Swaggy's Top Stonks - Earnings Sinkers & Swimmers

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with... The Motley Fool

November 9, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

This is an earnings run-down where we look into movers of the week and what's driving the action. Let's go.

Today's Letter

Today's Sinkers & Swimmers

Post-Market Earnings Movers

Upcoming Earnings

Trending Tickers

Sinkers & Swimmers

We had some interesting movers so far this week. It seems that unless companies are reporting blow-out quarters the direction they move is to the downside. Is this due to the forecast in tightening monetary policy that is expected in 2022? Tapering in QE might cause some headwinds for the market, but we'll find out several months from now once the Fed makes the final decision.

Today's Trading Action

The Trade Desk (TTD) stock is up 8% in trading today after the company reported EPS of 0.18 on estimates 0.15. They also beat on revenues by 6%. Not many upgrades on this name recently. We might see some new ones roll-out in the coming weeks giving another bump to the share price.

PayPal (PYPL) shares traded down 11% today after the company beat on EPS with a slight miss on revenues, however, they revised guidance to the downside for next quarter. PayPal shares are down 30% in the last 3 months.

Roblox (RBLX) shares are trading up 40% after reporting eps of -$0.13 vs -$0.14 expected and in-line revenues. The stock is up big on news of increased DAUs last quarters. Earnings were in-line after DAUs up over 30% YoY and the stock is up 35%? Makes you wonder sometimes.

SmileDirectClub (SDC) had an abysmal quarter. The company reported a -75% surprise miss on EPS and a -25% surprise miss on revenues. Several months ago SDC had a small boost in share price on a note regarding expansion into international markets. Tough quarter for the company and the shorts are having their way.

Palantir (PLTR) shares are trading down 13% today after reporting in-line EPS and and slight beat on revenues. PLTR added 34 net new customers in Q3 and raised outlook on Q4 guidance. Please refer to opening statement if you are wondering why PLTR is trading down after solid performance last quarter.

QuantumScape (QS) traded up nearly 25% yesterday after a positive response to the infrastructure bill. QS is in early-stage development of solid-state lithium batteries for electric vehicles and other applications.

AMC Entertainment (AMC) had a solid quarter reporting EPS of -$0.44 vs est. -$0.54 and a 4% revenue beat to the upside. The stock traded somewhat flat in post-market trading yesterday, but has succumbed to the downside today and is down more than 12%.

This Stock Could Be Like An “Early Amazon”

In addition to recommending investors get in early on Amazon, analysts at The Motley Fool have correctly predicted the success of many of the market’s biggest winners – stocks like Netflix, Nvidia, Marvel, and more.

The Motley Fool has been recommending stocks for a few decades now, and their average stock pick has returned a mind-boggling 637%*... that’s more than 4x the return of the S&P 500.

They’re the original diamond hands, while everyone was ignoring Amazon, The Motley Fool was buying. They bought Amazon stock in '97 for $3.19 and this stock could be just like it.

*This is promoted content.

*Returns as of 10/15/21. Past performance is not a guarantee of future results.

Post-Market Earnings Movers

Today's post-market earnings hits & misses, brought to you in "slightly delayed" real-time by Swaggy.

Nio (NIO) is reporting later this evening, however, shares were down 6% in trading hours today.

Coinbase (COIN) reported EPS: of $1.62 vs $1.79 est. Revenue: $1.31B vs $1.56B est. Shares are trading down 7% in after-hours back to $330 level.

Upstart (UPST) closed the day down 6% and has lost another 16% in after-hours on their earnings results. They reported EPS $0.60 vs $0.35 est. Revenues: $228m vs $215m est. Crushed earnings and stock is down bigly.

FuboTV (FUBO) is down 10% in after-hours action after reporting underwhelming earnings.

Plug Power (PLUG) reports EPS of -$0.19 vs -$0.09 est. Revenue: $143.92M vs $143.93M est. PLUG is trading down 4% in after-hours.

Unity (U) reported in-line EPS and beat on revenues $286M vs $266M est. The stock is down 10% in after-hours. Note the stock had a huge run-up over the last several weeks.

