Swaggy's Top Stonks - Market Update, Unusual Options Activity, and a DD on Global-E (GLBE)

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together With...

July 25, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

A couple weeks ago I did a quick content preference survey which received great feedback. Following up, I am trying to see what everyone's investing/trading style is preferred. For example, are you into short-term and momentum plays, swing-trading, long-term setups, etc.

In order to help create content that is catered towards most of your trading styles I created another short 6-question survey to get a better understanding of how you all trade and what your goals are.

This is the last survey (I hate surveys too) for the foreseeable future. Thanks!

This Week's Letter

Market Update

Unusual Options Activity

Earnings Season Roundup

Global-E (GLBE) Stock Analysis

Trending Tickers

Market Update

If you paid attention to last week's letter Swaggy pointed out the art of the (short-interest) trade and how short-interest stocks are becoming their own asset class. Coincidentally, many tickers that were on the "short-interest" watchlist took off and ended the week with double digit returns. AMC closed the week up 15% after peaking at a 40% gain in just a few days.

Was this really a coincidence or did Swaggy just happen to be extremely well prepared? As previously mentioned there were certain criteria making this type of play more favorable at this moment in time.

First, throughout most of May the short-interest trade was losing steam and popularity. In June we saw 300% increase in chatter around places like WallStreetBets. The most mentioned tickers were all short-interest stocks (AMC, WISH, WKHS, CLOV) while many others also a saw sharp uptick in activity (ROOT, WOOF, SDC).

Second, back in May after the continued drop in share price for short-interest names, valuations began to look favorable from a fundamental level and were also hitting way oversold on the RSI. Stocks can always become more oversold or overbought, but at some point if a stock keeps tumbling, the likelihood of a bounce increases.

When I look at social media (Reddit/Twitter) and the way many people "trade" it's almost alarming at the percentage of traders that buy stocks after they've squeezed 100% to the upside, and then panic sell on the way back down.

Personally, I like to invest in companies that are thoroughbreds of their industry or of current macro trends (digital payments, e-commerce, big-data analytics, chips and processing power, etc), but I also try to abide by the following two mantras:

Stocks don't go straight up NOR straight down.

As a stock price goes down (valuation contracts), the stock should become more appealing, not less.

For example, if I did my research on company X trading at $100 per share and at a P/E, price-to-sales, or enterprise value that I thought was favorable when I entered the trade, I should feel better about buying more at $90 or $80. At lower levels the valuation should be looking better from a risk-reward point of view. On the other hand, if the stock price shoots up to $150 that's when I become more hesitant and ask myself if I should take some off the table. At $150 it's trading at 1.5x the valuation of when I entered the trade.

A lot of the time I see a stock drop 30-40% and retail traders start screaming about why the stock should continue to drop another 10%. (IE: stock X dropped to $70 from $100 - people start posting "here's why I think the stock X should be $60 a share"). Why try to squeeze every last penny from a correction in the stock price? The valuation already contracted by so much, IMO the risk-reward has changed significantly. The same can be said for the opposite and I actually see this a lot more often (IE: Stock X has gone from $100 to $180 - people start posting "here is why X should hit $200 a share").

Next I'll discuss how I use unusual options activity as confirmation bias on my trades.

Unusual Options Activity, powered by VigTec

My investing style has always been 20% researching what stocks to buy and 80% waiting for an entry point. That means I am frequently looking at my charts and scans.

A couple weeks ago I went into some charting ideas as well as how I look at volume profiles and gamma exposure. Today I'll go through some of my unusual options activity scans and several criteria I search for.

These screenshots are from the VigTec web app and mobile app, give the 7-day free trial a spin.

Unusual Options Activity Scans

First, I'll admit that I NEVER jump blindly into any trade (I admit to always improving though) and so I have a solid 200-250 tickers on my watchlist that I continuously monitor. The watchlist is divided into different categories and industries: short interest stocks, top plays, high-growth tech plays, risk trades, potential value plays, etc.

