Swaggy's Top Stonks - Hot IPO Summer

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

June 27, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. The newsletter covers many topics around investing that revolve around what's happening in the market, stock research, and trending tickers all with a little edge. We also just added a new feature to the SwaggyStocks website, The Swaggy Terminal. I'll go over that here too.

What's in today's letter

Market Update

IPO Briefing

WISH Due-Diligence

The Swaggy Terminal

This Week's Trending Tickers

There are multiple reasons why pricing pressures are being exerted on lithium which include supply chain risks, reliance on China imports, and increased EV demand. Check out this article on the lithium shortage from one of our sponsors.

https://thegoldletter.com/wp-content/uploads/2021/03/eu-batteries.jpg

Dangerous EU Lithium Shortage

EU Sounds Alarm On Critical Lithium Shortage. (Sends Lithium Stocks Soaring)

Skyrocketing demand sends lithium stocks into a "supercycle." Don't miss it…

Get Your Lithium Report Here...

https://thegoldletter.com/carbon-free-2035/?utm_campaign=ULTHF_SPG&utm_source=27002&utm_medium=nlspon&utm_content=skyrocket

*This is an ad.

Market Update

Hedge fund managers are all a part of one big club and we aren't invited, however, social media has completely changed the landscape of investing.

What hasn't changed is the fact we STILL aren't invited to the hedgie club, but what HAS changed is that now we actually don't want to be.

Information is EVERYWHERE, a Google search can bring up almost every single detail about a public company. The problem is finding someone willing to dig through it all to make it useful. This is where social media comes in. Users of social media are the "workers" that piece together all this information into something that makes SENSE, then they post it publicly for clout and Internet points.

Believe it or not, the retail investor has an edge over big funds for several key reasons, two of them being:

1. Liquidity: If someone told you to build an ideal portfolio with $100k across 40 equities you probably wouldn't have any trouble doing that. Now what if someone gave you 1 billion dollars to create a portfolio? It's a lot more tricky allocating $50 million positions without crossing over any lines due to takeover code. You may inadvertently end up owning more of the company, percent-wise, than you expect. Also, whether entering or exiting a position larger trades will eat up most of the daily trading volume for the stock. Small investors can be a lot more dynamic in their trades and aren't locked into a position, per se.

2. More Control Over Position Size: You are the master of your portfolio. You can allocate 50% to Apple should you decide it is wise. Large funds generally have a minimum and a maximum amount they can allocate to a single stock and industry/sector. When the market gets wonky and you hear about "funds rebalancing" it has to do with just that, funds are "rebalancing" the weighting of individual stocks in their portfolio.

Additional Alpha

Retail investors can also find alpha-generating opportunities in small/micro-cap stocks and (the less hyped) IPO's.

Small cap stocks have a lot more risk, but also higher reward. Due to the higher risk these stocks should usually require a lot more hours of due diligence into the company and sector before entering a position, but can have substantial payouts. It's not uncommon for small caps to double or triple in a short period of time.

When I say IPO's I don't mean Roblox and well-established multi-billion dollar companies, but the lesser known ones much smaller in valuation. Remember what your GF always tells you, bigger is not always better. Move over "hot girl summer", the boys are back with "Hot IPO summer" (apologies to all females reading this newsletter).

What many retail investors don't know is that there is a "quiet period" that generally lasts 10-40 days post-IPO where banks are NOT allowed to release research and marketing materials for the company. This offers an opportunity for investors to capitalize by taking the lead and doing their own research. One thing I would like to add to this newsletter is focusing on upcoming IPO's that are at least somewhat going under the radar.

IPO Briefing

This is a new section I will incorporate from time to time. It will highlight some of the less-hyped upcoming IPO's that are on my radar. The point is not to give recommendations of what to buy or sell, but to outline some of the company's key metrics.

SentinelOne - (T)

IPO Date: June 29, 2021

Briefing: SentinelOne is an Internet of Things (IoT) data analytics and cyber-secutiry platform that includes end-point and data center protection.

Business Model: SentinalOne offers annual subscriptions to their cyber-security network. Most of their revenue will be annualized recurring revenue (ARR).

Key Metrics:

Over 4,700 customers

277 customers providing over $100,000 ARR, some of which include: Estee Lauder, Aston Martin, Pandora, Fiverr, Nvidia, and Wells Fargo.

CyberSecurity software and services expected to grow at CAGR of 10% from 2020 to 2027 (as per GrandViewResearch)

Similar Companies: CrowdStrike (CRWD), Microsoft (MSFT), BlackBerry (BB)

Financials: Fiscal 2020 revenue of $46 million, fiscal 2021 revenue of $93 million, 102% growth. Gross margin of 57%-60%.

Valuation: SentinelOne aiming to raise $880 million giving the company a valuation of roughly $7 billion.

Expected Share Price: $26-$29.

Xometry - (XMTR)

IPO Date: June 30, 2021

Briefing: Xometry offers on-demand manufacturing through an online marketplace for both buyers and sellers in the manufacturing space. They have a large network of buyers and sellers of over 5,000 suppliers providing prototyping and production solutions.

