Swaggy's Top Stonks - Deep-dive into meme stock performance

Swaggy's Top Stonks

Together with...Vig - The Option Flow Mobile App

August 22, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. We've got a special edition this week that includes a complete deep dive and break-down on stocks that end up "meme"-ing, aka trending hard, on WallStreetBets. How did they perform? What was their return when you look at the share price several weeks or months later? Check out the full report below.

This Week's Letter

Option Flow - Identifying Opportunities

A deep-dive into meme-stock performance

Option Flow - Identifying Opportunities

There’s a lot I can say about interpreting option flow and implementing it into your trading strategy. It doesn’t always have to be about watching big trades hit the tape and riding momentum.

As I’ve mentioned in some of my previous newsletter editions, one of the main processes I like to advocate using option flow for is actually by zooming out and looking at the “macro” level of what’s happening in the market. I always believed that option flow is a bit of a jigsaw puzzle and when you piece things together you can start to see the bigger picture. Metaphorically, the market is a living and breathing entity that is in an always-changing state depending on the economic environment.

If your portfolio is weighted heavily in growth-stocks you’ve definitely been feeling some pain lately. Most growth stocks are in correction territory while indices seem to make new all-time-highs every week. What story has option flow been telling us last week? Here’s a great thread on Twitter that describes this and also utilizes the data on the Vig platform.

What is this telling us? That while some option flow coming through the major indices is slightly bearish (especially the Russell and small caps), a lot of big tech and FAANG continue to be bullish. In fact, they’ve almost single-handedly carried the markets to new highs from the short-term lows in May. So while volatility and uncertainty in the markets may be rising, there is still bullish sentiment rolling through these pillars.

