Swaggy's Top Stonks - Sentiment & 3 Top Notch IPOs

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

July 28, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. This is the "Rundown" edition where we go through quick takes from around the market.

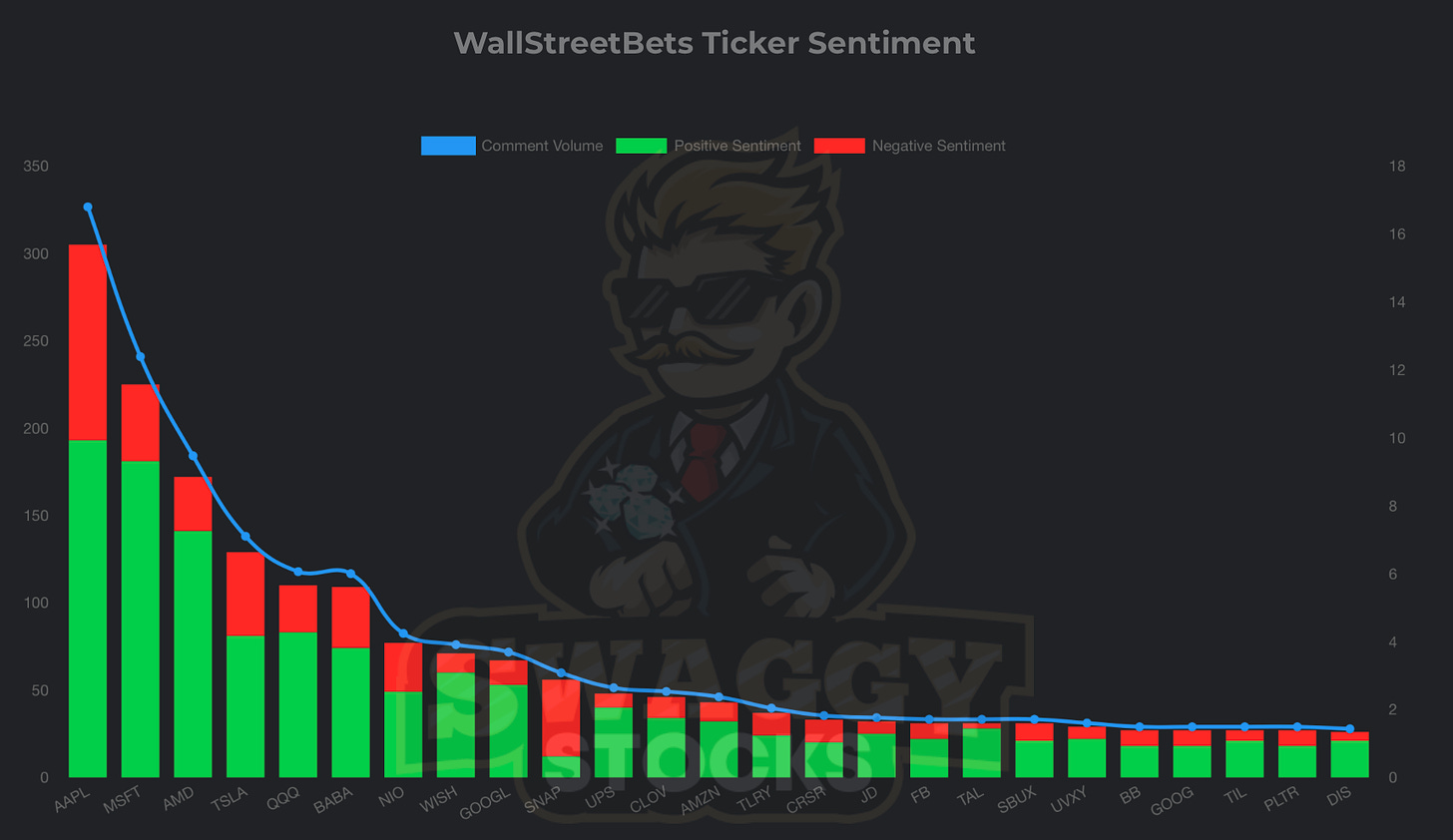

Today we'll go through the sentiment report and the main tickers that are trending around social media.

Also, there are a few IPOs on my watchlist I wanted to do a brief on. These are some quality names and although they might not be the right investment for everyone, they are definitely worth getting on the watchlist to keep an eye on.

