Swaggy's Top Stonks - Earnings Sinkers

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with... The Motley Fool

November 2, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

Today's edition will be a brief rundown of earnings results -winners and losers. Let's go.

Today's Letter

Market Update

Earnings Results

Vig Fantasy Stocks Update

Trending Tickers

Market Update - Winners & Losers

Twas a great start to November and the bulls were on parade. Your average Joe growth stock was up 5% on Monday, and then this morning came around. Futures turned red and stocks were hit hard after the open as tomorrow's FOMC looms in the Hallowed air. Tune in tomorrow at 2pm for FOMC and interest rate decision as this will be the biggest short-term catalyst, during earnings season as well, which will make for moar volatility... Is the Fed in a catch-22? Raising rates might hurt the economy, while keeping them where they are is creating inflation like we haven't seen in many years. These are unprecedented times so it is definitely worth to listen in.

For those of you that follow crypto, a new coin was born and then obliterated. Riding on the back of the popular new TV show taking over the Internet, Squid Games, some crypto-BROs ended up creating a "Squid Coin". It pumped several thousand percent, before eventually falling to zero. Amazing stuff and the video feed is linked below.

On the other side of things the market has blessed us with some entertainment in the form of big movers to the upside AND downside. Here's a summary of what happened today.

Avis (CAR) was up over 108% today after the company posted better-than-expected earnings.

Ocugen (OCGN) closed +12% on increased retail momentum.

Toast (TOST) was up 14% on no specific news.

Bed, Bath, & Beyond is up 70% after-hours after the company announced an accelerated buy-back plan and a retail partnership with Kroger (KR).

On the other side (the down side), we saw:

Chegg (CHGG) down 48% after missing top and bottom-line on earnings. The company cited a huge slowdown in educational growth.

Zillow (Z) closed -11% (-8% in after-hours as well). The company has shut down their home-flipping business, which has been racking up losses.

Mosaic (MOS) missed revenues and eps estimates and the stock tumbled 10% today.

Is 5G worth investing in?

If you know much about us at the Motley Fool then you probably know how well we’ve done identifying massive technological trends and then finding stocks that can benefit in explosive ways.

Like we did with:

Amazon and the e-commerce revolution, our recommendation up +21,454%* since we first recommended it September 6th, 2002

Or Netflix and the streaming trend, up +34,080%* since December 17th, 2004

Or Booking Holdings and the online travel explosion, up +10,428%* since we recommended it on May 21st, 2004

So what are we seeing today that might be the next big world-changing trend? Well, it’s 5G.

Learn where to invest $1,000 right now - and a free stock pick

*Returns as of 10/15/21. Past performance is not a guarantee of future results.

*This is an ad.

Earnings Results

Notable Earnings Today:

Pfizer (PFE): Pfizer posted a solid quarter and beat analysts estimates. Shares are up 5% in after-hours trading.

BP (BP): BP had a good quarter. The company stated oil demand is very high and they announced a 1.25 billion buyback program. BP shares traded lower by 5% today.

Under Armour (UAA): Under Armour soared 16% today after beating analyst estimates.

Activision Blizzard (ATVI): ATVI is trading down 10% in post-market action as the company provides soft guidance for next quarter. The company also announced delays in two of their up-and-coming hit titles, Overwatch & Diablo 4.

Lyft (LYFT): Shares of LYFT are up 12% post-market as the company had better-than-expected sales results.

Still quite a few more to come this week, keep an eye out for the following:

Wednesday

Roku (ROKU) - AMC

Qualcomm (QCOM) - AMC

Skillz Inc (SKLZ) - AMC

Fastly (FSLY) - AMC

Etsy (ETSY) - AMC

Thursday

Moderna (MRNA) - BMO

Datadog (DDOG) - BMO

DigitalOcean (DOCN) - BMO

Square (SQ) - AMC

Pinterest (PINS) - AMC

Uber (UBER) - AMC

Airbnb (ABNB) - AMC

MercadoLibre (MELI) - AMC

Peloton (PTON) - AMC

Cloudfare (NET) - AMC

Friday

DraftKings (DKNG) - BMO

Coinbase (COIN) - BMO

Vig - Fantasy Stocks

Mr. Swaggy is currently ranked 19th out of 82 participants for the week long VIG Fantasy Stocks Games. I was ranked #5 at one point yesterday, but my call on BTU is holding me back.

The VIG games are free to enter and you can win real cash prizes, for those of you interested there's still a few running this week (and they will run weekly). Check out the free trial.

Trending Tickers

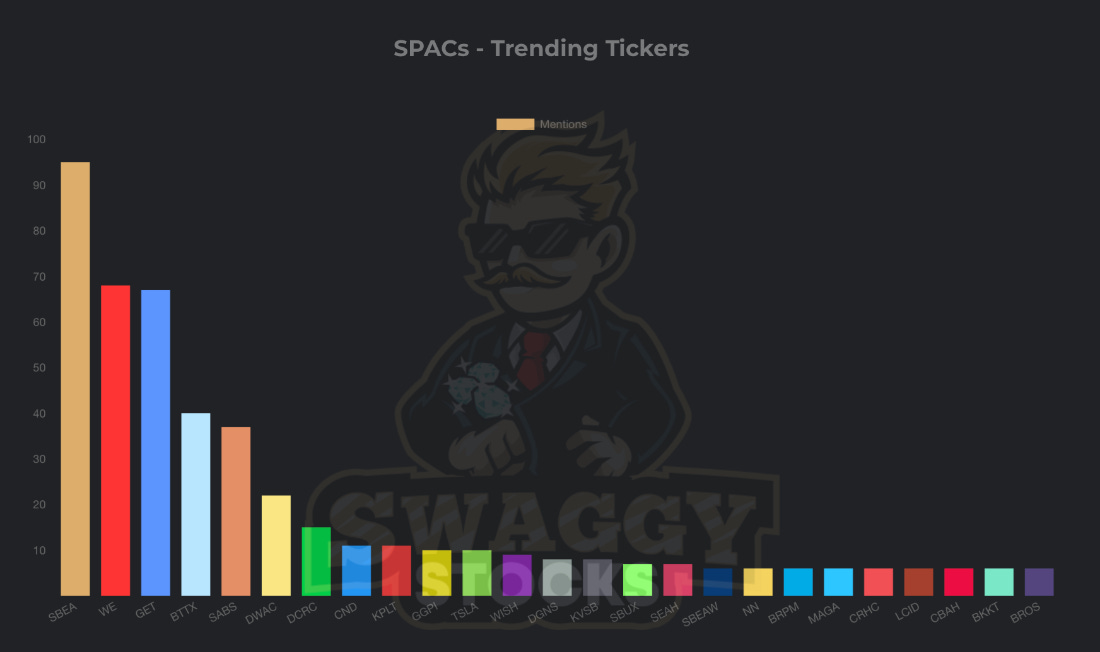

SPACs

SPACs are making a comeback and today I found one I liked. It's actually the most talked about from today's chatter.

The ticker is SBEA and they announced a merger with premium coffee company, Black Rifle Coffee Company. SBEA was up 50% at one point today, before closing only +15%.

Crypto

A new crypto currency was making the top of the list in crypto chatter. The name is Loopring (LRC) and it's up nearly 300% in just one week. Today's hype was built up after the coin shot up 50% in the last several hours.

WallStreetBets - Most Mentioned Equities

Today's most mentioned equities on WallStreetBets. Most names on the list today revolve around earnings results and news (OCGN, CHGG, BBBY, AMC).

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.