Swaggy's Top Stonks - Alpha Thought

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

October 3, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. This week's letter has an alpha thought I wanted to share as well as a list of short-interest stocks popular on WSB to go with the trending tickers section.

I also made a list of meme stocks that are trading at the lows with the potential to gain momentum on social media once the share price begins to appreciate. Today's edition is already long enough so I'll throw it in a bonus newsletter tomorrow at 11am SHARP. Be there.

This Week's Letter

Market Update

Alpha Thought

Top Short Interest Stocks

Trending Tickers

Market Update

September is over and those who haven't had their portfolio obliterated have a chance at redemption and "building back better". For those that don't actively pay attention to market details just know that September was the worst trading month since March 2020. This also included two of the worst trading days in nearly six months. It's not always easy to be slangin' these stocks, but alas the show must go on.

Looking forward into the next couple weeks Swaggy did another deep-dive on the performance of stocks mentioned on WSB and their returns, this time on an all-inclusive list of top stocks from 2020. The results are extremely interesting to see and I will post the report to this newsletter once I've added the final touches. Stay tuned.

Before we get into the rest of the letter, here's a message from our sponsor on the intricacies of the Helium market

Why Helium Prices Have Skyrocketed By 160%... And How You Can Tap Into A Rare Opportunity

Tech giants like Google, Facebook, and Amazon are hoarding helium. And that's because it's about to become one of the rarest, most important gases on Earth. And this small cap company has found what might be the most valuable helium sites on the planet.

Yes! Tell Me More About This Helium Discovery!

This is sponsored content*

Alpha Thought

One of my stocked market bros provided me with an alpha-generating thought last week. The opportunity is a comparison between recent IPO of Toast Inc (TOST) and NCR Corporation (NCR).

About TOST

Toast Inc recently IPO'd two weeks ago. TOST is a cloud-based, end-to-end technology platform -built for the entire restaurant community. Think of them as vertically-integrated SaaS solutions for Point-of-Sale (POS), among other things.

About NCR

NCR offers similar SaaS solutions to various industries that include banking, telecommunications, retail, and hospitality. These solutions include payment processing, ATMs, point of sale, etc. NCR also holds an asset called Aloha Essentials which provides services very similar to what TOST does. Let's compare the two.

NCR's Aloha vs Tost

Let's look at TOST

TTM revenues of 1.2 billion (over 75% comes from their FinTech solutions)

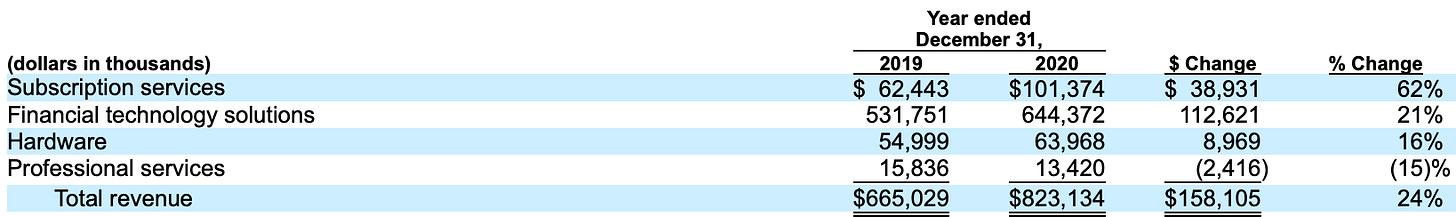

Two-year CAGR is skewed due to their growth from 2021 to 2020 being much larger than 2020 to 2019.

Revenues grew 24% in 2020 when looking at 2019 and when looking from 2021 to 2020 revenue growth is over 100% YoY.

Here are the revenue breakdowns from 2019 to 2020 and again looking at the first 6 months in 2020 to 2021.

Let's look at NCR's Hospitality Segment, which includes their Aloha Essentials program, that has many similarities to TOST's business model.

Hospitality Segment TTM revenues: ~690 million.

Y.o.Y growth in revenue for this segment is less than 10%, but it's interesting to see the growth in "Aloha Essential Sites", which is their growth in clients using their services, is up 90% YoY.

A visual from their recent earnings presentation.

Here's what Tim Oliver, NCR CFO, had to say about this segment on their most recent earnings call.

"Hospitality's key metrics in the bottom of this slide include Aloha Essential sites and recurring revenue. Aloha Essential sites grew 88% when compared to the prior-year's second quarter and grew 18% sequentially. We expect this rate of growth to also accelerate in the second half of the year."

NCR's management has a lot of conviction that their Hospitality Segment (Aloha Essentials) was going to continue the strong growth into the second half of 2021 and into 2022.

The Conclusion

This is where it becomes interesting. TOST is trading at:

A market cap of 25 billion

TTM sales of 1.2 billion

Price/sales ratio of 21x

NCR, the company as a whole, is trading at:

Market cap of 5 billion

TTM sales of 6.5 billion

Price/sales ratio of 0.80(!)

If we were to give NCR's Aloha Essentials/Hospitality Segment the same price/sales ratio as TOST, on TTM sales of 690 million and a 21x P/S we *should* be seeing a market cap of 14.5 billion -for this segment alone.

NCR did see a recent 6-7% spike in share price off TOST's IPO, but it leaves me wondering. Is the market currently under-pricing NCR or massively over-valuing the TOST IPO?

Top Short Interest Stocks

After AMC's unpredictable rise last week it has me questioning if short-interest plays are on the edge of another breakthrough. Here's a list of the top short-interest plays being discussed on WallStreetBets and their very rough estimate of current short interest as a percentage of float.

Workhorse (WKHS): 39%

Blink (BLNK): 38%

Root Inc (ROOT): 35%

SmileDirectClub (SDC): 33%

Aterian (ATER): 30% *This is not a WSB stock, but comes up a lot around other socials

Ocugen (OCGN): 27%

MicroStrategy (MSTR): 27%

GoodRX (GDRX): 25%

Senseonics (SENS): 26%

Sundial Growers (SNDL): 25%

Goatu (GOTU): 25%

Skillz Inc (SKLZ): 23%

Bed Bath & Beyond (BBBY): 22%

Many of these short-interest names are trading at 6-month lows. It could be an interesting play to pick up shares in companies you think might be having a turn-around in their business and the outlook is looking good. Short-interest plays are extremely risky, as always, do your own DD before entering any positions.

WallStreetBets - Most Mentioned Equities

Tesla was the clear winner this week in terms of ticker mentions and popularity. The remaining top 5-6 tickers are either short-interest stocks or have been beaten up badly in the last two weeks. Keep note of these.

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.