Swaggy's Top Stonks - Are short-squeeze stocks back?

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

August 29, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. Just a heads up that Swaggy's Top Stonks will be skipping next weekend's edition for Labor Day weekend.

For those of you that entered the raffle to win a 90-day premium subscription to the Vig platform, I have messaged all winners by email and/or Twitter. Please check your junk folder for my email as it may have gone there (I sent a test email to myself and it went to the junk inbox). Also, check your "other" inbox on Twitter for my message there.

While you're at it if you could simply move my emails from your junk inbox to the main folder, that would help my email deliverability going forward and would be amazing.

This Week's Letter

Market Update

Earnings SZN - Booms and Busts

Short Squeeze - Is it back?

TheStonksHub - SKLZ Stock Analysis

Trending Tickers

Before we begin, a message from our sponsor about the increased demand on the lithium industry

https://thegoldletter.com/wp-content/uploads/2021/03/fire-ring-li.jpg

Don't Miss The Burgeoning Lithium Megatrend

By 2025... manufacturers will need 1.1 million tons of lithium. Here's how investors could take advantage of this lithium explosion.

See The Full Report On The Lithium Explosion Now

Market Update

It was a good week for the market. The SPY closed 1% higher, the QQQ was up 1.85%, and the Russell/IWM closed the week up 3.85% -a much needed win for small caps. Many WallStreetBets trending stocks, current and former, also posted some nice gains due to several reasons. First, that "short squeeze" stocks started to pick up momentum again. Second, the Russell, which tracks the performance of small cap stocks, had one of it's best performing weeks so far in 2021.

What do small caps have to do with anything?

I don't know the exact stat, but off the top of my head I would say 80% of stocks mentioned on WallStreetBets, and also a lot of other investing forums, are small-to-mid-cap stocks. Small caps by definition are stocks with market caps in the range of 300 million to 2 billion. Under 300 million we start to get into micro-caps.

The general rule is that as market cap gets smaller, the stock becomes more volatile and experiences larger price swings. These stocks are some of WSB's and social media's favorites mainly because they present an opportunity to find the next 10-bagger (10x return). Imagine finding the next Apple, Google, or Microsoft, and getting in when they were at the very start of their growth.

That's why it's not surprising to see many popular stocks being discussed by retail traders to be small or mid-caps. Thus, a good week for small/mid caps is generally a good week for retail and WallStreetBets.

Earnings SZN - Booms and Busts

Earnings season is winding down. Here's what moved this week and a few more names to keep an eye on for next week.

Last Week

JD.com (JD) temporarily lifted most Chinese stocks after reporting solid earnings. Tickers like PDD and BABA also had moves to the upside after JD offered a glimmer of hope to Chinese stocks that have been battered down.

Best Buy (BBY) closed slightly lower this week after reporting solid earnings.

Shares of Dicks Sporting Goods (DKS) closed +20% for the week after beating estimates. The company referred to strong growth and robust demand being key factors for their success.

Salesforce (CRM) had a good week after posting solid earnings. Shares popped 5% to the upside after reporting, but ended up the week up 3%.

Snowflake (SNOW) reported strong earnings where revenues were up over 100% YoY. The stock saw a 6% increase after the earnings report.

Ulta Beaty (ULTA) beat on EPS and revenues leading the share price to new highs this week.

Peloton (PTON) shares tumbled down nearly 13% in after-hours trading after the company reported a huge miss on EPS and lowered guidance. This comes on the coat-tails of recalls that have affected their product line over the last several months. The company also noted of "internal challenges" they are trying to solve moving forward.

Next Week's Highly-Anticipated Earnings

Cloudera (CLDR): Monday BMO

ZOOM (ZM): Monday AMC

Chewy (CHWY): Wednesday AMC

C3.AI (AI): Wednesday AMC

Docusign (DOCU): Thursday AMC

The Short Squeeze - Is it back?