Purple Innovation (PRPL) missed on Revenue: $170m vs $199m est. and EPS: -$0.05 vs $0.17 est. PRPL is down 20%(!) after-hours.

Upcoming Earnings

There are still a whole bunch of interesting earnings coming up from tomorrow on. Remember,

BMO = Before Market Open

AMC = After Market Close

I don't write AMC frequently because I like the stock THAT much ;)

Wednesday

Fiverr (FVRR) - BMO

Monday (MNDY) - BMO

SoFi (SOFI) - AMC

Disney (DIS) - AMC

ContextLogic (WISH) - AMC

Affirm (AFRM) - AMC

Beyond Meat (BYND) - AMC

Root (ROOT) - AMC

Thursday

Paysafe (PSFE) - BMO

Sundial Growers (SNDL) - AMC

Blink (BLNK) - AMC

Coupang (CPNG) - AMC

Friday

AstraZeneca (AZN) - BMO

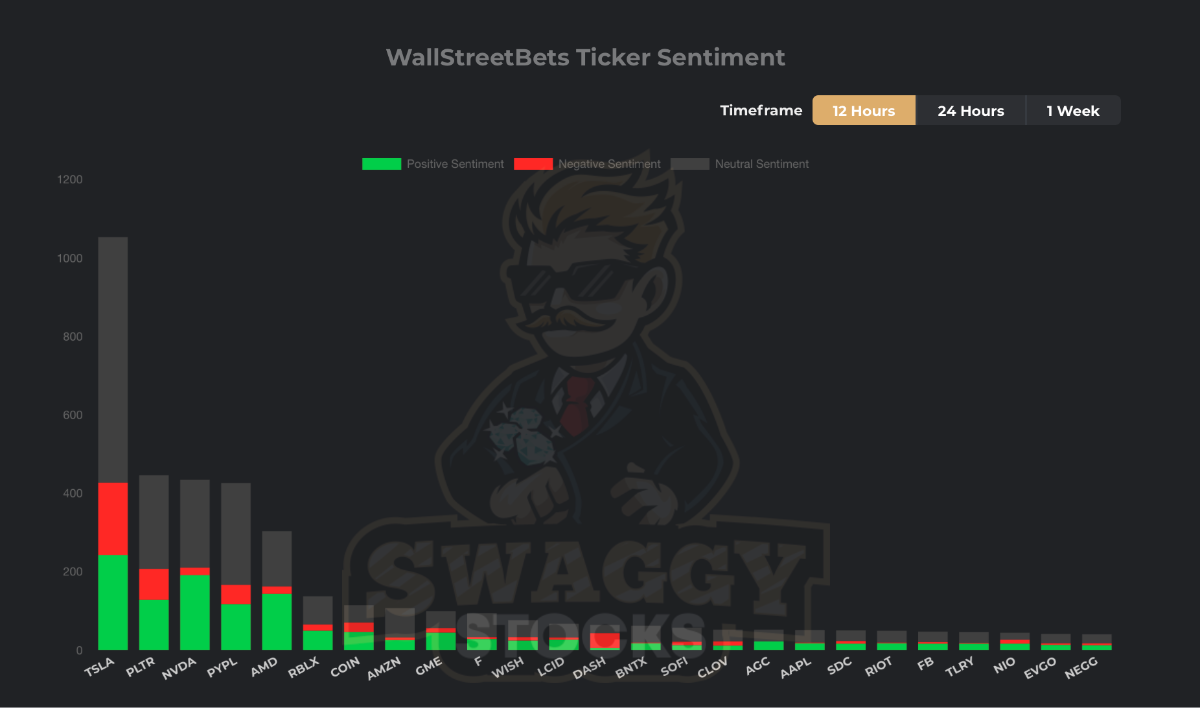

WallStreetBets - Most Mentioned Equities

What's happening over at WallStreetBets? Tickers are mixed based on earnings reactions, anticipated earnings, and the strong performance in the chip sector by AMD and NVDA.

Honorable mention: DoorDash (DASH) is making it's way to the top of the list and as usual, sentiment is very bearish.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.