Swaggy's Top Stonks - Hot Stock Trends

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with...Ei.Ventures

August 12, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

Today's Letter

SPACs r kill

A message from Ei.Ventures

Earnings Update

What's trends are next?

SPACs r kill

The SPAC trade has left a sour taste in investors' mouths after being massacred over the last 4-5 months. The era of Chamath is long forgotten, but is now time to buy the dip? I remember March of this year like it was yesterday... Chamath was king, SPACs were booming, SwaggyStocks just added a SPAC trend-tracker to the site, life was good. Since then SPACs have been brutally murdered and given a death sentence.

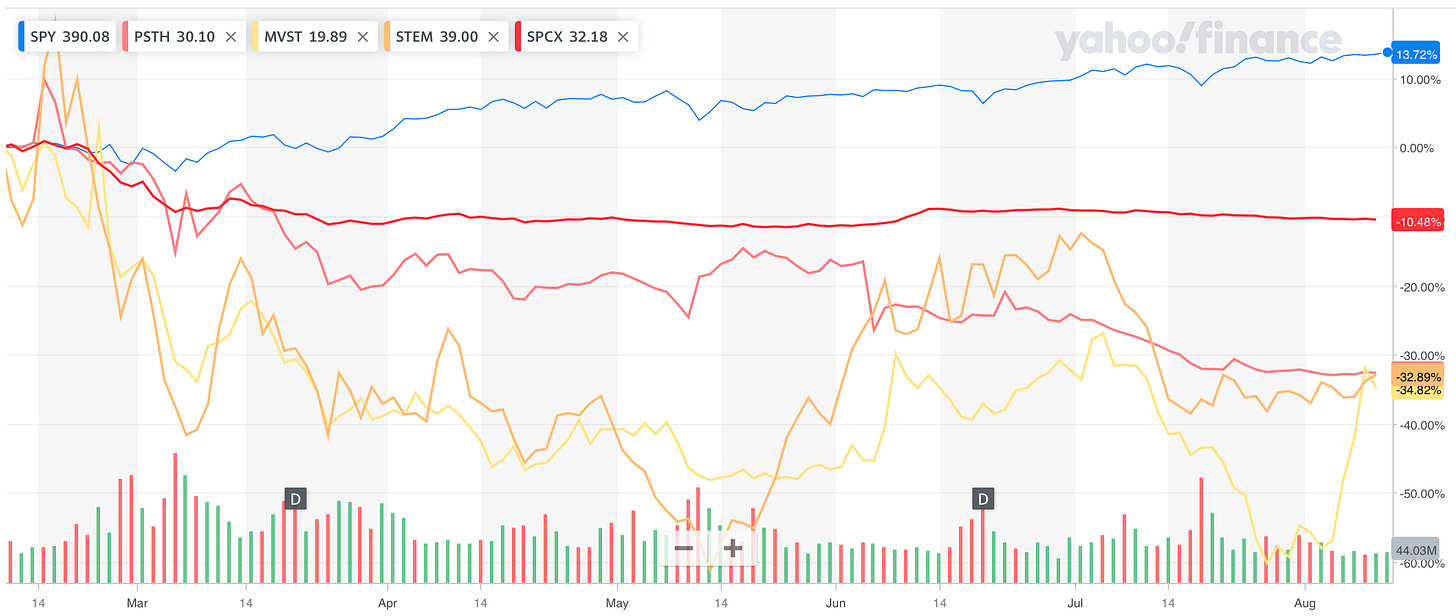

Even Bill Ackman's Pershing Square holding's (PSTH) deal with Universal Music Group fell through. Here's a look at how a few popular SPACs from early 2021 have fared since the peak of February (relative to SPY -the blue line).

While the market trucked along for a 13% return in the last 6 months, SPACs have way under-performed (and by a rather large margin). Similar to the growth stock bust we had recently, SPACs have followed suit.

