Swaggy's Top Stonks - Sentiment Summary & Upcoming Earnings

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

October 17, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

To all the Vig raffle winners. I've sent you an email with the details. Your accounts should be activated tomorrow!

Today's Letter

Sentiment Report

Earnings SZN (Season)

Trending Tickers

Before we get into it, here's a message from our sponsor on the lithium industry

https://investingtrends.com/wp-content/uploads/2021/09/dark-car-charger.jpg

Biden: By 2030, 50% Of All Vehicles Will Be Electric. Sparking New "Lithium Gold Rush."

Experts predict that the global lithium market will balloon by 500%. That's wonderful news for investors, because a "sure-thing" like this appears once in a lifetime. And this small-cap company just snagged what could be one of the world's largest lithium deposits.

Discover This Company's MASSIVE Lithium Opportunity!

This is sponsored content*

Sentiment Report

Stock sentiment and volatility usually go hand in hand.

When a stock pumps and/or dumps we generally see an increase in options activity, sentiment, and volatility.

When a stock does nothing for some time and is going through a sleepy period sentiment begins to die off, options activity generally decreases, and volatility decreases.

Speaking for myself, I prefer buying when a stock is sleepy and sentiment is low OR when sentiment picks up on a decrease in share price. Buying into the hype and FOMO has not been fruitful for my portfolio.

Today I'll get into a few stocks that might be over-extended along with hype, and others that may just be in a "sleepy" period. Let's go.

Over-Extended List

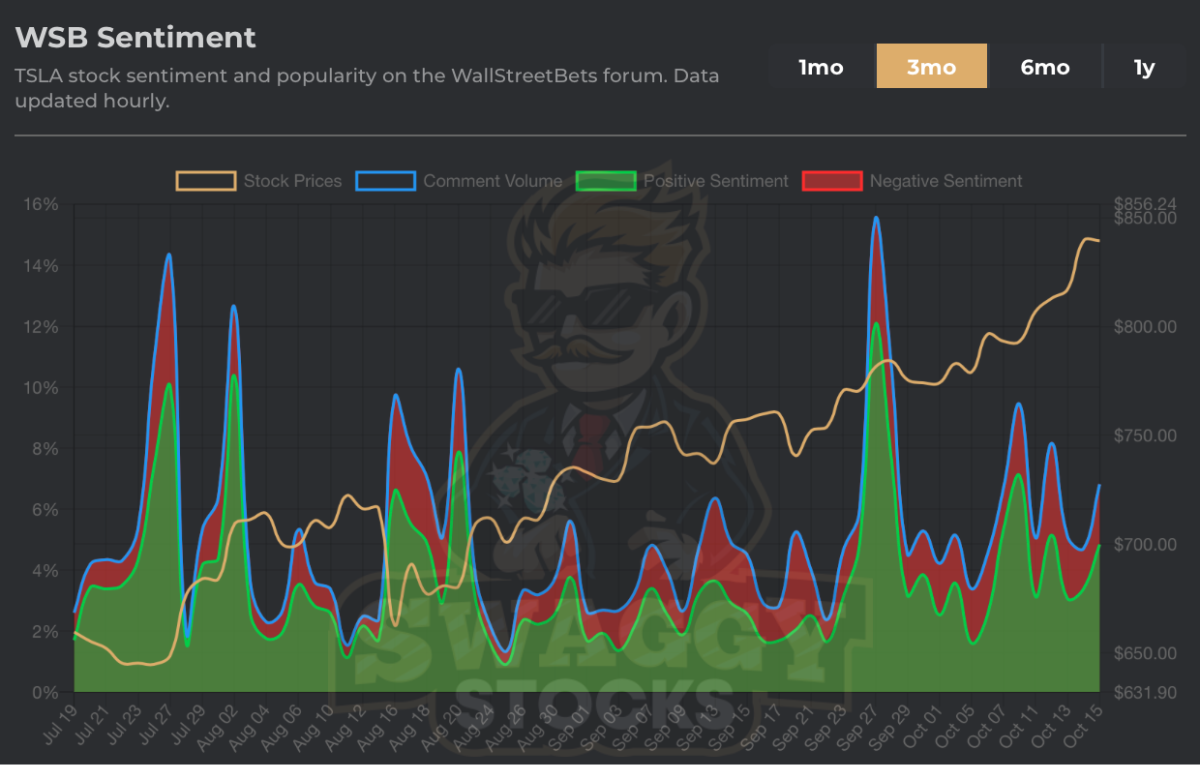

Tesla (TSLA)

Tesla has been on a solid uptrend over the last three months going from $630 to $850, a 30% increase. Cathie's ARKK ETF has also begun to decrease their Tesla holdings at these levels. I don't ever want to bet against Papa Musk, but the share price may be over-extended here. Earnings coming up Wednesday After Market Close (AMC).

SoFi (SOFI)

SOFI is one of those stocks that might be good to pick up on low hype and when nobody is talking about the stock. Last week we saw a 15% run to the upside and it was the second most talked about stock on WSB, behind Tesla. In my opinion, SOFI is a solid long-term hold, but historical sentiment shows that every time hype gets out of control the stock the share price displays a reversal to the downside.