Before we begin, here's an article on the cannabis sector from one of our sponsors*.

https://investing-trends.com/wp-content/uploads/2019/09/shutterstock_569319370.jpg

Is this Seattle Penny Pot Stock a Potential Blockbuster?

A small, rapidly expanding Seattle cannabis company is gaining attention from investors. Founded by two cannabis veterans, the company has increased sales 8-fold and is looking to double sales again in the next two years. Now selling for less than $1 per share, this is an opportunity to acquire thousands of shares – a potential windfall.

Get Free Report on #1 Cannabis Pick for 2021

https://allmarijuanastocks.com/this-hidden-stock-could-be-destined-to-become-the-starbucks-of-legal-marijuana/?utm_campaign=NLVVF_SPG&utm_source=27002&utm_medium=nlspon&utm_content=blockbuster

*This is an ad.

Sentiment Report

It's only Wednesday and the markets have been routed. China continues the crackdown on their own nation's companies. Many Chinese names have been body-slammed a la Brock Lesnar style over increased regulations and compliance.

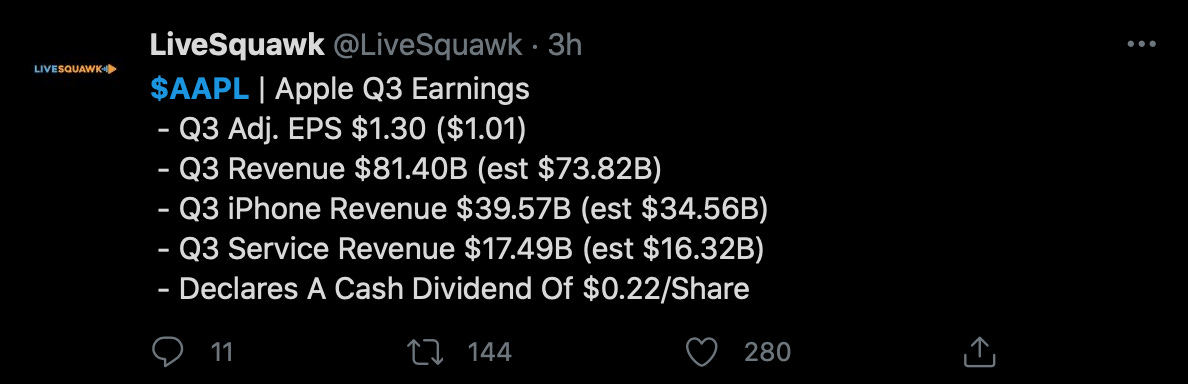