Business Model: From the S-1 “Xometry uses an AI-enabled (with machine learning) instant quoting engine based on factors such as volume, manufacturing process, material, and location”. Xometry receives a fee that comes out of the prices they charge buyers from each order placed through their platform. Xometry acts as the seller, however, once a customer places an order their AI algorithm will produce a quote and internally connect to various sellers willing to fulfill the order.

Key Metrics:

CAGR of 92%(!) 2018-2020

Works with 30% of Fortune 500 companies

Over 5,000 suppliers and 43,000 buyers

Similar Companies: 3D Systems (DDD), Protolabs (PRLB)

Financials: 2019 revenue of 80 million, 2020 revenue of $141 million, top-line revenue growth of 76%. Gross margin of 23%, however operating loss for 2020 was ($29) million.

Valuation: The offering is set to value the company at roughly $1.5 billion. This would give it a price-to-sales ratio of ~11x.

Expected Share Price: $38-42

Integral Ad Science - (IAS)

IPO Date: June 29, 2021

Briefing: Similar to what their company name suggests, Integral Ad Science provides analytics, insights, and fraud protection to advertisers. IAS aims to increase accountability, transparency, and effectiveness in the advertising industry.

Business Model: They’ve created a platform that delivers real-time results and campaign performance by using AI and machine learning (ML) to analyze over 100 billion daily web-page transactions (ie: clicks). Through this they provide ad-performance efficiency and accountability saving advertisers money.

Key Metrics:

CAGR of 22%

70% of revenue from top 100 customers

Clients include almost 2,000 advertising customers and 138 publishers

Similar Companies: DoubleVerify

Financials: 2019 revenues of $213 million, 2020 revenues of $240 million, 12.6% growth. Adj. EBITDA margin of 23%

Valuation: The offering is set to value the company at a valuation up to $2.6 billion. This would give is a price-to-sales ratio of roughly 11x.

Expected Share Price: $15-17

The Weekly DD - WISH: The Shopping Mall in your Pocket

WISH has been the hot ticker around town lately. Many are joining in on the action for the only sake of "the short squeeze". TheStonksHub aims to bridge that gap between investing in trending tickers and knowing all about their business model. This week's report was on ContextLogic (WISH) and it's free. At 7 pages the full report is long so here's a short preview. I'll post a link below to the full article for those wanting to continue reading.

WISH - The Shopping Mall in your Pocket

WISH controls the most popular shopping mobile application in the world. In short, the company is a direct-to-consumer online retailer. However, a few key features differentiate it from its competition:

WISH not operating any brick-and-mortar locations allows it to maintain low capital expenditures (CAPEX) and frees up its cash flows.

WISH’s focus on unbranded items allows it to compete in a more niche market that has not been taken over by other e-commerce giants. This is a space that WISH dominates.

WISH’s decision to work directly with manufacturers rather than wholesalers allows it to procure its product catalog at a much cheaper price point than any competitor which it then passes on to its customers. With independent sellers, WISH offers a more unique product catalog than its competitors.

These three features combined defines how it interacts with its customer base. WISH targets mostly younger, low to middle income households. It offers cheap and unbranded products, an area that was historically ignored by larger e-commerce companies. Even their strategy to be a mobile app reflects this.

Continue reading the full version (it's free)

The Swaggy Terminal

It's finally here, The Swaggy Terminal has landed. As cliché as it sounds The Swaggy Terminal is quite impressive. It has all social sentiment charts on a single page and includes new sections for trending keywords and news sentiment. I'll go through a quick breakdown.

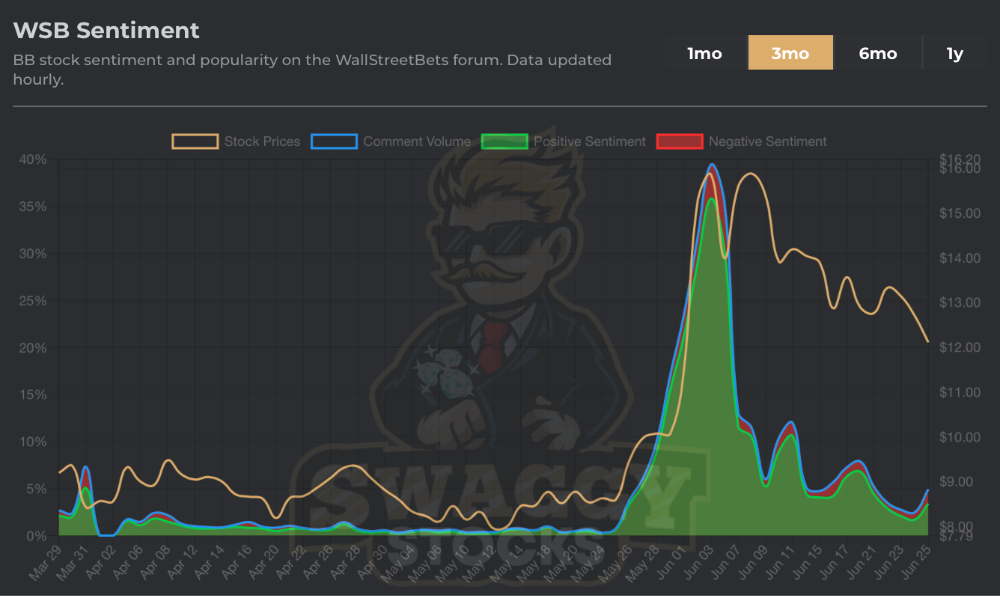

WSB Sentiment

Everyone knows this as the classic SwaggyStocks WSB Sentiment tracker.

