Swaggy's Top Stonks - Unusual Options Activity

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Together with...

Swaggy's Top Stonks

October 10, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

Today I'll be holding a raffle for 15 FREE 3-month subscriptions to the very popular options analytics platform, Vig. Keep an eye for the details below.

You may have noticed an increase in email sends over the last two weeks. I've had a good number of requests to offer mid-week updates about trending tickers and what's happening in the markets, so I'll be testing this out for the next month or so.

Our usual Sunday edition will always contain the same market updates and in-depth reports while the mid-week editions will be a lighter version of what's moving markets. From trending tickers, unusual options activity, hyped IPOs, and upcoming earnings Swaggy will provide something for everyone with a broad range of ideas.

Today's Letter

Market Update

Free Vig Subscription

Unusual Options Activity

Activision Blizzard (ATVI) DD

Trending Tickers

Market Update

One of the reasons why this market has been so choppy over the summer is none-other than the fact that we are in very peculiar times.

We have a market that is afraid of a 25 bps increase in rates and the same fear is seen in the rising 30-year.

We are pushing the debt ceiling and on the brink of passing another monstrous stimulus package.

We are seeing unlimited government spending all while unemployment is making lows.

Job openings are shooting through the roof and with the labor shortage it seems like either nobody has to make a living these days or people just don't want to.

It's a game of musical chairs and if the music stops someone is going to get hurt.

Here's a look at the Federal Reserve's Economic Data (FRED) job openings and unemployment charts.

Job Openings

Unemployment Rate

I wish I had better insight into what happens next, but I'm just the captain of a ship trying to weather these storms in an attempt not to capsize.

All Eyes on Facebook

Facebook's stock has been under pressure. The entire Facebook ecosystem has been seeing server troubles and the company is taking some heat for it.

Here's a tweet I made earlier in the week that really highlighted how a lot of news platforms are extreme laggards when it comes to alpha-generating headlines.

I don't care if you use the SwaggyStocks platform or my long lost cousin's, GhettoStocks, this is why every investor should be using some kind of social sentiment/tracker in their investing activities.

Social sentiment allows you to find trends before they take off and give you insight to whether you might be early on the trend or buying into the absolute hype of FOMO.

Vig Raffle

The team at Vig has authorized me to host yet another raffle for a bunch of free subscriptions to their platform. For those of you that are new to the letter Vig is a premium options analytics platform that has many cool features. Outside of the popular unusual options activity (UOA), they also offer Gamma Exposure (GEX) charts, custom watchlists, a plethora of UOA scans, in-depth scanners, real-time news feeds and a whole lot more.

To enter the raffle all you need to do is reply to this email with a random number and I'll count that as your submission. If you want to get a head-start on the platform, give their 7-day free trial a go and familiarize yourself with it. I'll contact raffle winners by the end of the week.

Vig is dropping a new layout tonight and will be adding new features throughout the week. If there was ever a time to check out the free trial then this is it.

I'll continue below with some unusual options activity from several of my scans this week so you can get a feel for how I use it.

Unusual Options Activity

When it comes to unusual options activity, I personally don't look to ride off hype on the intra-day level, but rather I look for consistent accumulation in names on my lists. There are definitely some big short-term moves that are the result of large amounts of call-buying, but I like to look for plays where a player is potentially building a position. For example, has the stock been hit hard recently, but call-buyers are coming in at each dip? A lot of the time this slow accumulation is what makes the GEX build up for a possible lift-off.

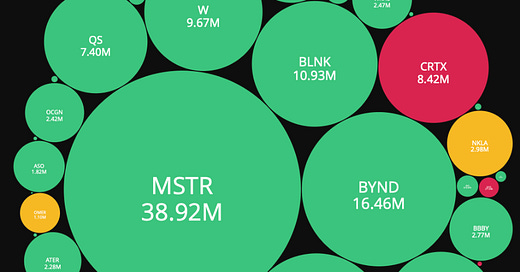

One of my watchlists that I am constantly checking is the highly-shorted names list.

A lot of the usual suspects that we see here, but some of the names that stick out for me are Virgin Galactic (SPCE) and Carvana (CVNA). Here are their charts.

These tickers have seen a hit in share price. The SPCE chart is interesting to me because it looks like history might repeat itself with a rip to the upside. Both names worth getting on the watchlist.

Moving on to the index ETFs list, I've been pounding the table over the last few months as energy and oil stocks continue to see bullish flow run through. Here's the sentiment from Friday.

Let's look at some option flow I've singled out from last week.

