Swaggy's Top Stonks - Stocks on the chopping block

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with... AsomBroso

September 30, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

This Week's Letter

Market Update

A message from AsomBroso

DD on "meme stock" CCJ

Breakout Trends

Top Trending Tickers

Market Update

The tape has been weak and my growth-stock bags make me feel like Atlas shrugged. Mr. Market is concerned with the energy trade that's currently on a collision course with the moon, along with unstoppable (transitory) inflation and higher rates. There is no doubt the market is on hard mode after bulls have been cleaning house for the last several years. All rips to the upside are quickly sold, it's time to stay as nimble as ever and personally I am not over-exposed to the long-side.

Yesterday we opened higher and a glimmer of hope could be seen in most investors' eyes. Within minutes the bulls were slapped in the face and by mid-day stocks had tumbled to the day's lows. If you bought the afternoon dip you probably felt like Zeus engaging in lightning-warfare going into the close only to experience an absolute ripper to the downside and ending the day at the ramen noodle shop, selecting which flavor of dried chicken you'll have for dinner.

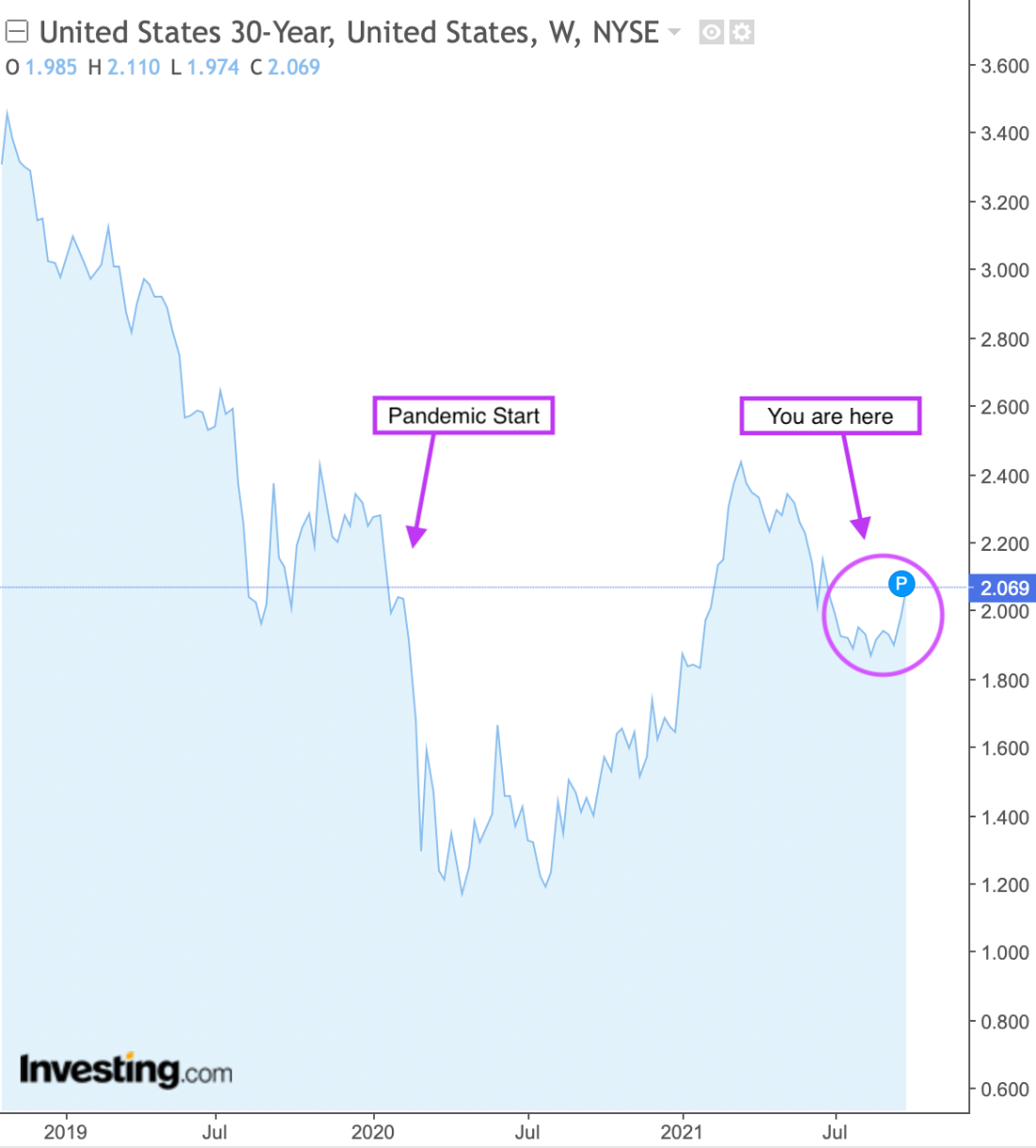

At this point I sound like a broken record when talking about how growth stocks are under pressure and being put on the chopping block. The Russell, a small cap index, has done absolutely nothing and returned only 1% in the last 6 months. This is mainly caused by uncertainty in yields, which up-ticked higher yet again this week. Here's the frightening 7-day chart of the U.S 30-year bond.