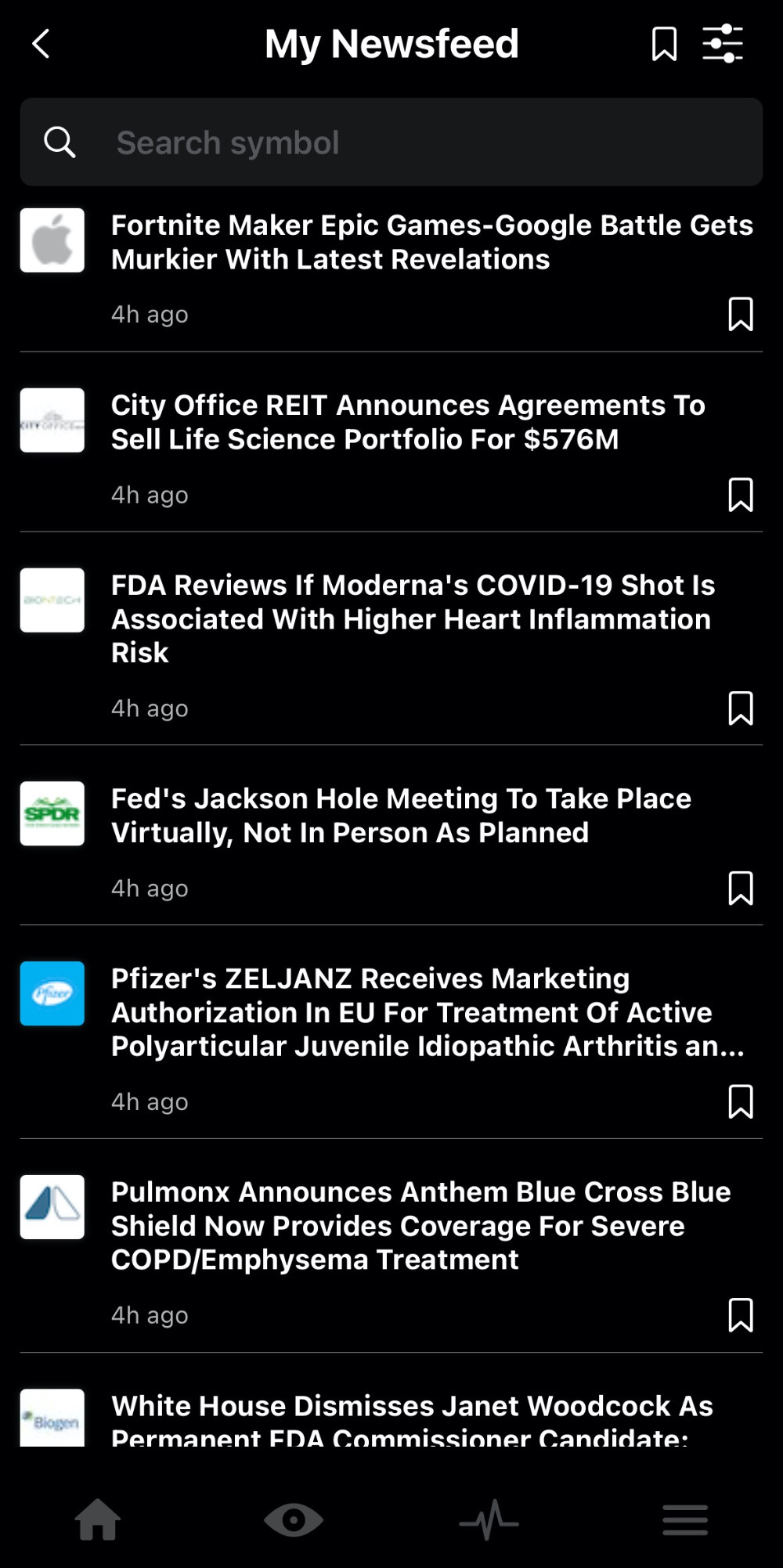

I’ll be incorporating more of this kind of analysis into future newsletters, but you all should definitely give the Vig mobile app a go. Even with the free plan you can utilize things like:

Real-time 24/7/365 News Feeds & Headlines

Breath Indicators

Market breadth is useful because it demonstrates what percentage of stocks are participating in a rally. When breadth is high it is usually a sign of a healthy bull-run. From Friday's performance only 63% of stocks participated in the SPY rally and 45% in the QQQ.

Notable Market Gainers/Losers

Check out what’s moving and why with the market gainers/losers of the day. The free app also displays the top 10 unusual options activity for different categories. This includes the top plays from various UOA scans, such as "Heating Up Calls", "Paper Hands Puts", "Wall Street Bulls", and more.

This can all be found on the Vig mobile application, but to make things sweeter (and as me being an affiliate with Vig) I’ve been authorized to run a promo that offers 25 of my followers/subscribers with a free 90-day premium subscription. I’m confident most of you will be able to integrate the premium analytics into your trading strategy and this promo should give you enough time to take the premium features for a spin.

To enter, all you have to do is reply to this email with any number between 1 and 100 in the message body and/or retweet my promotional tweet linked below.

I’ll be using a random number generator to pick random winners from those who retweet or replied to the email. Results will be finalized by the end of the week!

A deep-dive on... Meme-stock performance

The Gamestop saga brought many new retail traders to the game all with the hopes to get rich quick... But are playing these trending stocks a gamblers delight or are they hidden gems with alpha-generating opportunities?

Over the last couple weeks I went through all my SwaggyStocks data on WallStreetBets social sentiment and broke down the numbers. I've provided my conclusions at the end of the report, but I'd like to preface the report with a few key points to explain how I used the data and some variables that might be affecting these stock's performance.

1) I looked at data from every single ticker that trended on WSB in 2021. By "trended" I mean where mentions for a particular ticker reached 4% market share of all tickers. Why 4%? I concluded that this number would have put the ticker in roughly the top 5-7 tickers mentioned for that day.

2) If a ticker dropped lower than 4% of ticker mentions for a full 30 days then I would close the entry for that trend and add a new one if it were to get back over 4% mentions at some point in the future. For example, GME has been over 4% mentions for almost all of 2021 since January, so there is only one entry. On the other hand a ticker like BlackBerry (BB) trended in January, but hype died off and wasn't really mentioned much until it spiked again in May. In BlackBerry's case there are two trend entries: from Jan to March and again for May to June.

