Swaggy's Top Stonks - Market Sentiment

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with...Vinovest

August 15, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

This Week's Letter

Market Update

A message from Vinovest

Sentiment Report - The Underdog List

Trending Tickers

Market Update

Unless you are a long-term investor this market is only for those who are light on their feet and quick with their fingers. I don't believe any stock market "gurus" are consistently making bank in this chop. Although the VIX (measure of volatility) is down to some short-term lows many stocks are having huge daily swings. Up 7% one day and down 5% the next, the market is still full of excitement and very much alive.

Lucky for us, we've got data and analytics on our side to see exactly which tickers are trending, why, and when... SwaggyStocks is a beacon of light in a market full of darkness. It still amazes me throughout this chop MANY stocks have gone absolutely nowhere. 5% daily swings and many tickers are almost exactly where they were several months ago.

Which brings me to the question of "is market sentiment a lagging or leading indicator?"... The short answer to that is "both". Just like any investing or swing trading strategy there are many ways to play the market. Whether you are a long-term investor, swing-trader, or day-trader (day trading is very risky BTW) you can create a strategy that works for YOU.

In my non-expert opinion and what works for me personally is to patiently wait for plays that I think will yield me a 5-20% return in about 6 months... then be prepared to hold these positions for months or up to 1-2 years. Almost every single time I've chased a FOMO trade hoping for a quick 50% in a short-period I was surprise-sex'd by the market into a losing position. A position that ended up being down 20-50% and cost me double the time to get back to break-even. Instead, I wait for buy-the-dip opportunities where I like my risk vs reward and usually buy shares or sell cash-secured-puts if volatility allows me. I might get a bit more into this strategy in a few weeks time.

Today, I'll focus the newsletter on a sentiment report of trending stocks and where I might see some opportunities next week.

Before we get into it, here's a quick message from our sponsor...

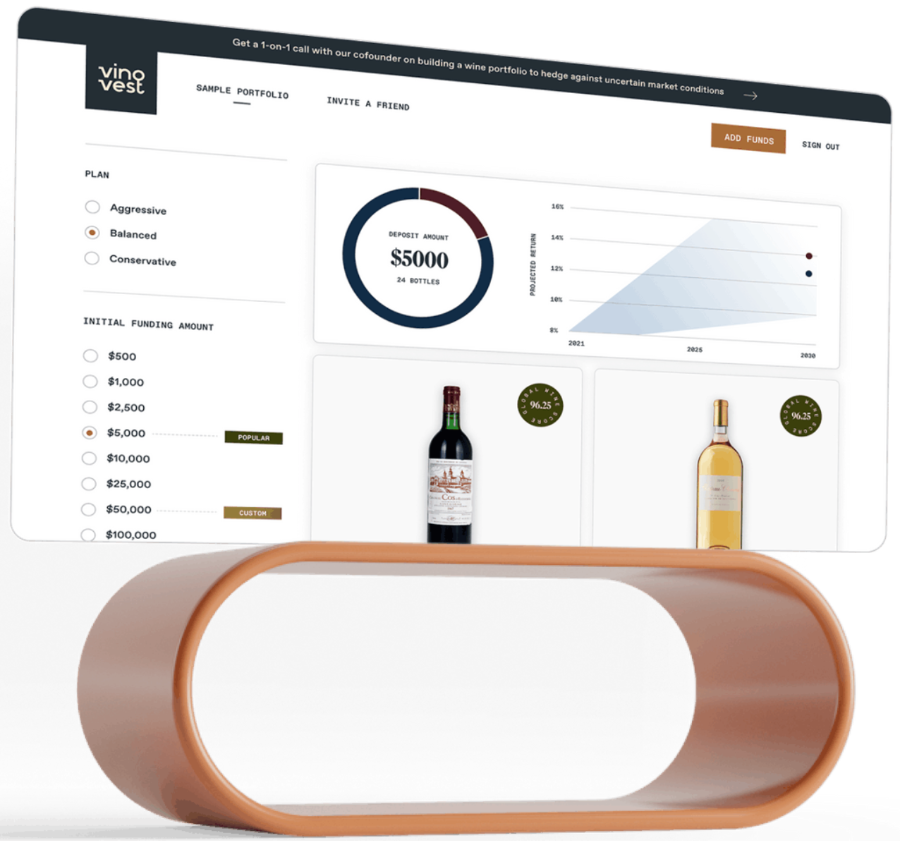

Did you know fine-wine-related investments have outpaced the S&P 500 over the last twenty years? Now you can get away from the hustle and bustle of this volatile market by investing in blue-chip wines.

An activity that used to be reserved for only the elite has become a lot more accessible. With the technology platform Vinovest, anyone can now invest in fine and rare wines. Vinovest works like any other financial services platform, but instead of stocks, it’s all about wine.

Vinovest even helps you plan a portfolio of wine that meets your diversification needs. The platform is smooth, simple, and slick, and gives you an opportunity to invest in this popular asset class with ease. You don’t need to be an expert in wine, let Vinovest help you.

Sentiment Report - The Underdog List

A lot of movement this week with all sorts of earnings driving the market. I looked through a large amount of the SwaggyStocks data to find tickers with the following criteria:

The ticker has historically seen some sort of spike in hype and popularity on the Internet or WSB.

To go along with the hype, the ticker has seen large spikes in share price.

The ticker is currently near short-term lows OR

The hype/popularity around the ticker increased while share price decreased (retail investors were "buying the dip").

Today's list has 4 tickers:

Nvidia (NVDA)

UPS (UPS)

BioNTech (BNTX)

Oatly (OTLY)

I'll break it down.

Nvidia (NVDA)

One of the most popular names in the semi-conductor industry Nvidia has seen a meteoric rise over the last 3 months. Chip-issues have bogged down this industry, but demand remains high. Nvidia has seen some choppy price action for 3 weeks and ticker mentions have started to cool off. Is a new round of hype around the corner?

United Parcel Service (UPS)

UPS stock price took a 10% tumble on earnings several weeks ago, but average WSB social sentiment remained bullish. After a rather large drop and the holiday season around the corner this could potentially be an entry point that I prefer. I will personally be keeping an eye on this one and might add it to my swing-trade list next week to hold for the coming months.

BioNTech (BNTX)

This biotech company (biotech can be extremely volatile, FYI) gained popularity after the stock price nearly doubled in just one month. You'll notice that hype around this name first began after the stock went from $200 per share to $250, a 25% increase in just several days. A rather large dip occurred last week which gave the stock a 20% haircut and the name is still being mentioned on WSB roughly 20-40 times per day. After such a big rise in share price I'd like to see hype die off a bit more for this uncommon name before I put in on my personal watch-list.

Oatly (OTLY)

Not many believe in the story of an oat-milk brand being worth 10 billion dollars. However, most analysts price-targets are in the $30+ range, which would give it a valuation of 20 billion. The share price has dropped 50% recently from $30 just one month ago and we see a few spikes of hype/sentiment on the chart. Keep in mind these spikes are only 0.10-0.50% of comment mentions, but for a ticker that averages maybe 0 or 1 mention per day even a spike of 6 mentions could be significant to get the ball rolling.

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.