Swaggy's Top Stonks - The Swaggy Watchlist

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with...

October 4, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

This is a follow up from yesterday's email where I wanted to point out stocks that I am currently looking at to enter a position. We all know that FOMO feeling and the trade that "could have been" if we only held a little longer or got in a day earlier. However, most of the time that FOMO trade is incredibly risky, especially if the trade is driven by social hype.

Today I want to highlight several tickers I'm looking at that are the exact opposite of FOMO. I'll be finding charts where social sentiment is at the lows, and the chart agrees with a proper entry. Let's go.

Today's Letter

Swaggy's Watchlist

Before we get into it, here's a brief message from our sponsor

Invest In The Future Of Equity Crowdfunding

StartEngine helps retail investors invest in startups for as little as $100. The company is moving into wine collections, real estate, and more. With a goal to help raise $10 billion by 2029, StartEngine has big plans. You can invest in the company’s current equity raise.

The company’s highlights include:

$400M raised for more than 500 companies.

146% revenue growth year over year in the first half of 2021.

The platform currently has over 500,000 prospective investors signed up.

Led by co-founder of Activision (ATVI).

Launched StartEngine Secondary-a trading platform for startups.

Now investors can invest in the platform itself.

Check it out here for more information.

This is promotional content.*

Disclaimer: Reg A+ offering made available through StartEngine Crowdfunding, Inc. Investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. View StartEngine Crowdfunding, Inc’s offering circular and selected risks. Past performance may not be indicative of future results.

Swaggy's Watchlist

Not all stocks are driven by social sentiment to the extreme, aka "meme stocks". What makes a meme stock isn't the underlying fundamentals or business model of the company, but how much of the movement in share price is "attributed" to momentum from social media.

When looking at some of these sentiment plays I break-down the following:

What was the reason for the hype? Was it a dip opportunity or was it hyped from a huge run to the upside?

Is the ticker a blue-chip? Solid fundamentals? Or is it a high-risk/high-reward short-interest play?

What's the share float? Is it under 100 million? Will accumulation in social sentiment lead to the share price being prone to large swings?

Some of these meme stocks will be risky regardless of the situation, but I always try to understand what is going on under the hood and look at various scenarios.

As always, please do your own due diligence before entering any positions because like your mom always said, you shouldn't be getting financial advice from strangers on the Internet.

Meme Stock List

Palantir (PLTR)

One of WSB's babies they treat this stock better than their newborn child. Most of these up-ticks in sentiment were "after-the-fact" the stock shot up in price, except for one instance. That instance is back in May when the opposite happened after the share price dropped 20% in a relatively short time. WSBers "bought the dip". Looking recently I might see a similar opportunity. After PLTR almost broke out of the $30 level two weeks ago it has re-traced back to $24. I like the stock here.

Advanced Micro Devices (AMD)

Although AMD still consistently makes it to the top 10 most mentioned stocks on WSB the share price is in somewhat of a lull. A similar lull occurred earlier this year from April to July before it really took off. After this 15% retracement I like the risk-reward opportunity that is presented.

Robinhood Markets (HOOD)

Ahhh, Robinhood. This stock is like the kid that always gets picked last for pick-up basketball. However, in my opinion this stock is a huge underdog. With nearly 20 million users locked into the platform there is an opportunity to expand to new markets. What I like about this stock? After the IPO and down over 50% from the intraday high NOBODY is talking about it anymore.

The Lesser Meme List

Apple Inc (AAPL)

Not quite a meme stock, but not quite not a meme stock. Apple is still one of WSB's favorite's tickers and has suffered a drawdown in share price along with the weakness in the market. At $142 per share this brings us back to where the stock price was in June. AAPL is up roughly 8% YTD relative to the SPY's 16%, so it's performance has been somewhat lackluster. In my opinion the market weakness has opened an opportunity to get into blue-chips like AAPL.

Cleveland Cliffs (CLF)

CLF has an interesting story on the fundamentals behind their acquisition of AK Steel. Here's an article from our partner site that goes through some of the company's business model and the outlook for the steel industry.

WSB sentiment for CLF really spiked back in June. Again, this was after-the-fact the share price went up 35% in a short period of time. You'll notice that shortly after sentiment spiked the share price tanked.

The China Evergrand news has greatly effected the steel and coal industries and took CLF along for the ride to the Earth's core. At CLF's current price it presents an opportunity to get a better cost basis than before it took off back in June. In my opinion, the entry point is solid here.

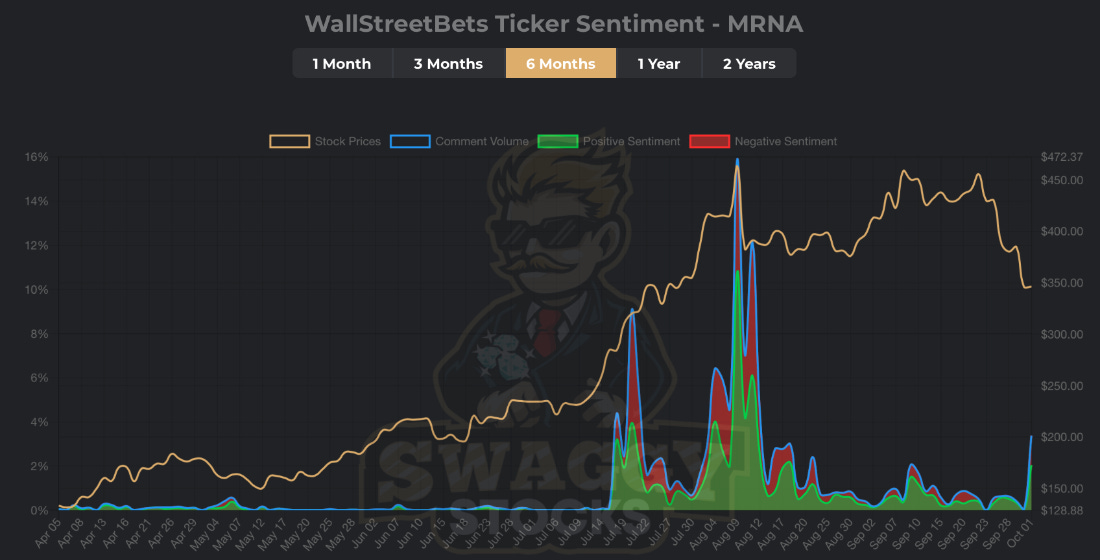

Moderna (MRNA)

This could be the most risky of stocks mentioned today. Although MRNA's share price has tumbled from the highs it's still up a considerable amount YTD, 225% to be exact.

Sentiment began to spike on this down-trend after a few heavy days of selling. It might be possible that WSB thinks MRNA is reaching a point of being over-sold.

That's all for the Swaggy Watchlist edition. If there was something you really liked or hated from the newsletters this past weekend feel free to respond to this email and provide the feedback. It's always welcome and helps me improve the quality of content.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.