Cloudfare (NET)

NET has had a monster two weeks, up almost 50%. Sentiment has picked up AFTER this move, and I can't say for others, but personally I think this might be nearing FOMO levels until we see the stock consolidate for a while.

The Underdog List

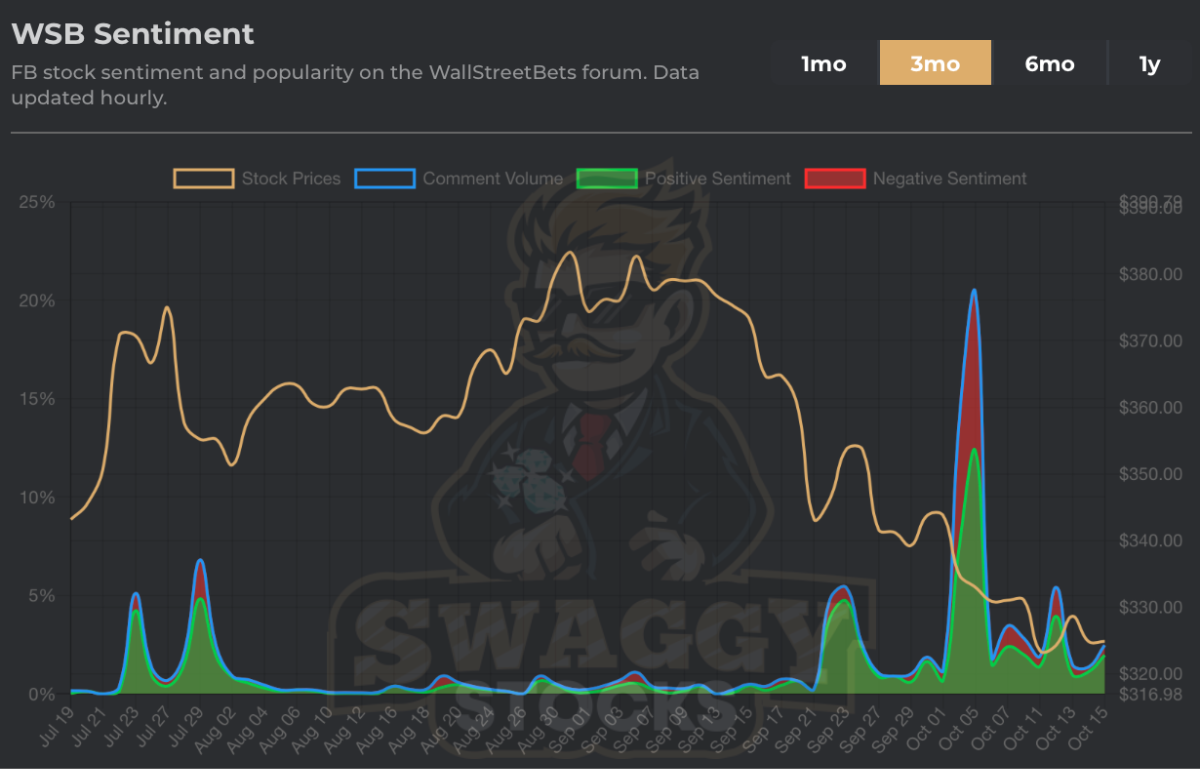

Facebook (FB)

Facebook sentiment peaked just about two weeks ago as a result of negative headline news. FB is usually a popular ticker among any crowd, WSB or the risk-averse, and this 7-layer 15% dip to the downside might prove to be a favorable entry for a long-term position.

Traeger Inc (COOK)

I highlighted COOK several weeks ago on their IPO debut, which was fantastic. The share price was $22 at IPO and eventually hit over $32 per share. A series of unfortunate trading sessions has led this stock down below their original IPO price.

The levels of hype on this stock aren't anything to write home about, but it's good to see it catching some mentions on WSB. Could mean a possible meme-in-the-making scenario and I like the current risk to reward here.

Purple Mattress (PRPL)

Pre-Gamestop WallStreetBets OGs will remember the story of Purple Innovation (PRPL). The story this time is a little different where PRPL is in a big down trend. Throughout this reversal their valuation has also contracted significantly, trading at a price/sales of roughly 1.9x. The company has a market cap of 1.4 billion on roughly 730 million in TTM revenues. PRPL has posted solid growth and at these levels looks enticing for an entry.

Upcoming Earnings

Earnings SZN is back! Last week was kicked off by the banks that showed solid results for the most part. This week we've got some good names reporting, here is what I am watching.

Tuesday

Netflix (NFLX) - AMC

United Airlines (UAL) - AMC

Wednesday

Tesla (TSLA) - AMC

Thursday

American Airlines (AAL) - BMO

Southwest (LUV) - BMO

Snap Inc (SNAP) - AMC

Intel (INTC) - AMC

Chipotle (CMG) - AMC

Friday

Cleveland Cliffs (CLF) - BMO

WallStreetBets - Most Mentioned Equities

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.