Swaggy's Top Stonks - The art of the (short-interest) trade. Part 1

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together With...

July 15, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. This is "The Rundown" edition which is a mid-week update that goes down the rabbit hole of trending events. Today's edition will be particularly focused on the art of the short-interest trade.

This Week's Letter

Market Update

A Message From Masterworks

The Art of Short Interest Stocks

Preface Into This Weekend's Report

Unusual Options Activity

Market Update

When the Gamestop saga began in January I'm sure everyone thought this was a once in a decade event. This one trader managed to turn $100 into $10,000. Banks hate him!

The Trader:

However, looking back at AMC with what happened at the end of May and early June we might see that the "short squeeze" play could very well have formed it's own asset class. Just like how stocks rotate to and from value to growth or to and from different sectors, we might begin to see the occasional rotation into "high short-interest" stocks. Wild!

Personally, I also thought the Gamestop madness was over once the hype began to fade in April. It turns out I was wrong and that period was only a lull in what soon picked up again for a new round of excitement. What I remember quite clearly though is before these high short-interest stocks took off again many of them were "down bad" from the peak of the hype.

Why this is interesting to me is because if (BIG IF) these shorted tickers do take off again, the best entry points would most likely be during or after the hype has died off. Today I'll be going through a list of the short-interest names that are extremely popular among the retail crowd on WallStreetBets as well as Twitter.

*Highly shorted stocks are extremely risky, please read the not financial advice disclaimer at the bottom of the newsletter and of course do your own research before entering any positions.

Before we get into the art of short interest stocks, here's a brief message from our sponsor, Masterworks.

A Message From Masterworks

Hedge funds started buying Tesla at $7.50...

...we don’t need to tell you what followed. Now they’re pouring millions of dollars into the next untapped asset class: blue-chip art. What do they know that you don’t? Check out these juicy stats:

Contemporary art prices outperformed S&P 500 returns by 174% from 1995 through 2020.

The $1.7T art asset class is projected to grow by $900B over the next 5 years.

Over half of ultra wealthy investors are estimated to allocate more than 10% of their overall portfolio to art.

But unless you have $50M lying around to build an art collection yourself, you’ve been locked out of this under-the-radar investment. Right? Think again, Playboy. Introducing Masterworks, the premier platform for investing in legendary artists like Basquiat, Warhol, and Banksy at a fraction of the traditional entry cost. So get over your crypto blues and join an elite asset class that's centuries in the making.

Bonus: with this private link, SwaggyStocks subscribers can get priority access to Masterworks today.*

*This is an ad, please see important disclosures.

The Art of Short-Interest Stocks

When it comes to short-interest stocks GME and AMC will always be the "go-to" for most of WallStreetBets. However, there are other categories of tickers that follow the lead of the short-squeeze and have tracked a similar performance. These are:

Main Short-Squeeze Stocks

Gamestop (GME)

AMC Entertainment (AMC)

Non-Squeeze Stocks*

Blackberry (BB)

Nokia (NOK)

Palantir (PLTR)

Weed Stocks

Tilray (TLRY)

Sundial Growers (SNDL)

Other popular Short-Squeeze stocks liked by retail

Clover Health (CLOV)

Workhorse (WKHS)

ContextLogic (WISH)

Petco (WOOF)

FuboTV (FUBO)

Less popular short-squeeze stocks liked by retail

Blink Charging (BLNK)

Smile Direct Club (SDC)

GoodRX (GDRX)

MicroStrategy (MSTR)

Carv (CARV)

Ocugen (OCGN)

Geo Group (GEO)

Academy Sports (ASO)

Root Inc (ROOT)

*Non-Squeeze Stocks Nokia, and Palantir participated in the January squeeze, but not recently in the AMC squeeze. Interestingly enough for the category of "non-squeeze" stocks, they never really had a high short-interest, but still participated in the rally.

I will be writing up a YUGE short-interest report for Sunday. There will be a lot of data so to shorten the report and make it easier to analyze all the data-points I will be grouping them into the categories I just mentioned. We'll look at factors that make these short-squeezes possible, such as: shares float, short interest of float, recent share price performance, and retail "popularity" (driving force).