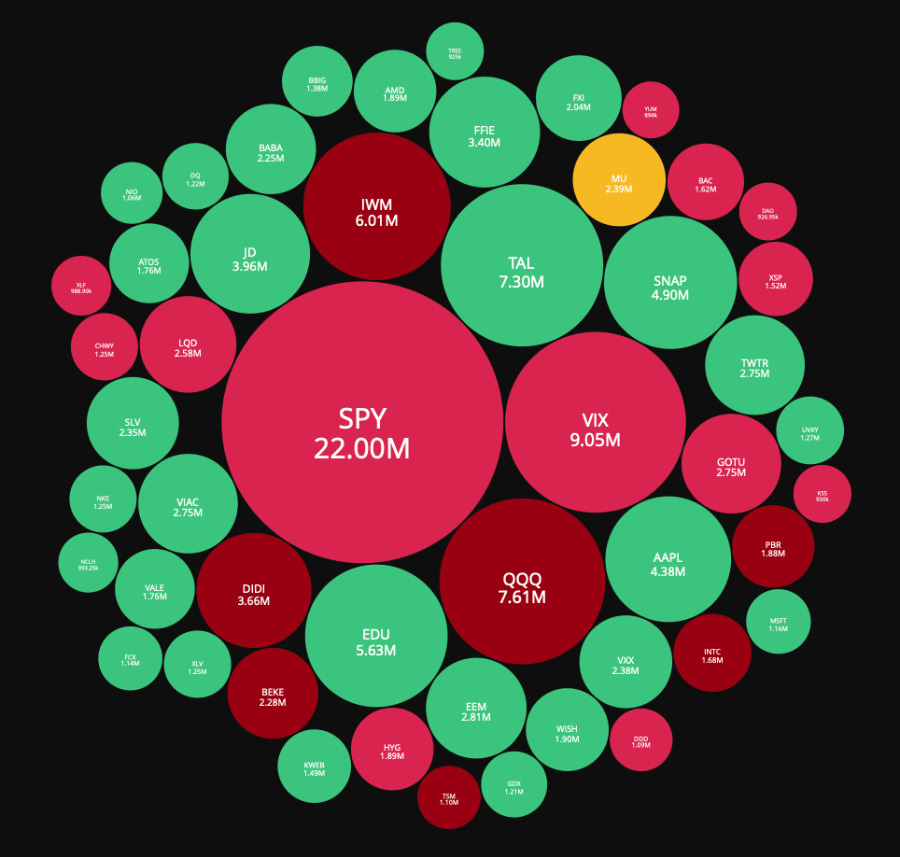

The great thing about VigTec is that I can very easily see the aggregate option activity sentiment each day for my different watchlists. It looks something like this (this is for my high short-interest stocks watchlist from Friday).

Right off the bat we can get a feel for the option flow. How much volume rolled through each ticker and what side the trade was on (aggressive call buying vs put buying).

Next, I'll do a custom scan that I look at frequently. This was the criteria:

Trade size > $50k premium and < $500k premium (weeds out small trades and also large ETF or mega-cap trades)

Trade volume > 500 (removes deep in-the-money trades that might have low volume)

Expiration > 1 month out (eliminates short-term hedges and lotto plays)

With this particular scan I am looking for one-directional bets that are fairly large in size AND that are not linked to another trade. This is not always easy to determine, but with this criteria if a player buys a large order of PUTS and also CALLS (a straddle, strangle, or simply a hedge) I should be able to spot it. When I say large order I'm talking something like $100k position and 1,000's of volume. Remember, options flow is more like piecing a puzzle together, rather than seeing a large trade hit the tape and following the player into the trade.

Here are the results from Friday's scan that meet the criteria mentioned above:

I actually avoid ETFs and mega-cap stocks (sorry QQQ and AAPL). There is so much option flow going through those names you really need to look at repeat buying and HUGE orders to spot something.

