Swaggy's Top Stonks - Trending Stocks Today

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with...

October 1, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. Today's edition will be a brief run-down of trending tickers to close the week.

Today's Letter

Market Update

WallStreetBets tickers

Macro "general stocks" trends

Penny stocks trends (yikes!)

Swaggy's Watchlist

Market Update

Congrats to all the stock-market "gurus" that have consistently picked winner after winner over the summer. For those of us back here on planet earth grinding away for a mere 0.69% gain on our swing-trades I wanted to go through a few segments of trending tickers to go into the weekend.

If you've had a tough few months in the market, just know you are not alone nor is this the end. In fact, it is quite the opposite. There will be more opportunities that lay ahead and we will be sipping champagne of the highest grandeur. You are on this newsletter because you yourself are an intellectual among scholars all with similar interests in the stocked market.

I don't expect anyone to pay attention to the SwaggyStocks data on the daily, but this week there was an entire assemblage of new tickers trending around the internet. This is why I am here, to pay attention to detail and in times like this we do what we do best, we adjust. I'll dive into a few of these today in an attempt to find a beacon of light in this vast ocean of darkness.

Before we get into it, here's a brief message from our sponsor

Invest In The Future Of Equity Crowdfunding

StartEngine helps retail investors invest in startups for as little as $100. The company is moving into wine collections, real estate, and more. With a goal to help raise $10 billion by 2029, StartEngine has big plans. You can invest in the company’s current equity raise.

The company’s highlights include:

$400M raised for more than 500 companies.

146% revenue growth year over year in the first half of 2021.

The platform currently has over 500,000 prospective investors signed up.

Led by co-founder of Activision (ATVI).

Launched StartEngine Secondary-a trading platform for startups.

Now investors can invest in the platform itself.

Check it out here for more information.

This is promotional content.*

Disclaimer: Reg A+ offering made available through StartEngine Crowdfunding, Inc. Investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. View StartEngine Crowdfunding, Inc’s offering circular and selected risks. Past performance may not be indicative of future results.

WallStreetBets Tickers

Notable events:

AMC sentiment picked up yesterday around 1pm EST. Shares rose 10% within the span of one hour for no reason, but does AMC ever need a reason to do what it does?

IrontNet (IRNT) first gained popularity a few weeks ago when the share price shot up from $13 to $40, over 200% gain, in a matter of days. The stock is down 40% in four trading days and back to the $15 level.

Bed, Bath & Beyond (BBBY) dropped 23% on earnings after a huge slow in growth and missing estimates. BBBY has very high short-interest and WSBers still hoping for a squeeze.

WISH/SDC/CLOV are the top short-interest and squeeze speculation plays.

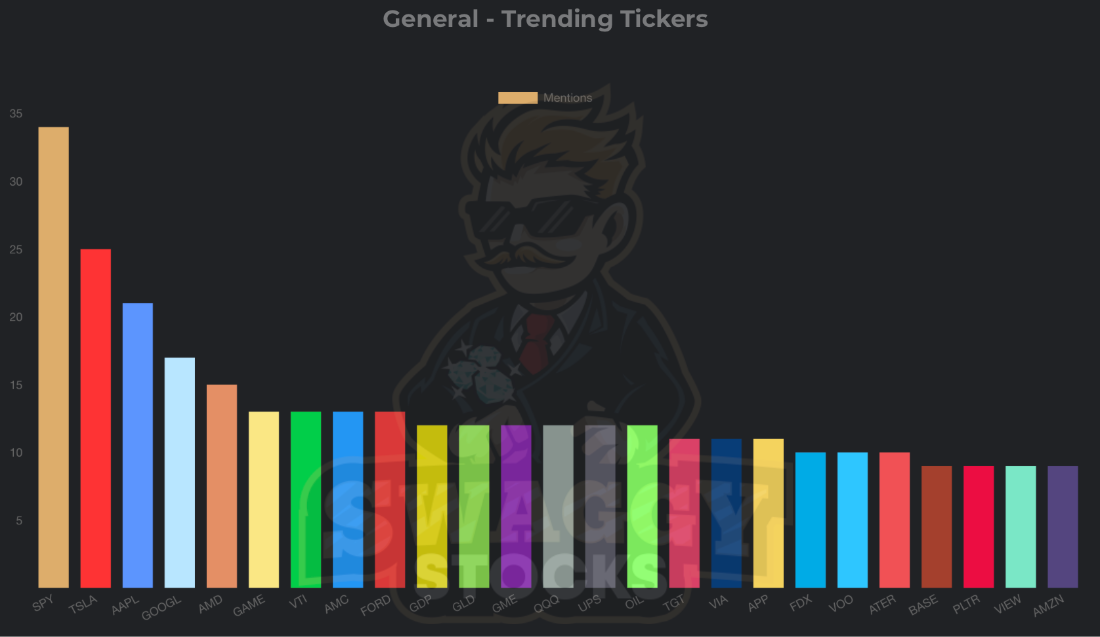

A more "macro" list of tickers

I don't frequently browse the list of "general trending tickers" for the sole reason that most of the names are usually boring blue-chip tech stocks.