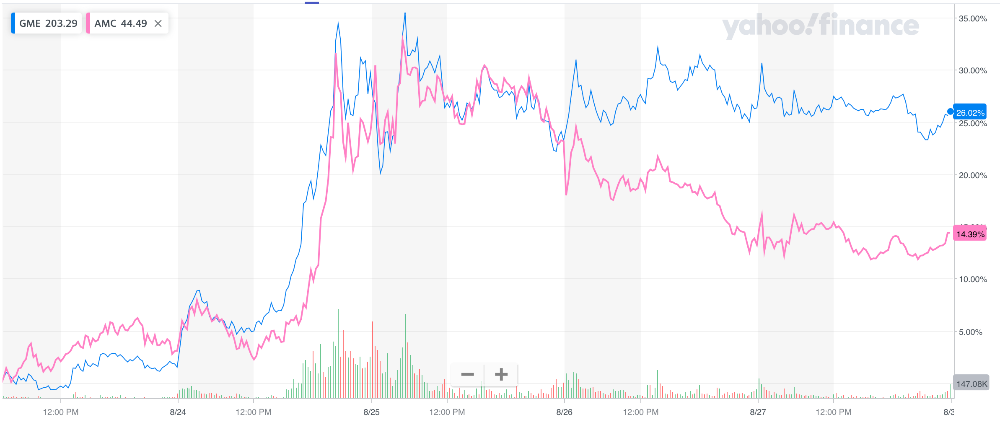

A few key names in the short-squeeze saw some precarious price action starting Tuesday afternoon going into the close. At exactly 1:30pm on Tuesday both AMC and GME started a significant rally that lasted into the closing bell. Here's a look at the chart.

If you remember back at the end of May, something similar also happened. Which leads me to ask... will we see something comparable this time? Short-squeeze stocks have become a cyclical asset class with extremely unpredictable timing. If you believe other short-interest stocks will begin to follow suit of AMC/GME, here are a few of the other more popular names that tend to trend on WSB. Some have high short-interest and others just simply follow the trend for unknown reasons.

ContextLogic (WISH)

Workhorse (WKHS)

BlackBerry (BB)

Nokia (NOK)

Palantir (PLTR)

SoFi (SOFI)

Clover Health (CLOV)

Root Inc (ROOT)

Petco (WOOF)

SmileDirectClub (SDC)

MicroStrategy (MSTR)

Senseonics (SENS)

Bed Bath and Beyond (BBBY)

TheStonksHub - SKLZ Inc. Stock Analysis

Our partner site, TheStonksHub, released a free analysis and breakdown of e-gaming company, SKLZ Inc (SKLZ). SKLZ gained popularity earlier this year as one of the stocks that joined the short-squeeze, but also because of ARK's investment into the company. SKLZ is down 80% from the high and TheStonksHub break's down what the company's business model is and how they earn money. Read the sample, or continue reading the full version using the link below the preview.

Not a gaming company

SKLZ is a mobile tournament platform. Basically, they take competitive mobile games, and create some sort of tournament experience for those games with a prize pool. They provide this service through an API (application program interface). Basically, their product goes like this:

They create the software for hosting tournaments with prize pools

They offer the software to mobile game companies as an easy-to-implement solution

Mobile game companies implement tournaments using their software

They take a cut of the total prize pool every time a tournament is hosted with their software

It is extremely important to note that SKLZ’s product is only this tournament software package. They do not develop any mobile games themselves and are entirely reliant on 3rd parties to choose to use their software.

The mobile gaming market

Mobile gaming accounts for over 50% of all video gaming revenue worldwide. In the US, one of the largest gaming markets in the world, mobile gaming revenue reached ~$11B in 2020. It’s expected that the global share of mobile gaming will continue to rise even in relation to the rest of global gaming growth.

In the US specifically, there has been an increased in global mobile gaming revenue share. Over the years, it has overtaken Japan as the largest mobile gaming market globally.

(Continue Reading - SKLZ: E-sports for non-gamers)

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.