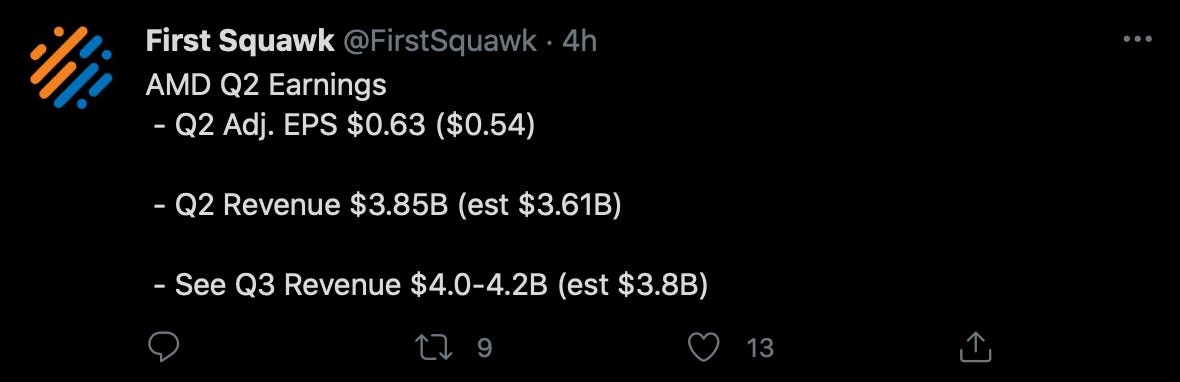

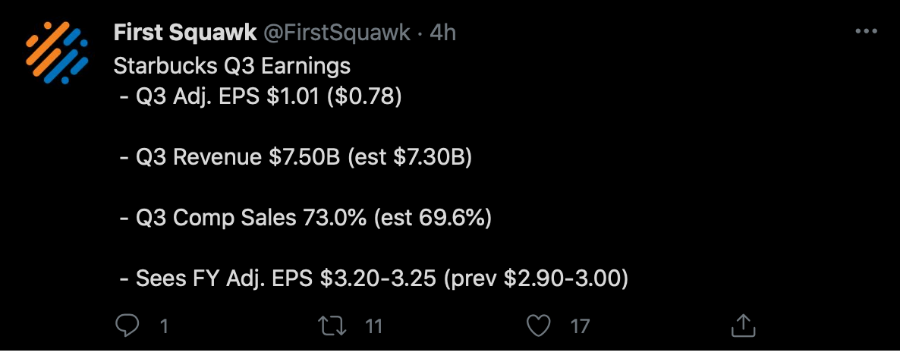

The biggest headlines this week have been China stocks and yesterday's big-tech earnings by which they all blew them out the water. The market seemed to disagree and has shrugged off Apple's beat during after-hours trading. Here are a few other household names that reported earnings.

Blue chips are leading the way with superb earnings and yet the market is so frothy, maybe something is up after-all?

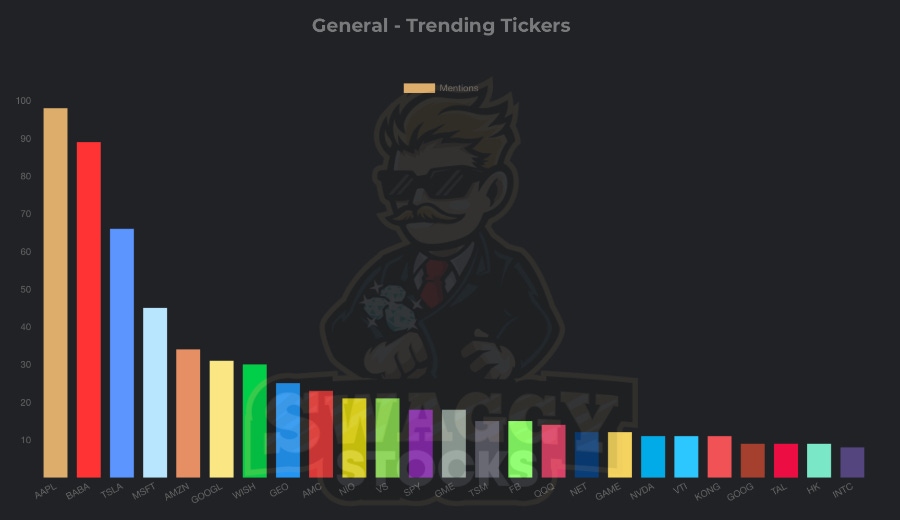

Moving along, for the first time in a long time WallStreetBets tickers are looking more like a proper portfolio with a mix of both growth, risk, and blue chips stocks. Let's compare the WSB ticker list versus mentions of tickers outside of the forum dedicated to YOLOs. They are quite similar this go around.

The next big question that is being asked among investors are China stocks -time to buy the dip? There are a whole stack of quality Chinese companies available for trade in U.S markets. Some of these are: JD.com (JD), Pinduoduo (PDD), Tencent (TCEHY), Tencent Music Entertainment (TME).