A sharp increase over the last 7 days, 20 basis points higher and we are losing our minds.

However, why don't we use the "zoom out" button and ask ourselves if the market should be nearing bear territory over this.

Which begs me to ask, why are the expansion and contraction of valuations so heavily reliant on the risk-free rates? How much emphasis should this have on asset valuations and where do we draw the line? After-all, it is a clown world so I don't expect anyone to have the right answer.

I do not expect this chop to subside within the next few weeks. I've got my knee-pads on and my diamond-hands have never been more prepared for this moment.

Today's edition is sponsored by AsomBroso...

Premium tequila sales are booming, and you don’t need to be a Hollywood A-lister to get in on the agave game.

AsomBroso Tequila can make waves in this massive market—one that’s projected to surpass $14.7 billion by 2028—and they’re offering you a seat at the bar.

What makes AsomBroso particularly special? They’re considered top shelf by many, receiving multiple awards and honors from tequila experts at Robb’s Report and the San Francisco World Spirits Competition.

The best part? You can jump on board and reserve shares for as little as $480.

The rich and famous may call investing in this fine spirit a “hobby”—we’d call it an opportunity.

Don’t miss your shot at getting in with AsomBroso—this one goes down easy.

Disclosure: You should read the Offering Circular (Asombroso OC) and Risks (Asombroso Risks) related to this offering before investing. This Reg A+ offering is made available through StartEngine Primary, LLC, member FINRA/SIPC. This investment is speculative, illiquid, and involves a high degree of risk, including the possible loss of your entire investment.

This is sponsored content*

The Weekly DD - Cameco Corp (CCJ)

Uranium stocks and CCJ were trending over the last few weeks on social media. Somewhere on WSB you can hear a user yelling "CCJ to da moon", but do they really know much about the company's business model and valuation?

Our partner site, TheStonksHub, released a quality article on Cameco Corp (CCJ), the uranium miner. Here's a quick preview, but you can continue reading the full article on TheStonksHub newsletter, for free.

CCJ at a glance

CCJ is the world’s largest publicly traded pure-play nuclear fuel company. They are involved in the extraction of the uranium ore taken all the way to its enrichment where it will eventually be pressed into pellets and sold as nuclear fuel. This involvement includes 4 key steps:

Mining and milling: the actual mining of the uranium. If it is mined as ore, this ore is crushed into powder. If it is mined as a dissolved liquid, then the uranium is extracted from the liquid.

Refining: the reduction of impurities within the uranium.

Conversion: a conversion of the uranium in preparation for enrichment.

Enrichment: the separation of usable uranium isotopes so that it can be packaged into fuel and sold to nuclear reactors.

Within these four steps, CCJ is heavily involved in the first three steps of mining to conversion. Their involvement drops with enrichment as they usually utilize third-parties for enriching and selling the nuclear fuel. However, they have expressed interest in creating their own enrichment business. Currently, they own a 49% stake in Global Laser Enrichment (GLE).

CCJ’s involvement primarily comes in three business segments:

Uranium production: the ownership and partial-ownership of uranium mines throughout Canada and Kazakhstan for uranium production (steps 1-2)

Fuel services: the conversion of the uranium in preparation for enrichment (step 3) which is offered as a service to other uranium producers as well.

Reactor components: refurbishment of reactor components for Canadian reactors

Continue reading Cameco Corp (CCJ): Uranium mining and more

Breakout Trends

I caught three stocks yesterday that saw an unusual ramp of chatter on WSB.

Traeger - COOK

I highlighted COOK on the IPO-brief and stocks to keep an eye on. After out-performing and a 50% gain shortly after their IPO the stock has tumbled bigly. A slight increase in WSB sentiment today recognizes this dip.

Bed, Bath & Beyond (BBBY)

BBBY saw a sharp increase in chatter relative to the 7-day average. Shares in this company have lost a third of their value in only the last 3 months. Short-interest is also quite high on this name sitting at ~20%. Is WSB buying this on-going dip?

Virgin Galactic - SPCE

Papa Branson and Co have been suffering from a slew of negative headlines. Who thought a company pre-revenue could still be so exposed to headline risk. Instead of going to the moon, SPCE has been drilling to earth's core in an attempt at becoming an oil company (this was satire). Another ticker at 3-month lows and high short interest (~15%) that is seeing an uptick in chatter. Keep an eye on it.

Top Trending Tickers

Here are the hottest stocks from yesterday's WSB chatter.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.