Swaggy's Top Stonks - Is the short-squeeze losing steam?

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

June 13, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

The short-squeeze was real this week. What other group of stocks tagged along for the ride similarly to back in February? WEED STOCKS. Why are the two groups correlated? I'm not sure, but I think it has something to do with WallStreetBets.

Here's a sponsored article on the cannabis industry*

https://allmarijuanastocks.com/wp-content/uploads/2021/02/MJ3.jpg

Should You Invest In Cannabis?

If you're not sure about investing in cannabis. You should read this full report from a top analyst.

Get Your Cannabis Report Here

https://allmarijuanastocks.com/CADMF/canna-biz-investors-early-alert/?utm_campaign=CADMF_SPG&utm_source=27002&utm_medium=nlspon&utm_content=should

*This is an advertisement.

Market Update - Is the squeeze squoze?

Another wild week in the markets. It seems retail traders and social sentiment is playing more of an important role in the (short-term) price action of equities. Good thing SwaggyStocks exists ;) By next weekend we'll have a new feature addition to the site, The Swaggy Terminal. I'll send a note when it's finally released.

What happened this past week?

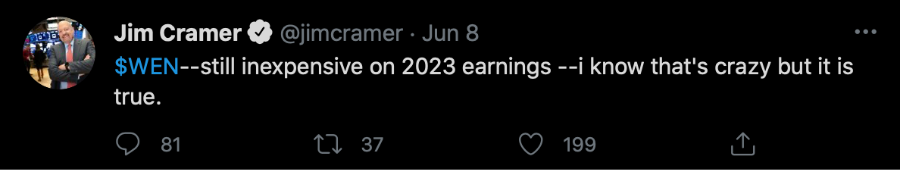

On Tuesday Wendy's (WEN) started trending on WallStreetBets and was within the top 5 most mentioned tickers accounting for 1,400 total mentions. During pre-market hours Jim Cramer actually noticed the trending ticker and tweeted a comment of his own.

What happened next? Wendy's joined the party along with many high short-interest stocks "mooning", including CLOV, BB, and AMC. Here was the price action that day.

Very cool, very normal stuff *insert sunglasses emoji*

However, the party did not last very long as the stock had a roughly 15% draw-down from the top over the next two trading sessions.

The Weekly DD (Coupang CPNG): Something, something, the "Amazon" of Korea

TheStonksHub has finally fully launched in newsletter format and provides summaries as well as full company research reports on a weekly basis. Instead of giving stock recommendations it provides an unbiased look at a company's fundamentals, addressable market, valuation, and more. The idea is to eventually cover all stocks that get mentioned on social media and give retail traders a bird's eye view on the company's business model.

Investors should be better informed on the risks associated with meme stocks (and non-meme stocks) instead of investing blindly with the sole reason being that "WallStreetBets" is buying. TheStonksHub aims to bridge that gap and they just launched their 20th report today (maintaining about 6-8 per month). Here are the cliff notes of a recent report done on Coupang (CPNG).

Company Overview

Coupang (CPNG), founded by Bom Kim, has become the top online retailer in South Korea (SK). What started out as the “Groupon” of SK has now turned into one of the largest e-commerce and logistics businesses in the nation. Coupang is a logistics phenom that has completely changed the game when it comes to speed of delivery and the user experience. Coupang delivers millions of SKUs in re-usable packaging almost eliminating the need for cardboard boxes (Jeff Bezos is green with envy while reading this), all powered by over 15,000 “Coupang Flex” drivers that deliver on days and times of their choosing.

Business Model

Coupang has several segments that contribute to top-line revenues.

Rocket Delivery: E-commerce

Rocker Wow & Dawn Delivery: Coupang’s version of Amazon Prime

Rocket Fresh and Coupang Eats: Grocery & meal delivery

Coupang Pay: Their more recent venture into FinTech payments (think ApplePay and AliPay)

Read the full report here, or

Continue reading the summary

Summary of the report

Coupang is currently the market leader in the South Korean e-commerce industry. They had investments from Softbank pre-IPO as well as some well-known financial firms betting on the company’s success.

Coupang is undergoing hyper-growth with an increase in revenues of 90% YoY. Their bottom-line is still highly unprofitable due to large investments in their infrastructure and vertical integration while focusing on the providing “wow” to the customer. They are the market leader when it comes to efficiency and speed of delivery with their main segments consisting of e-commerce, food & grocery delivery, and e-payments.

Coupang has been highly dominant in their market and provide great value (mainly from speed of delivery) which in turn has a stickiness to retaining customers. This is displayed effectively by the rate of increase that existing customers continue to spend on their platform.

Although the company has witnessed incredible growth in revenues, they still remain highly unprofitable. In 2020 they operated at a net loss of 475 million, which was down from their 2019 loss of 699 million. Bottom-line is improving, but profitability is yet to be forecasted.

They are facing a “meat-grinder” of local competition and will need to dominate market share in South Korea before expanding internationally. For this reason their current TAM is still small as it’s limited to the e-commerce industry in SK, currently estimated to be $206 billion by 2024 growing at a CAGR of 10%.

In my opinion they are trading at somewhat of a rich valuation while they only maintain a gross margin of 15-16% over the last several years.

WallStreetBets - Most Mentioned Equities

Quite a few new names on this list. I'll go through them here.

CLF

Cleveland Cliffs is an iron ore mining/steel producer and was trending this week for two reasons. It was somewhat of a short-interest play and also seemed to join the bandwagon of other high short-interest stocks. Jim Cramer (again) said he REALLY likes the stock (on Twitter). The ticker was also up roughly 25% this week which helps it get noticed among WSB.

WEN (Wendy's)

We went through the Wendy's story earlier. I'm interested to see how this name holds up next week. Was there any validity to the stock popping this week?

ROOT

This company offers insurance products in the United States. Short interest was roughly 40% going into the week and it was one of the short-interest plays.

ORPH

This volatile biotech company was trending mainly because of the price action it saw. This week alone ORPH was up 1,000% and then lost 85% of it's value the next day. How does that math work? Here's the chart.

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.