Swaggy's Top Stonks - The Sentiment Report

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with...

October 7, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. This is the end-of-week run-down where we take a look at what's trending, why, and some potential opportunities.

This Week's Letter

Sentiment Report

Stocks Picking Up Steam

Trending Tickers

Sentiment Report

#1 SmileDirectClub (SDC)

This is currently the #1 most mentioned stock on WallStreetBets for reasons none other than the short-interest play. SDC had a nice day yesterday and provided 6% return. WSB hoping that this is the squeeze.

Looking back at the 6-month sentiment vs stock price chart SDC looks to still be in a relatively calm area with the potential of getting back to it's former glory. of $12 per share (currently $7).

Tilray (TLRY)

Tilray reported earnings in pre-market and the results were lack-luster. TLRY opened red, but has turned green carried by the rest of the market strength.

Palantir (PLTR)

Palantir has seen lots of good news in the last few days which include signing several large contracts. PLTR was up 15% in pre-market yesterday, but shockingly ended the day only +1.5%. It takes a lot for this stock to gain momentum, however, there are a couple things holding this stock back. Here they are the following.

First is from PLTR's recent earnings call (transcript).

Management is talking about Papa Karp's (CEO) options compensation. Many investors look at the insider transactions and only see that Karp is selling a boatload of shares. However, if he doesn't exercise these options by the end of the year he will lose all his shares. He's actually paying massive amount in taxes compared to if he was able to exercise his options over the next several years.

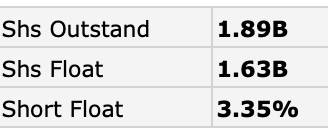

The other factor is Palantir's hefty valuation and shares float.

This data is per FinViz, but forward P/E it quite high. Price/Sales is quite high. Price/Book is quite high.

As much as I believe Palantir will eventually become a world-renowned company and begin to compete with other mega-cap stocks, it's valuation is pretty rich at this point in time. Combine that with Papa Karp exercising options and periodically selling hundreds of thousands of shares with a 1.9 billion float and we have figured out why the stock price hasn't really done much this year -even off good news.

ContextLogic (WISH)

WISH is the highly popular online retailer -a flea market, if you will. TheStonksHub wrote a pretty good in-depth analysis of the company and their business model, check it out. WISH has been hit hard and is somewhat trading at an unbelievable price/sales of only 1.11. They are currently doing 2.8 billion in sales and have a market cap of 3 billion, incredible. Even with the poor quality of product they sell they do have a large amount of users and an established network. This could be a decent entry point for this severely beaten stock, down almost 70% from the intra-day highs not long ago.

Sentiment is picking up due to how "under-valued" the company currently is, according to WallStreetBets.

Before we get into the rest of the newsletter, here's a brief message from our sponsor

Invest In The Future Of Equity Crowdfunding

StartEngine helps retail investors invest in startups for as little as $100. The company is moving into wine collections, real estate, and more. With a goal to help raise $10 billion by 2029, StartEngine has big plans. You can invest in the company’s current equity raise.

The company’s highlights include:

$400M raised for more than 500 companies.

146% revenue growth year over year in the first half of 2021.

The platform currently has over 500,000 prospective investors signed up.

Led by co-founder of Activision (ATVI).

Launched StartEngine Secondary-a trading platform for startups.

Now investors can invest in the platform itself.

Check it out here for more information.

This is sponsored content*.

Disclaimer: Reg A+ offering made available through StartEngine Crowdfunding, Inc. Investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment. View StartEngine Crowdfunding, Inc’s offering circular and selected risks. Past performance may not be indicative of future results.

Stocks Picking Up Steam

The only way you can find the next meme stock is buy monitoring trends frequently. Luckily, SwaggyStocks has your back. Here's a look at stock that are picking up steam over the last 24 hours.

Interesting Headlines

Ginkgo Bioworks (DNA): This company making headlines after yesterday's 10% decline. The company just IPO'd on September 17th and has performed poorly. WSB is very aware of this.

Affirm (AFRM) mentions up 2,200% after the stock making some bullish moves to the upside. AFRM shares closed up 20% yesterday.

RKLB continues to build social momentum this week. I highlighted this stock on Tuesday as it continues to trend under the radar.

Other interesting names beginning to trend include EA, MSTR, and MINT.

WallStreetBets - Most Mentioned Equities

Today's most talked about stocks on WallStreetBets.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.