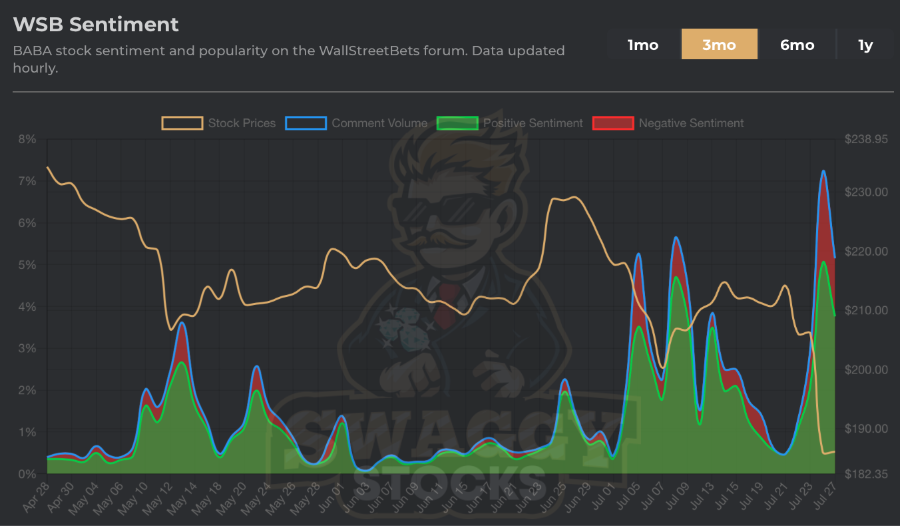

The one ticker that retail always seems to lean on when it comes to Chinese stocks has always been Alibaba (BABA). What are retail traders thinking right now?

Looking at the sentiment on WallStreetBets it shows that most traders are still generally bullish and "buying the (everlasting) dip". The chart below describes the hype quite well. On the two most recent 15% set-backs, chatter has increased to 5-7% of all mentions.

On one hand you have risk of the de-listing of some Chinese stocks.

On the other it could prove to be an extremely good entry point. Many of these names are already down 30-40% in the last 2 months.

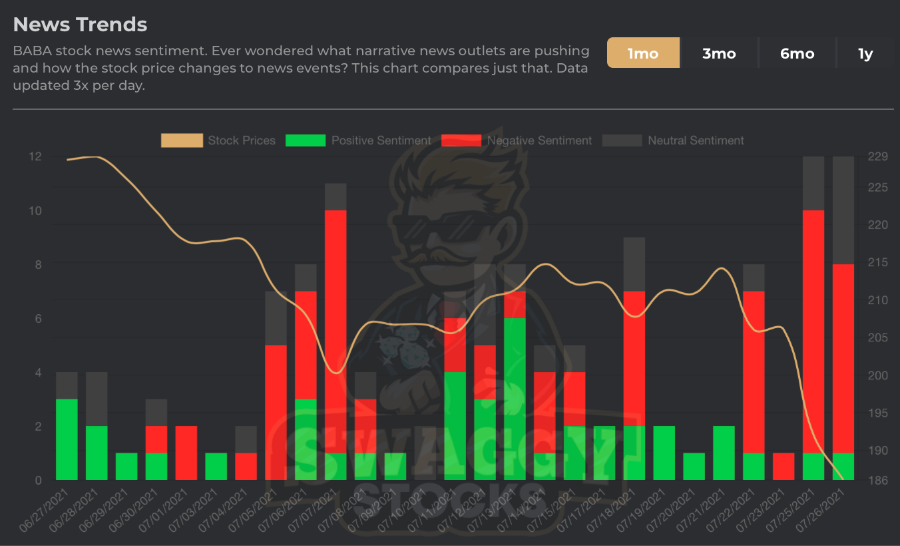

Headlines from the news have had similar sentiment. A rare occurrence to see such one sided sentiment on an individual ticker. Although this looks interesting, I always find the news sentiment to be more reactive than predictive when it comes to the headline.

Remember, all this data is available on the Swaggy Terminal, via SwaggyStocks.

IPO Brief

On the IPO front there are two handfuls of IPOs this week, but here are 3 that should really be on anyone's watchlist. They are:

Duolingo (DUOL)

Riskified (RSKD)

Traeger Grills (COOK)

Company Name: Duolingo (DUOL)

IPO Date: July 28, 2021

Overview: Duolingo is an educational platform with the core product being learning languages. Their flagship mobile app has received over 500 million downloads, globally. They offer courses in 40 languages to 40 million monthly active users (MAU). They are also working to eventually extend their platform beyond language learning (think something like Coursera). Doing so they will be able to further monetize their already massive user-base.

Business Model: They use a freemium business model which has allowed them to scale to their current size. Users can begin learning for free, but to perfect their skills with add-ons (like additional testing, pronunciation checks, etc) it costs extra. Their premium membership begins at $12.99 per month.

Key Metrics:

All platforms combined, their app has over 500 million downloads.