On one hand you have WSBers that live and die by the sword that is high-beta growth stocks, and on the other hand you have the rest of the world talking about AAPL, GOOGL, AMZN, and MSFT. I like to use a healthy mix of both for my portfolio and I always keep an eye on the trending list to see if there's anything out of the ordinary to learn about.

Current top names here are:

AAPL

GOOGL

AMD

VTI (Vanguard ETF)

GLD

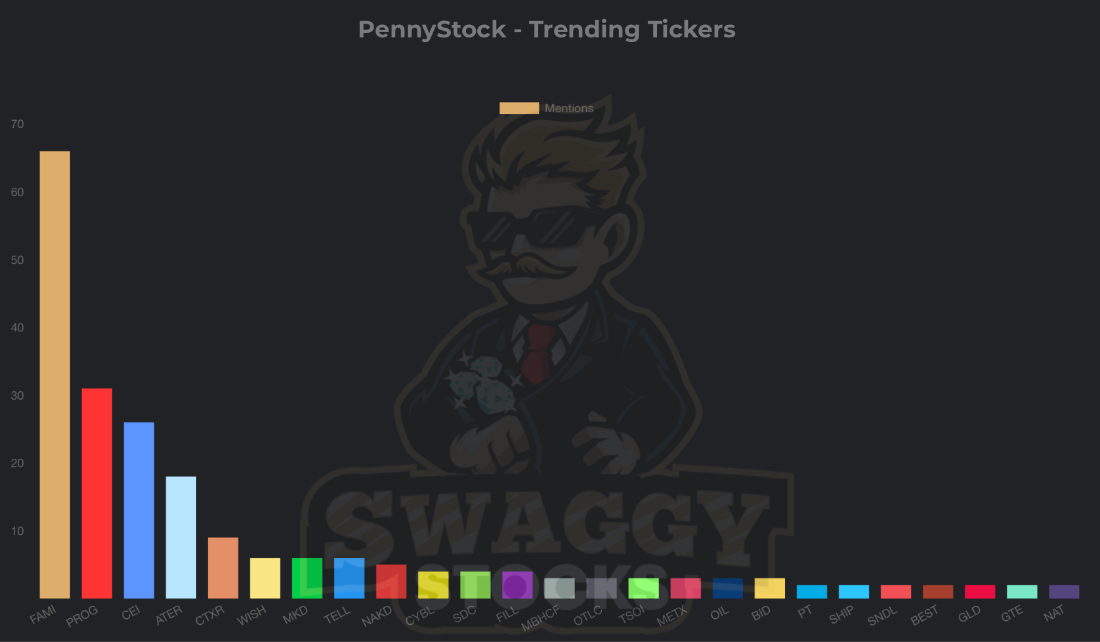

Pennystock Trends

Aah penny stocks, the bane of my existence and what you constantly find the Twitter Gurus and Discord chats pumping. Penny stocks are risky assets usually due to their micro-cap size. They can have wild swings to both the upside and downside, and for that reason I don't typically trade them. Top on this list are:

Farmmi Inc (FAMI): This stock has doubled in just two days and is trending due to the action in share price.

Progenity (PROG): Another stock that doubled in only the most recent 3 trading sessions.

Camber Energy (CEI) has been quite popular among Twitter users. The stock has performed VERY well and is up almost 1,000% for the month of September.

These are high-risk, high-reward equities. SwaggyStocks usually picks up these trends early on, but just as easy that these names can double, they can also go the opposite direction. CEI is already down 20% this morning and swings like this are common among micro-caps.

Swaggy's Watchlist

Among all this madness, what does Swaggy himself keep an eye on? Personally, I like to find stocks that are rising in sentiment, and not necessarily have become the top meme stock (yet). What I mean by this is looking at something like IRNT that was a top trending ticker on WSB not long ago. Here's the sequence of events that happened.

Pretty unknown stock among retail traders has 1-2 good trading days in a row and shoots up 30%.

The stock begins to trend around social media and WSB.

The stock then goes up 100% in short amount of time causing retail FOMO.

Ticker reaches "meme" level and is a top 3 most mentioned ticker around the Internet.

Traders start giving reasons why the stock will "double again by the end of the month".

The trade becomes over-crowded and next thing you know the share price plummets.

Now, step #6 doesn't always happen, but it is a frequent occurrence and I'd rather not take the risk after the stock has reached step #3. Here's the IRNT chart, for example.

Can you spot each step I just laid out? If you hopped on the trend when something unusual was just starting to happen you were able to ride it on the way up, otherwise you got on the trend late and ended up on the bus going the wrong direction.

Instead, I glance at the intraday trends and have my own alert system setup to notify of incremental changes in ticker mentions and activity. Here's a screenshot from yesterday's WSB Trends page.

Some of the names on this list that caught my attention for a swing trade are:

RKLB

INDI

SPCE

NAKD (was on the list two days ago)

Remember, these are all somewhat risky stocks so I only allocate a very small position size here.

I am currently working on an alert/notification system for all SwaggyStocks trends and I'm looking forward to introducing this feature in due time.

That's the end of today's edition and I want to say a sincere thank you to everyone that has shown an interest in SwaggyStocks and enjoy the newsletter content.

Cheers,

Swaggy

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.