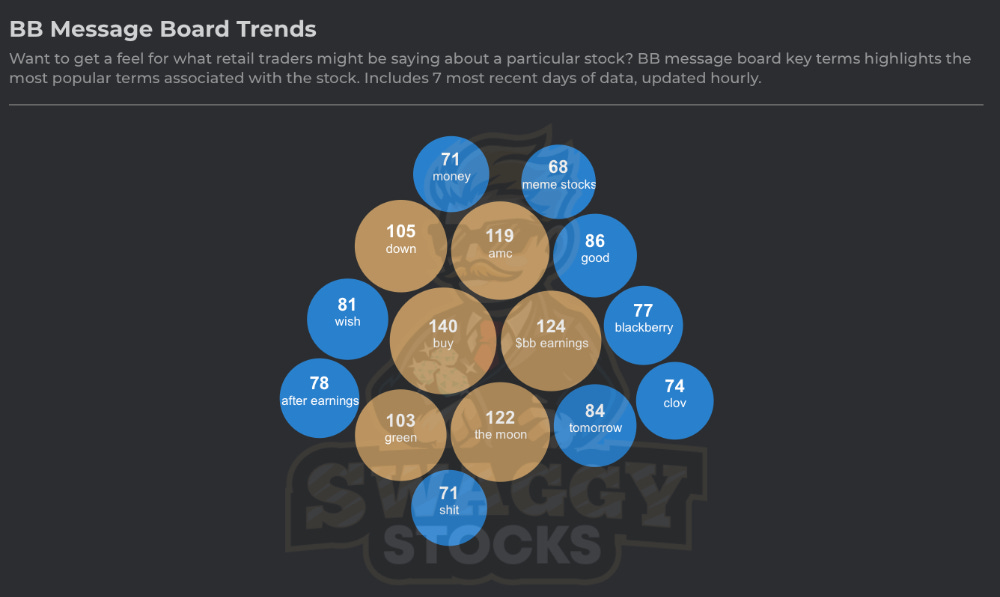

Trending Terms

This highlights terms that appear multiple times on social message boards. Don't have time to read all the comments? No problem, take a quick glance and you'll be able to see what terms are being associated with the ticker. For Blackberry it looks like: BB earnings, meme stocks, and 'the moon' are all trending.

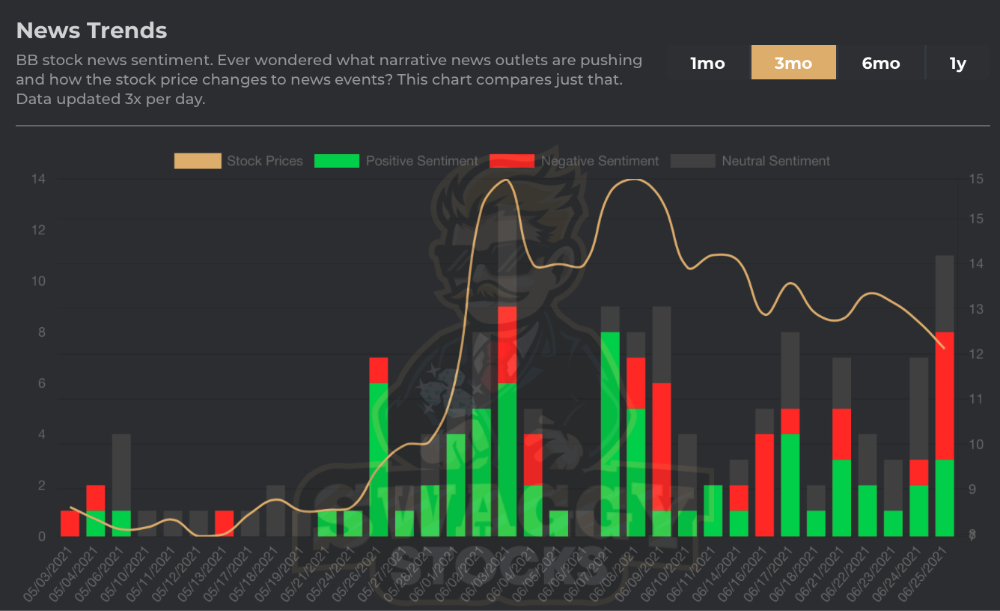

News Sentiment

Have you ever wondered if the news is pushing predictive or reactive information regarding a stock? Now you can see for yourself. For Blackberry it is quite obvious that news coverage picked up during the short squeeze event.

Were they able to "predict" where the stock was going? Or simply reacting to stock price and making up headlines as they go along? The proof is in the pudding.

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.