a very different story when looking back to 2020 where IWM returned ~20% compared to the SPY's ~15%.

I went through all this because 80% of WallStreetBets stocks, or stocks mentioned around Twitter or Reddit are usually high-growth small-cap stocks that fit into a similar category as the Russell (even if they are not included). These are names like: WISH, DKNG, CRSR, PTLR, and SOFI to name a few.

Final Thoughts

Over the next couple weeks I'm going to go through some of the top WSB stocks mentioned from 2020 and gauge their performance to the FAANG portfolio or SPY over the same time-period. 2021 has been tough times for small caps, but naturally I would expect in big bull runs that a highly-skilled stock picker could greatly out-perfom the 9% yearly average return some of the other indices offer. Stay tuned!

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.