Today, I'll start with my thoughts on what could possibly be going down. Again these are my non-expert, non-financial-advice opinions and should not be taken as investment advice.

Swaggy's Thoughts

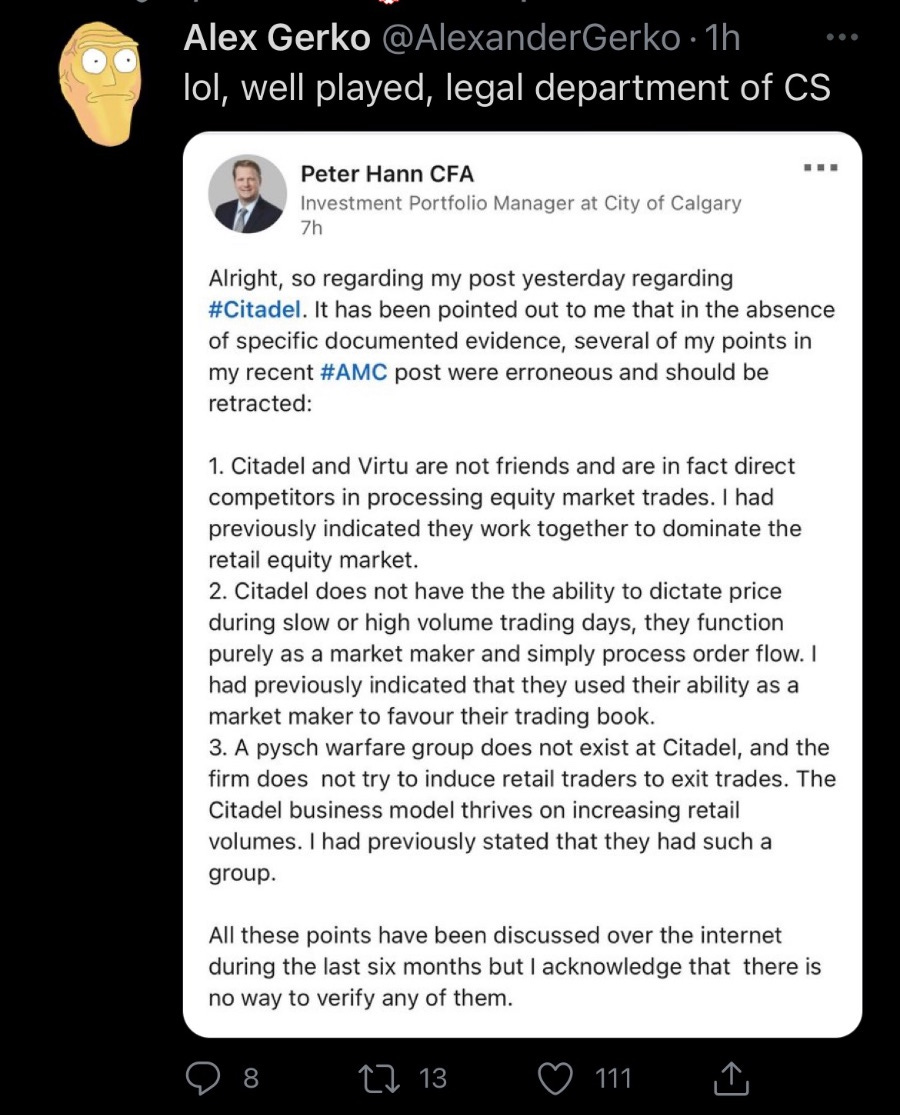

In my opinion, what could be happening is that some hedge funds are still majorly short names like Gamestop and AMC. If you have been continuing to follow the story you might have noticed there are infinite amounts of speculation around what is currently happening with those names. From creating synthetic shorts, "borrowing" shares that don't exist, shorting ETFs that are holding these tickers, and to having trades directed to dark-pools (off-exchange trades), the list (and possibly witch hunt) goes on. Here's a screenshot of a popular post from LinkedIn that has been making it's way around Reddit and Twitter.

That post was followed up by another from the same author the following day.

What I'm trying to say is we don't know if the shorts have closed their positions or if there is still blood in the water, but what we can do is set ourselves up for the next play. If "short-interest" stocks are indeed a new asset class then it is quite possible we do see another wave of hype sometime around the corner.

