Swaggy's Top Stonks - Sentiment, earnings SZN, & trending tickers

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with..

August 1, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

This Week's Letter

Sponsored post with Vinovest

Sentiment Report

IPO Recap

Earnings SZN

Due Diligence Sampler

Trending Tickers

Invest in wine, with Vinovest

Did you know you can create a portfolio of wine investments just like you do with stocks? What many investors don't know is that investing in fine wine has been the top performing asset over the last 5 years and has performed well through economic uncertainty.

Now you can get away from the hustle and bustle of this volatile market by investing in blue-chip wines.

An activity that used to be reserved for only the elite has become a lot more accessible. With a platform like Vinovest, anyone can now invest in fine and rare wines. Vinovest works like any other financial services platform, but instead of stocks, it’s all about wine. Check it out.

*This is an ad

Quick Brief

I think when most people look at trending stocks and riding momentum they look at very short time-frames. IE: Trying to make 100% gains in just a few days on the hype of certain stocks like WISH, AMD, NIO, etc.

What if Swaggy told you that there was more alpha-generating opportunities looking at the same trending tickers, but through a different lens and a longer time-frame. Is that something you would be interested in?

I am working on a "trending tickers" report where I go through every ticker that has trended on social media using SwaggyStocks data and look at their returns. I think the results will be very interesting to see and hopefully I'll be able to include it in next weekend's newsletter.

IPO Recap

In Wednesday's newsletter I emphasized 3 IPOs opening by the end of the week. This is how they performed after being priced.