40 million MAU, 10 million daily active users (DAU)

1.8 million paid subscribers

Q1 2021 generated $50 million in subscription bookings

Financials (revenue, growth, margin)

Metrics Growth

From 2019 to 2020

MAU grew 34.5% from 27.3 million to 36.7 million

DAU grew 57.7% from 5.2 million to 8.2 million

Paid subscribers grew 77.8% from 0.9 million to 1.6 million

Subscription bookings grew 100% from $72 million to $144 million

Comparing Q1 2020 vs Q1 2021

MAU grew 19% YoY

DAU grew 40%

Paid subscribers grew 64%

Subscription bookings grew 64%

Financial Statements

Revenue growth 2019 to 2020 was over 128% (gross profit grew +130%)

Revenue growth from Q1 2020 vs Q1 2021 was over 97% (gross profit grew +100%)

On track to do $315 million revenues FY 2021.

Gross margin sitting at roughly 70-72%

Offering: 5.1 million shares between $95-$101 raising up to $515 million.

Valuation: The company is estimated to be valued at 3.6 billion, giving it a price/sales ratio of 12x FY 2021 revenues.

Company Name: Riskified (RSKD)

IPO Date: July 29, 2021

Overview: Security and fraud management platform that integrates machine learning to minimize online payment risk. They describe themselves as a scaled machine learning factory dedicated to e-commerce.

Business Model: They aim to increase sales, reduce fraud, reduce operating costs, and optimize customer experiences for their merchants. Riskified takes a fee, expressed as a percentage of Gross Merchandise Value (GMV) dollars the platform approves.

Key Metrics:

60 billion+ GMV in 2020

170 million revenue in 2020

50% revenue CAGR from 2018-2020

117% net dollar retention rate (customers are creating more revenue for them)

10 largest merchants account for 35% of billings

Financials (revenue, growth, margin):

GMV growth 2019 to 2020 was 60% from 39.7 billion to 63.4 billion

GMV growth Q1 2020 vs Q1 2021 (YoY) was 77% from 10.7 billion to 18.9 billion.

Revenue growth 2019 to 2020 of 30%

Revenue growth Q1 2020 vs Q1 2021 of 55%

On track to do $255 million revenue in 2021

Gross margin in 2019, 2020, and Q1 2021 of 50%, 54.45, and 56%, respectively.

Offering: 17.5 million shares between $18-20 raising up to $350 million.

Valuation: Riskified is targeting a valuation over $3 billion, giving it a price/sales ratio of 12x relative to 2021 estimated revenues.

Company Name: Traeger (COOK)

IPO Date: July 29, 2021

Overview: From the S-1 “Traeger is the creator of the wood pellet grill, an outdoor cooking system that ignites all-natural hardwoods to grill, smoke, bake, roast, braise, and barbeque.” They’ve also built a community for those passionate about grilling and using the products, called Traegerhood. The grill can connect to Internet of Things (IoT), and be controlled through the Traeger app, which currently has around 1.6 million monthly users.

Business Model: Their business model includes the retail sales of the core product, however, they are continuing to further develop DTC channel to provide digital content, subscriptions, and things like rubs, sauces, and recipes. Approximately 7% of their revenue was generated through DTC in 2020.

Key Metrics:

Revenue CAGR from 2017 to 2020 was 28% (262 million to 545 million in that time period).

They estimate approximately 60% of households own a grill, creating a Total Addressable Market (TAM) of 75 million households.

Traeger has sold approximately 2 million grills from 2016 to 2020 with an estimated penetration of 3% of the TAM.

Financials (revenue, growth, margin):

2019 to 2020

Revenue growth: 363 million to 545 million

Revenue growth as percentage: 50%

Cost of Revenue growth: 207 million to 310 million

Cost of Revenue growth as percentage: 50%

Q1 2020 vs Q1 2021:

Revenue growth: 113 million to 235 million

Revenue growth as percentage: 107%

Cost of Revenue growth: 62 million to 134 million

Cost of Revenue growth as percentage: 116%

On track to doing over 1.1 billion revenues in 2021.

Gross margin is averaging between 42-44%

Offering: 23.5 million shares between $16-18 raising up to $423 million.

Valuation: Traeger is targeting a valuation of roughly 2.2 billion, giving them a price/sales ratio of only 2x on their estimated revenues for FY 2021.

That's all for this edition. I'll be back Sunday with the weekend version of Swaggy's Top Stonks.

Have a great weekend,

Swaggy

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.