Short-interest plays "could" be cyclical

So why did all these stocks take off again the last trading week of May? My theory is that it had something to do with approaching end-of-quarter position rebalancing as well as options expiration (OpEx), which have been known to cause increases in volatility.

Why does that matter? It's possible funds with large open short positions were actually looking to close only a portion of their positions and book a small loss at the end of the quarter.

Why do these short-interest stocks spike so fast? The common denominator in a lot of these names is the fact they have so few shares available for trade, also known as "the float". A ticker like Gamestop has 57 million shares available for trade. For comparison, Palantir (PLTR) has a 1.45 billion share float. For low float stocks even a relatively small buy order by a fund could cause the price to spike due to liquidity and how many shares are available at current prices.

Getting out of the short position

Due to liquidity issues mentioned above, it's not as easy as buying all the shares back to exit your position. There might only be 100,000 shares of AMC for sale at $10, what happens when you buy all those? The liquidity and supply of shares dries up and next thing you know you are buying at $15 per share.

That's why closing the entire position at once might incur a realized loss of 500%. The alternative is to buy back during "boring" periods and realize a 10% loss several times throughout the next 12 months. These numbers are made up, but it gives an idea of what I mean. Remember that we are dealing with large amounts of capital allocated to these positions so the difference between a 500% loss and 50% loss could be in the range of billions of dollars.

This leads me to my next point. Funds who have shorted might also have their own set of trading "rules" to follow. For example, if they shorted AMC at $10 and the stock is now $40, that is a 300% unrealized loss. They might only be "allowed" a max loss per share and to be able to buy back in the $15-20 range. The tricky part is that when AMC was only $10 the stock needed to double for short-sellers to incur a 100% unrealized loss. At $40 the stock only needs to go up 25% to incur another 100% of losses for the shorts. The risk is beginning to be exponentially higher.

The Exit Strategy?

You might be thinking how short sellers can continue to navigate these trades with large amounts of unrealized losses. It's unrealized because they haven't exited the positions they are trying to get out of. I'll re-iterate that I am only speculating, but here is how I think the process (somewhat) looks like.

Step 1: The high short-interest stock share price spikes due to shorts closing positions (buying shares back) on a low liquidity name or simply a crowded trade that went the wrong way.

Step 2: Retail joins in the action because they think it's easy to make money by diving in head first. This causes the stock price to keep going up.

Step 3: Profit takers and people riding the momentum sell shares because it seems like a logical thing to do.

Step 4: Stock price tumbles and continues somewhat of a slow bleed. It's up for debate whether market participants are using tactics to drive stock price down, I don't know enough to comment on it.

Step 4-A: This "slow bleed" process could last weeks or months, making the ticker look particularly boring compared to other stocks. Do traders holding the shares lose their appetite to hold the stock after losing money day in and day out? Eventually the stock price either drops to a "buy area" where a fund can buy shares back at an acceptable loss (80% loss versus 300%) or another catalyst drives shorts to cover, going back to step 1.

Here's a visual of it in action on the Gamestop (GME) chart

Closing Thoughts

I could be wrong and it might simply be another case of "meme stocks gone wild", but this may also be 5D chess being played funds who are short and trying to navigate the potential of losing billions of dollars. Either way, it makes for interesting times in the market and I am enjoying the ride.

This Sunday's newsletter will have the complete short-interest report with popular high short-interest among retail traders. So stay tuned. For now, let's get into some unusual options activity.

Disclosure: I do not hold any positions on AMC or GME and am impartial in the direction the stock goes.

Unusual Options Activity

Personally, my trading style is less of day-trading and more of looking for good entry points and riding trends with a buy-and-hold strategy. I also like monitoring what the option flows are hinting at through unusual options activity (UOA). UOA has been known to show where "smart money" might be entering positions or setting up for a big play. I'm not talking about YOLOs on options expiring next week, but more about million dollar directional bets placed on a ticker already on my watchlist.

My scans usually consist of a pretty straightforward process. First, I check out option flow for my individual watch lists (which are always getting adjusted). Below I'll show you some option flow sentiment from my "popular stocks" watchlist and also my list of "short-interest" stocks that are on my radar. Again, I'll monitor these daily to see what kind of option flow is building up. Has the ticker seen weeks of bullish activity and the technical’s agree for a breakout? Mainly I'm looking for repeat activity in some of the names I am interested in.