Out of the current names with medium-sized green bubbles I randomly picked JD (China play) and ATOS (biotech). I'll usually go through all the mid-sized green bubbles and look at potential plays.

Looking at the data we can piece the following together:

JD

Call blocks for September and October being traded

JD stock price has stagnated along with most China stocks that have tumbled due to regulations

ATOS

August and September call blocks being traded

ATOS is a biotech (usually entails more risk)

The last step to my process, which I do on almost every ticker on the scan (many more to look at like FUBO, VALE, WISH, BBIG, VIAC, etc), is to look at the chart. Is the chart showing something that I agree with, technically? Here are the two for JD and ATOS.

Interestingly enough JD has been trading in a range for 4 months. With China crackdown on most companies it's sort of in "limbo". Gamma exposure might put some pressure to the upside if it can get into the $80 range.

ATOS is a biotech company that often picks up on hype from social media, mainly due to it's wild price action. The chart is showing a head-and-shoulders pattern (I look at technicals with a grain of salt), which could be bearish.

I much rather the consolidation I see in the JD chart versus what I see in ATOS.

*I am a VigTec affiliate

Earnings Roundup

It's earnings SZN and we have some big names starting to report next week. Here's what I'm keeping an eye on.

Monday: TSLA, Logitech (LOGI)

Tuesday: UPS, AAPL, AMD, MSFT, Alphabet, Visa (V), SBUX, Enphase (ENPH)

Wednesday: Boeing (BA), Shopify (SHOP)

Thursday: AMZN, Pinterest (PINS), ArcelorMittal (MT)

TheStonksHub Stock Analysis - GLBE

Our partner site, TheStonksHub, offered a deep dive on the business model and fundamentals of an up-and-coming e-commerce enabler, Global-E (GLBE). Global-E seamlessly integrates with e-commerce stores and provides them with a one-size-fits-all plugin to begin selling products internationally. They have partnerships with e-com giants such as Shopify, Salesforce Cloud, and BigCommerce, and have been growing over 100% YoY.

The full report is linked below (it's free), but here's a quick overview to get you started.

Also, TheStonksHub July 4 sale is coming to an end in the next few days, so if you want to subscribe to the newsletter for 20% off ($12/month) this will be your last chance to do so.

Overview

What is exactly is Global-E? They are a company that integrates with e-commerce platforms to remove complexity with international transactions and provide localized solutions that improve the online shopping experience. The core of the services revolve around the following (from the S-1):

“The vast capabilities of our end-to-end platform include interaction with shoppers in their native languages, market-adjusted pricing, payment options tailored to local market preferences, compliance with local consumer regulations and requirements such as customs duties and taxes, shipping services, after-sales support and returns management. These elements are unified under the Global-e platform to enhance the shopper experience and enable merchants to capture the cross-border opportunity.”

They are the “plug and play” of making e-commerce international. Their vast network of APIs allow a customer to simply integrate their platform and seamlessly begin selling across different borders and languages. Here’s what they do.

Currently, Global-E supports:

Local messaging in over 25 languages

Purchases in over 100 currencies

Accepts over 150 payment methods

A multitude of competitively-priced shipping options

Business Model

Global-E generates revenues by charging a fee (“service fee”) for the integration of their platform into a merchant’s services. Service fees are highly variable based on transaction volume, destination markets, level of customer service provided, etc, and are generated as a percentage of the Gross Merchandise Value (“GMV”) that flows through the platform. Global-E mandatory bundles certain components of their integrated platform solutions that they believe are essential for achieving improved sales conversions from international traffic. However, their fulfillment services are offered on an optional basis and merchants can choose to utilize those services or cancel at any time. Think of it as bundling service A and B to have the greatest effect, while offering service C as an add-on component. Service fees make up for approximately 35% of revenue while fulfillment services are currently accounting for roughly 65%.

Continue Reading: GLBE - The Uncut Diamond

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.