Swaggy's Top Stonks - The Squeeze Continues

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

June 6, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

This week's letter

Market Update

Trade Ideas & Chart Analysis w/ VigTec

Unusual Options Activity

What we're reading

SwaggyStocks - New Feature (News Trends & Keywords)

This week's trending tickers

Market Update

Last week was the continuation of short-squeeze names moving higher and making headlines all around the news. It seems there is no rhyme or reason to this squeeze other than the fact they are high "short-interest" stocks.

The last time something similar to this happened back in Jan/Feb the market began it's epic rotation out of growth names and into the beaten down sectors of financials, energy, and industrials/materials.

Nobody knows for certain what could happen this time around. If big funds get blown up (yet again) this could make for some margin calls and liquidation of their other holdings. We'll have to see how this plays out.

Last week I mentioned several other names that had similar qualities. Those 2 qualities were:High short interest names that haven't already gone up 100% in 3 days.Had a high number of retail mentions, aka were on the radar for many traders.

Those names were: FUBO, SPCE, ROOT, CLOV, and SDC. I should add BBBY (Bed Bath & Beyond, not to be confused with BBW), since that is also on the radar. Two of these names were up 13% and 17% respectively, while the others remained somewhat flat. Here's a chart of their performance over the last 5 trading sessions.

Trade Ideas & Charts

I've been using the VigTec platform mainly for monitoring unusual options activity, but their charting tech is also best in class. A few stocks on my watchlist have been consolidating for some time and have caught my eye for a potential entry. These 3 names are: Salesforce (CRM), Alibaba Holdings (BABA), and Advanced Micro Devices (AMD). If you haven't already, check out the VigTec 7-day free trial. Here's a breakdown of the BABA chart AND volume profile.

BABA is trading where it was exactly one year ago. The e-commerce giant has been hit with government sanctions and there is some uncertainty about what Chinese regulators will do next. The volume profile, which I've highlighted in the yellow box, displays the supply and demand at each level in stock price. We can see it is "thick" between the price of $210 and $240 (the stock is currently $220) which means there is a lot of supply at that level. A more simplistic take would be saying that for every $1 it goes up, it needs to chew through a million shares a long the way. The same can be said for the stock going down (this was just an example and wasn't the real volume). However, we can see on the chart at the $240 level that supply starts to "thin" out. This indicates there is potential for the stock to gap quickly above that range and into the $260 level where it will be met with more supply.

Disclosure: I purchased shares of BABA last week at $216. Stocks are risky assets and can cause a loss of capital, please read the not financial advice disclaimer at the bottom of this newsletter. My intention on these shares is also to hold for a year+ and is NOT a short-term play.

Unusual Options Activity

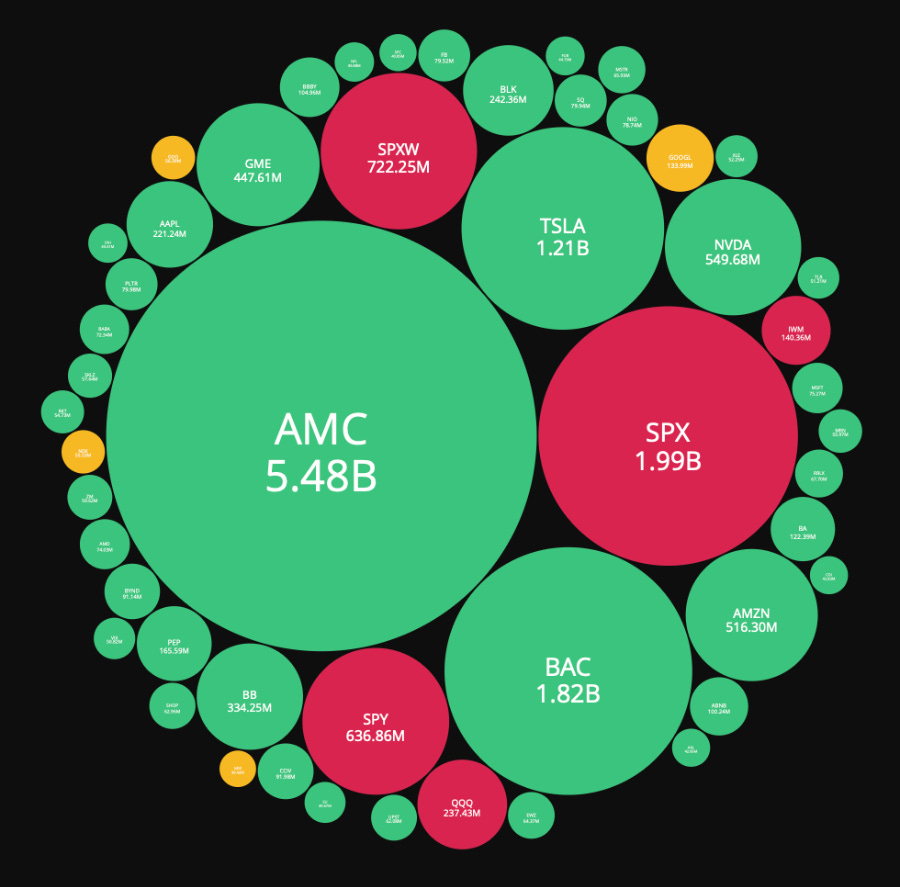

I always keep an eye out on unusual options activity because it can really show where momentum is picking up and where smart money may be entering positions. In my opinion this momentum trading has really taken off since the Gamestop saga and it could be here to stay. Here's a look at options activity from Wednesday when AMC shot up 100%.

It's incredible that AMC was the most heavily traded ticker with ~5.5 billion dollars worth of premium exchanging hands via options. Although not as much volume as AMC, for a $5 billion market cap ticker, BB was also quite high on the list.

Circling back to a couple weeks ago I mentioned how players were picking up calls in Gold and Silver. Here's the option activity on popular ETFs.

It looks like momentum is continuing to build in GLD and SLV, while bearish on HYG (a high-yield bond ETF). Something could be brewing and this might just be a hedge on inflation using precious metals as the underlying. This upcoming Thursday at 8:30am we get some important economic data, the CPI. The following week we have core retail sales numbers coming out for May as well as the highly anticipated Fed interest rate decision, so keep an eye out for those.

If you want to check out these charts for yourself, take a browse on the VigTec Free Trial, and read this complete guide I posted on how to setup your watchlists and navigate the platform.

What we're reading

TheStonksHub Weekly DD - Clover Health (CLOV - Full Report)

GritCapital - The 'M' in AMC stands for Moon

MacroDrip: A Macro Newsletter - How to play the chip shortage

SwaggyStocks - New Feature

A few days ago a new feature was added to the SwaggyStocks website, News Trends. This feature is a part of a much larger idea that will be released very soon, The SwaggyTerminal (very cliché). The terminal will have all trends data, mentions, ticker popularity, news sentiment, key terms being tracked for stocks all on one single page. I'll get into it more when the feature is released, here is the new "News Trends" feature.

1. Most mentioned stocks in the news & sentiment

2. Key terms associated with those tickers. For AMC the terms were:

"Retail investors"

"Meme stocks"

"short sellers"

"Mudrick Capital"

All these features are still completely free on the site. If you feel like supporting SwaggyStocks and buying Swaggy a nice Starbucks (SBUX) latté, check out our Patreon page.

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.