2) I calculated the returns on each ticker and trend at "X time" AFTER the trend. These time-frames were the 1-week, 1-month, and 3-month benchmarks. The initial share price I calculated the return from was the closing price of the ticker on the day it trended. This is important to note because it gives even more conservative results as these tickers generally trend when they have significant action in share price to the upside (I'm not trying to make any numbers look good). For example, if BB trended on a day where the stock went from $10 to $15. I would calculate the return on each timeframe from the $15 point, not $10.

3) I use these set time-frames because I want to generalize how I look at the return. It's easy to say "at it's peak X stock had a return of 4,000%". That would imply someone could time the market perfectly each and every time.

5) From the 62 total tickers that have trended, nearly all are either "high short-interest" plays OR high-beta growth stocks, which means they will be relatively volatile to market movements. So far in 2021 these stocks have been HAMMERED relative to FAANG and the energy/financials sector that have remained steady or seen consistent gains in share price.

6) I would be very interested in comparing this data to the returns of 2020 and 2019 in convincing bull-markets where growth stocks provided exceptional returns. I will most likely do a similar report on tickers mentioned in 2020.

7) Some tickers could be on the top winners and top losers list at the same time. You might ask, how is that possible? Remember that I've logged multiple entries for tickers that trended multiple times. It's possible that for one trend entry the ticker performed exceptionally well, while on a separate occasion the ticker trended it performed very poorly shortly after.

Without further ado, let's look at some of the data.

Interesting to see that after a ticker has trended hard their potential of ending up being a winner or loser is close to 50/50.

Due to AMC and GME's massive increase in stock price that occurred shortly after they started trending I also provided an adjusted set of data. The data below offers a similar look at returns without a few of the baskets of stocks that trended around the same time as AMC. The baskets that have been removed from the following data-set are:

BANG stocks (BB, AMC, NOK, GME)

Weed Stocks (TLRY, SNDL)

Crypto/blockchain miners (RIOT, MARA)

The adjusted results are the following.

Removing those baskets of stocks had quite the negative impact on average gains, reducing them from the 60-80% on the 1 and 3 month return to only ~20%. They did have a slight positive impact on the average loss and improved those numbers by roughly ~2-4%.

The Worst Performing Meme Stocks (Biggest Losers)

You might be wondering how AMC is on the worst performing list of tickers. If you recall back in January it first started to trend on a HUGE spike in share price of 200% (according to Yahoo finance stock price data). The SwaggyStocks trend entry would have logged the share price at about $20 and the stock price declined back to the low teens shortly after.

The Best Performing Meme Stocks (Biggest Winners)

FAANMG/Mega-cap stocks - Can they become "memes"?

I get asked a lot how can a mega-cap and some big-tech stocks become "memes" and trend so much on social media. In my opinion, and what the data seems to agree with, is that mega-cap stocks tend to trend after they've have several positive days of price action. By the time they trend they've already gained 10-15% and the move is over, aka you are too late. Looking at the data below it seems that the average 1-week and 1-month return were almost flat, while the 3-month return provided positive returns, which might also just be due to most mega-cap FAANGs going up (most of the time). I'm not sure if this data is actually correlated to the ticker itself trending or the fact that FAANG generally out-perform the market.

Final Thoughts

I will definitely be going back to the 2020 data and performing the same evaluation to compare results, but in my opinion I see several conclusions to be drawn from the data.

The chance the stock went either up or down after trending was close to 50/50. However, stocks that increased usually out-performed by a greater margin than those that decreased. *Keep in mind growth stocks have been severely beat up as of late.

The best time to get into a stock is obviously BEFORE it trends (this would take a sophisticated level of prediction), or to potentially enter on a DIP after the stock was trending. A stock trending hard generally represents a short-term peak in it's stock price.

Share price in FAANG stocks didn't seem to be too affected by a lot of hype building around the name. They performed as usual and followed the market on it's trajectory.

The below chart shows the return of the SPY, IWM, and the Nasdaq over the last 6 months. Returns for small caps and stocks in the Russell have under-performed with a -6% return, whereas the SPY and Nasdaq are up 13.7% and 4.8%, respectively. The IWM under-performing lately has a HUGE impact on small-cap growth stocks. This needs to be factored in to the results.

Disclaimer: NOT FINANCIAL ADVICE