Popular Stocks

Although yesterday was a massacre for many stocks, there was definitely some bullish flow out there. The names with bigger market cap will have more "volume" and "premium" traded in options compared to a small-cap stock, so their "bubbles" will naturally be larger. What I like to look for are the "mid-size" bubbles and then drill down on the ticker to see what kind of option trades hit the tape.

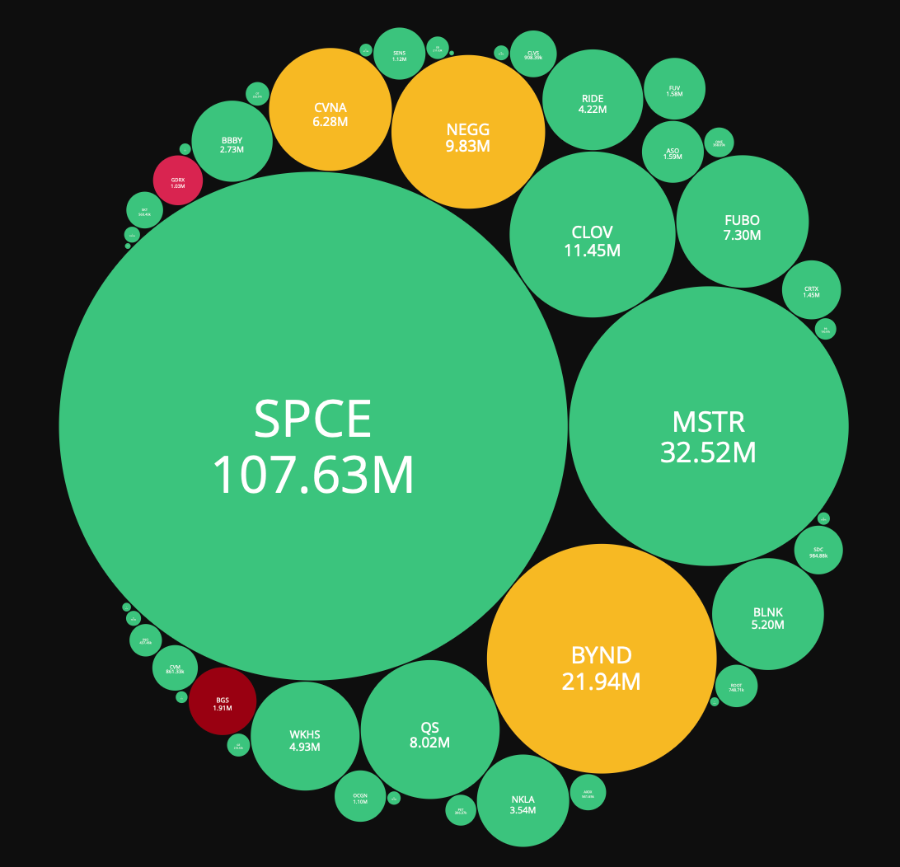

Short Interest Stocks

Short-interest stocks have been hit hard and are almost trading at a favorable level for an entry on this "risky" play. Here's what came out on my scan yesterday. At first glance MSTR is a name that popped up that I haven't seen in a while.