Have many of these stocks bottomed out? It's a good question to ask at this moment in time since literally nobody is talking about them anymore. When it comes to hype-related categories of stocks (SPACs, WSB tickers) it's times like these that may prove to be great opportunities. Almost like a reverse-FOMO trade.

Here are a few SPACs that have been popular recently and that have been on my radar. The list also includes many that have already merged with their target companies.

Lucid Motors (LCID)

Stem Inc (STEM)

SoFi Technology (SOFI)

BarkBox (BARK)

Proterra (PRTA)

Avepoint (AVPT)

Microvast (MVST)

Katapult Holdings (KPLT)

For more interesting SPAC ideas and see what people are chatting about, check out the trending SPAC list on SwaggyStocks.

Here's a message from our sponsor, Ei.Ventures

Invest in Psychedelic Medicine – A $35 Billion Market

The global mental health crisis is a huge problem... and the chance to help turn the tide is big. This could be good news for early-stage investors.

For example, nearly 300 million people suffer from depression worldwide and yet… modern-day psychiatric drugs are falling short.

· 50-66% of those taking antidepressants never make a full recovery.

· 33% of adults with Major Depression are “treatment-resistant”.

· The COVID-19 pandemic has made the problem much worse.

Psychedelic medicine continues to show great promise to help those who suffer from mental illness.... and that’s where Ei.Ventures comes in.

Their flagship product “Psilly” (derived from the Psilocybin Mushroom) is a potential game-changer for the millions who struggle with mental illness.

Ei.Ventures is the first Psychedelic Medicine to launch a qualified Reg A+ Tier II public offering. Both accredited and non-accredited investors can purchase shares during this round.

There’s no better time to get in on the next big growth trend.

Click here for more and to invest in Ei.Ventures.

Earnings Update

Another busy week with earnings, here's what you missed.

AMC Entertainment has been making headlines after crushing earnings on Monday after the close. The CEO mentioned the company is in a favorable position moving forward, yet the stock is down nearly 12% since the start of the week.

Shares of Moderna (MRNA) were up 25% last week, but have given those gains back on possibly more side effects linked to their vaccine.

Crypto trading platform, Coinbase (COIN), crushed earnings with huge growth in revenues and their user-base, but guidance was not favorable for the company. The stock traded relatively flat since the report.

FUBO, Unity (U), Upstart (UPST) have been the biggest winners this week with their share price trading much higher after reporting positive earnings (particularly UPST).

Today after the close we still have a few popular names reporting earnings:

Disney (DIS)

Rocket Companies (RKT)

AirBnB (ABNB)

Sundial Growers (SNDL)

ContextLogic (WISH)

What Trends are Next?

We've finally seen some positive price action this week, so what are the current trends? I'm seeing more activity in only a few select names and for the most part many bullish rips have been short-lived in this choppy market.

What's hot this week:

Palantir - Sentiment

Palantir (PLTR) reported earnings today. This is by far one of WallStreetBets (and a lot of retail traders) favorite stock. PLTR saw a good run-up in stock price over the last few days and their earnings were highly anticipated by many. The beat on both revenues and EPS and provided solid guidance. The stock price is up nicely today. Starting last week there was a rather large uptick in hype around PLTR, given earnings were around the corner.

Moderna - Sentiment

Some bearish sentiment has been seen with Moderna and Ebay this week. As previously mentioned with Moderna the stock is down on unexpected side effects concerns and many people do not believe the company's valuation is sustainable (currently valued at $155 billion market cap).

Ebay - Sentiment

Ebay reported good financials this quarter, but a drop in it's total active buyers has the stock trading mostly flat post-earnings. Sentiment on WSB has been bearish in this name as it's currently one of the most mentioned tickers.

Top Lists

Top 5 short-interest plays in terms of WSB and other retail chatter:

Other top trending growth-stocks this week:

Lastly, new additions to the top trending list:

That's all for this week's rundown. See you all on Sunday with more trending tickers and a preview into another sentiment analysis I am putting together.

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.