Duolingo - Priced at $95-101. DUOL closed at $140 on Friday

Riskified - Priced $18-20. RSKD closed at $27.50 on Friday

Traeger - Priced at $16-18. COOK closed at $22 on Friday

Sentiment Report

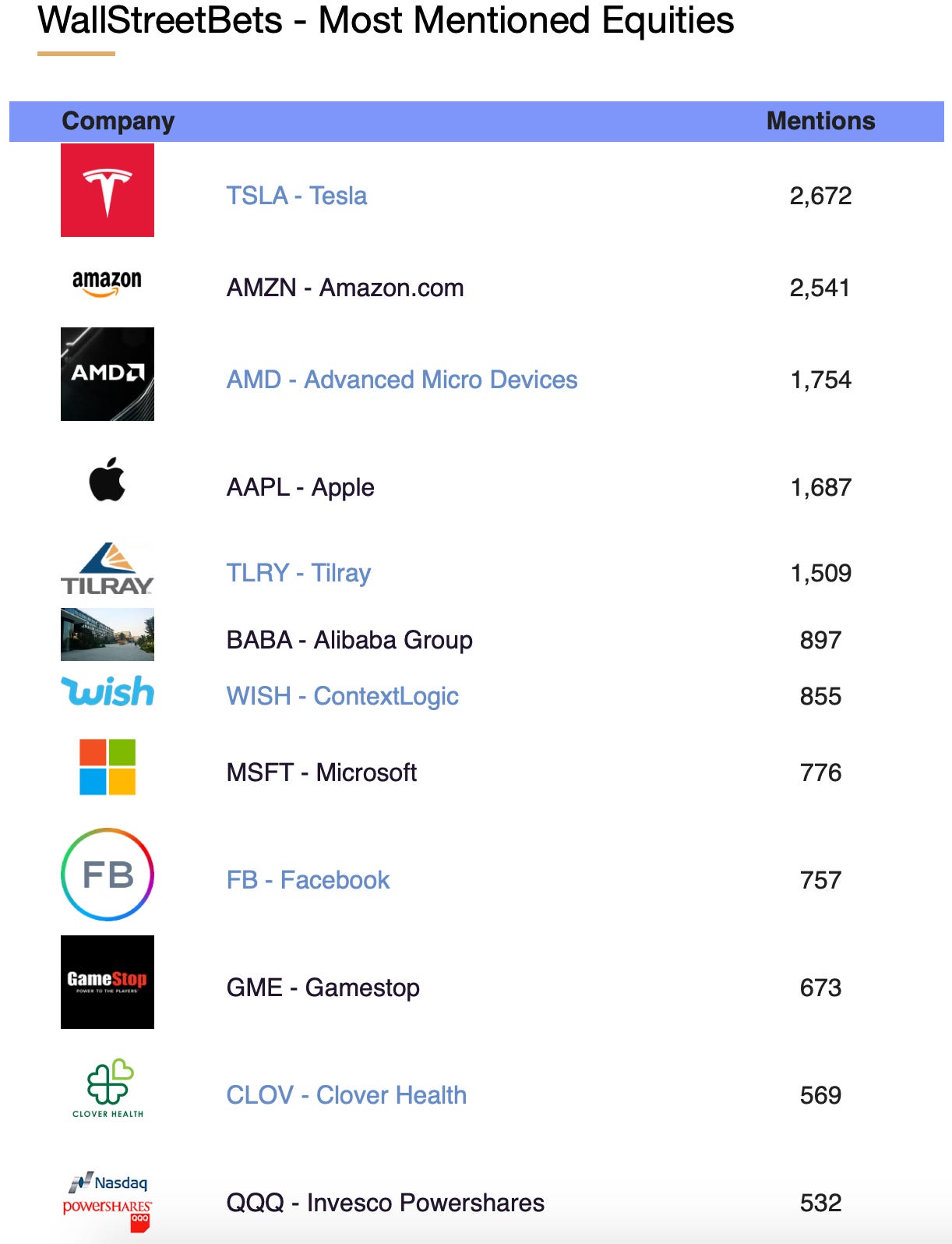

This week was all about big tech earnings and for the most part they were all rockstars (minus Amazon). The top trending tickers of the week were the FAAMG group (Facebook, Apple, Amazon, Microsoft, Google) and rightfully so since it was a big week for them.

Other names included in the top list were short-squeeze tickers and weed stocks. I'll go through what was happening this week.

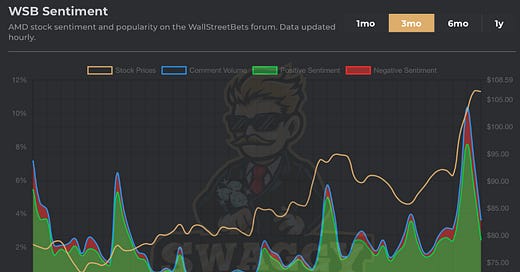

Advanced Micro Devices (AMD)

One of WallStreetBets' favorite names over the last 2 years has been AMD. Lord and savior Su Bae, slang for Lisa Su (the company's CEO), did not fail to deliver on earnings and the stock was up 20% this week.

Bullish sentiment was strong, but the amount of hype was getting to concerning levels as it reached almost 10% of all ticker mentions.

Tilray Inc (TLRY)

WallStreetBets' favorite weed-stock, TLRY, had a great week closing at +15%. Along with the stock price, hype surrounding the ticker also rocketed to roughly 13% of all ticker mentions and over 1,500 mentions this week.

Even after this huge move to the upside the stock is still trading at a 30% discount compared to the peek in June. It leads me to believe there are many bag-holders holding the stock waiting for it to get back to it's glory. Important to note the stock was also trading at $67 in February, but it's trading at it 7-month low.

TAL Education Group (TAL)

This unusual ticker trended early in the week when China announced crackdown on educational platforms that are turning a profit. TAL traded down 70% for the day and WSB saw an opportunity to "buy the dip". Just 3 months ago TAL was trading at almost $60 and is currently only $6, down 90%.

Snap Inc (SNAP)

When it comes to WSB absolutely hating a stock, there are only a few names that come to mind after NKLA and Robinhood. One of these tickers happens to be SNAP.

If we look at the 6-month sentiment chart we can see previously back in April sentiment spiked to the bearish side. Similar to now, WSB doesn't believe the rally is sustainable (SNAP had great earnings)... Looking at the stock price from last earnings until now it doesn't seem like WSB was on the right side of the trade and SNAP has out-performed recently.

Earnings SZN

Another week of BIG names reporting this week. Here's what's on my list of market-movers. Keep in mind for scheduled times BTO = Before Market Open, AMC = After Market Close.

Tuesday

BABA Holdings (BABA) - BMO

Corsair Gaming (CRSR) - BMO

Skills (SKLZ) - AMC

Activision (ATVI) - AMC

Wednesday

Kraft Heinz (KHC) - BMO

Roku (ROKU) - AMC

Uber (UBER) - AMC

Etsy (ETSY) - AMC

Fastly (FSLY) - AMC

Thursday

Moderna (MRNA) - BMO

Square (SQ) - AMC

Cloudfare (NET) - AMC

Clean Energy (CLNE) - AMC

Friday

DraftKings (DKNG) - BMO

Due Diligence - dLocal (DLO)

Our partner newsletter, TheStonksHub Substack, released a premium article on a company that enables cross-border transactions in emerging markets, dLocal (DLO). The company only IPO'd two months ago and is up 50% from it's IPO price.

TheStonksHub research goes through the company's business model, expected market growth, and breaks down their prospectus before going into their first earnings report.

The platform has just recently released it's 25th company break-down, some of which include:

Tilray (TLRY): Playing the waiting game

Global-E (GLBE): The Uncut Diamond

Clean Energy Fuels (CLNE): Turning manure into money, literally

ContextLogic (WISH): The shopping mall in your pocket

Roblox (RBLX): Can Roblox live up to the hype?

Stem (STEM): The next Tesla?

If you enjoy Sunday morning market reads, TheStonksHub releases one report every Sunday morning at 8am EST (minus some holidays).

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.