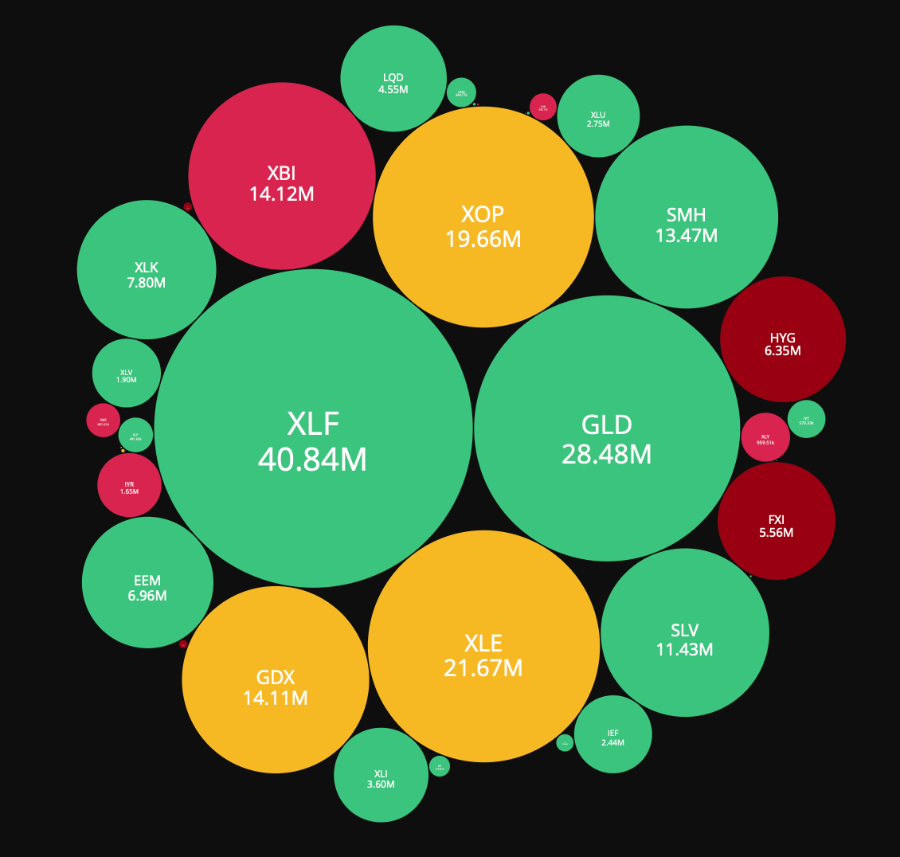

Major ETFs

Last, but not least I like to look at popular ETF indices. Over the last few sessions HYG, a high yield corporate bond ETF, has seen some bearish flows come through. Energy was mixed while Gold, Silver, and some Tech ETFs were in the green.

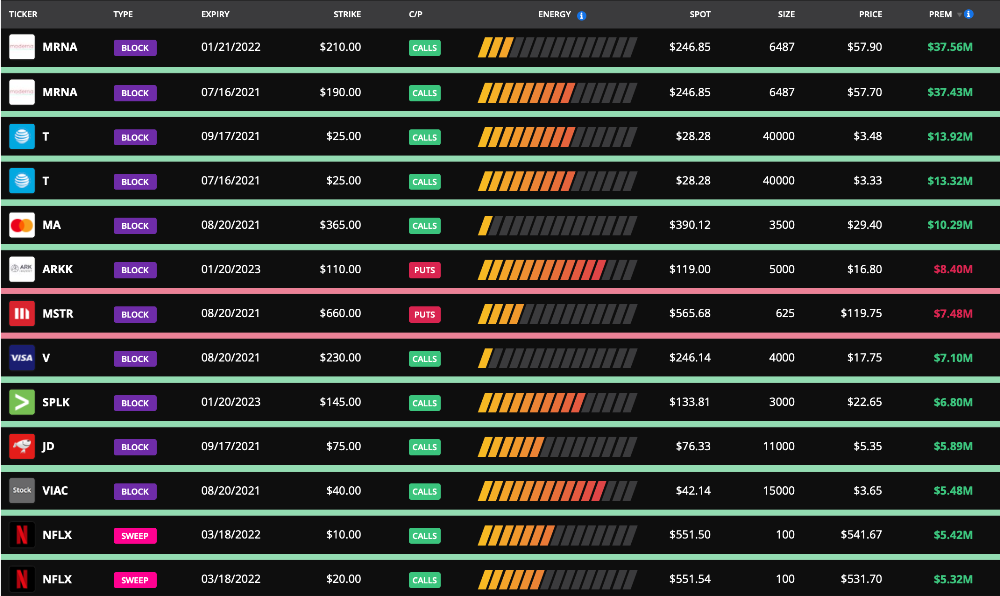

My due diligence doesn't end there. Drilling down to a ticker I can see large block/sweep trades that happened in each ticker. Here are some of the larger trades from yesterday. Like I said, I don't trade DIRECTLY off this information, but I piece things together on what might be going on under the hood of each trade, then use that as confirmation bias for names that I am already holding or want to enter positions on.

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.