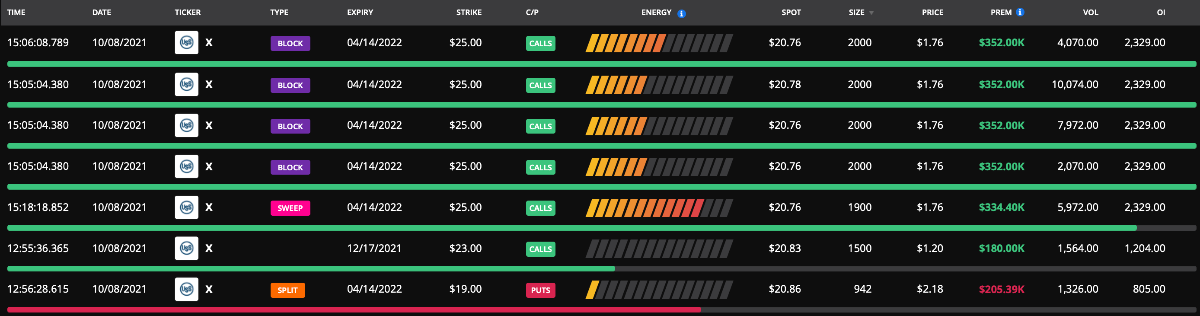

United States Steel (X)

We had several block trades hit the tape at 2,000 contract a piece. Energy was mid-to-high which means sentiment was to the buy-side. We also had some low-energy puts (sell-side) at the $19 strike. Here's the chart for X.

A lot of steel and infrastructure plays were hit hard throughout the Evergrande news, bringing X along for the ride (to the downside). This recent sell-off might have provided a dip-buying opportunity for many names in these industry.

AT&T (T)

T is another name that is down 10-12% from recent highs. These puts look to be sold to open (low-energy and on sell-side). Both blocks were over 3,500 contracts a piece for the $27 strike. Could be that a player is expecting this stock to be finding it's bottom. T is a high-dividend name which generally speaking does not see large swings in stock price. In this potential trade the player is collecting premium, rather than buying the options, and thus hoping the stock remains above $27 by expiration.

Petco Health (WOOF)

Highly-shorted WOOF saw some TLC with a single block trade of calls bought. 2,500 contracts expiring in December at the $25 strike price. Did someone say YOLO?

Activision Blizzard (ATVI) Due Diligence

Our partner stock-research newsletter, TheStonksHub, released an awesome article on ATVI and some of the opportunities in their current pipeline. Here's the first bit of the article, but you can continue reading by clicking the link below.

While the gaming sector may have experienced a slow-down from the Covid tailwinds that propelled the industry for most of 2020, the sector still remains very hot. The demographic has also changed. What used to be predominantly consumed by teenage boys and males in their twenties has now expanded to a much broader, all-inclusive demographic. Studies show that although males still dominate this space, it is gaining rapid popularity among females and also those aged 40+.

Activision Blizzard (ActiBlizz) - About the company

Where does Activision Blizzard (ATVI) fit into all of this? ActiBlizz is one of the world’s most renowned triple A game developers. The company is divided into 3 separate publishers that consist of various studios and intellectual property: Activision, Blizzard, and King. Here’s where each of their IP fall under by publisher.

ActiBlizz’s largest-grossing franchise is by far the Call of Duty IP, also known as CoD, that releases a new addition to the sequel every year in the fall. Coming in second is the King publisher with Candy Crush, and very close behind is the Blizzard segment that consists of games like World of Warcraft, Diablo, Hearthsone, Starcraft, etc. Here’s a pie chart that displays the percentage of revenue from each publisher. Activision is by far the largest source of revenue producing nearly 50%.

Gaming Market - CAGR and TAM

Let’s look at the potential growth of the video game industry. A report by Cision, suggests that the video game market, which includes PC, console, and mobile gaming, will have an expected CAGR of 11% between 2021-2026. The total addressable market (TAM) of the gaming market, currently estimated at $175 billion, is forecasted to reach approximately 300 billion by 2027. Roughly half of this is attributed to mobile gaming, leaving the other half for PC and console.

It’s not easy to put an exact number on ATVI’s current market share in this industry. Based on their TTM revenues of roughly ~8.3 billion and a current market size of $175 billion we can make a broad assumption that ATVI currently holds a 5% market share of the entire gaming industry. If all things remain equal a 5% share of the estimated 300 billion in 2027 would equate to 15 billion in revenue for ATVI, almost double what they are currently bringing in.

Activision Blizzard (ATVI - Full Stock Analysis) The Diablo Super-Cycle

WallStreetBets - Most Mentioned Equities

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.