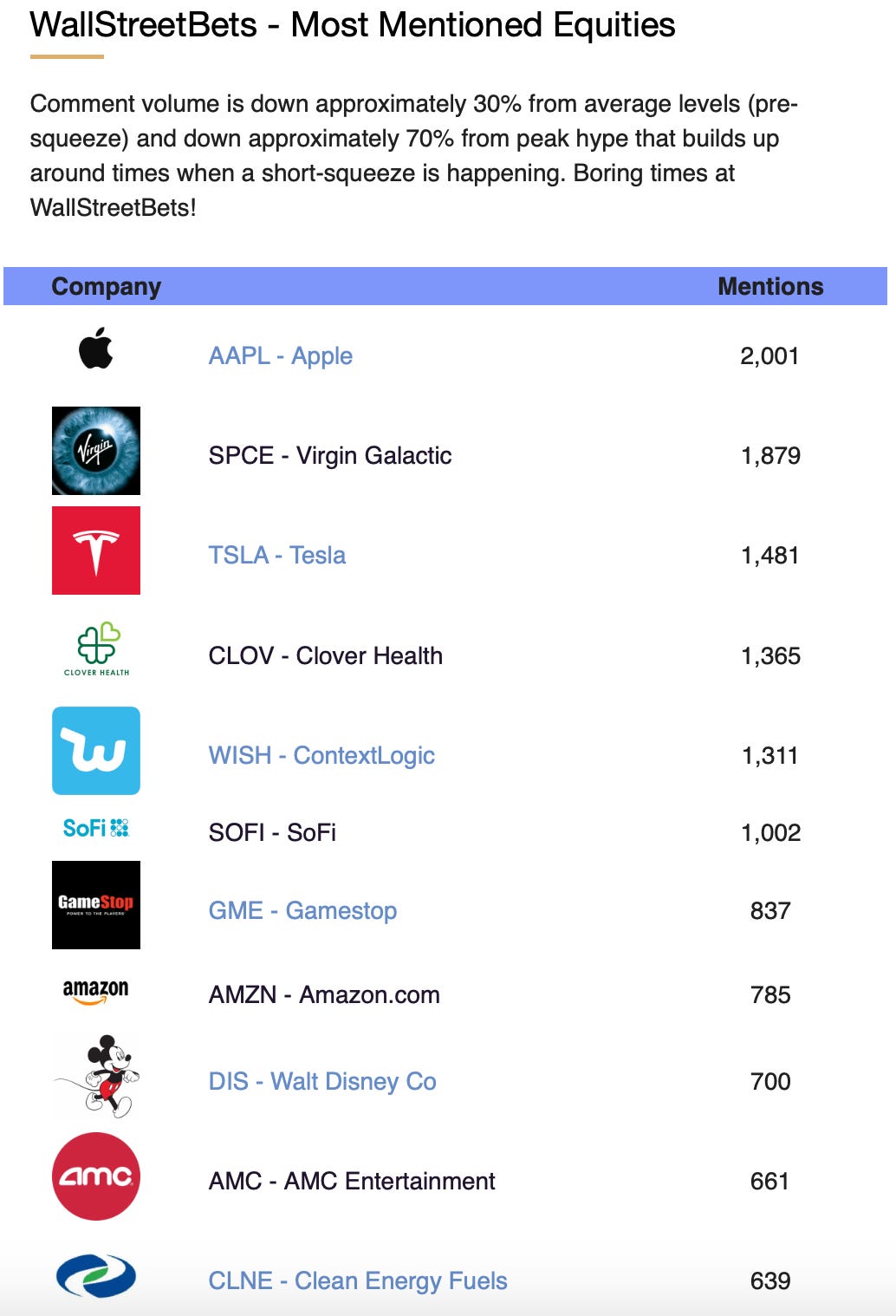

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together With...

July 18, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. In last week's edition I went over some important elements of the short-squeeze and what are generally the key drivers of momentum. Today I bring you a complete short-interest report for stocks that seem to driven from popularity by means of social media.

This Week's Letter

Market Update

Investing in Wine with Vinovest

Short Interest Report

Trending Tickers

Market Update

Markets have been frothy for what feels like the larger part of the year now. Will we see a continuation of the great bull run that lasted almost a decade coming into 2021? I sure hope so, however, it's almost as if every headline that comes out has a negative effect on the market.

Delta/lambda covid variants = Bad for markets

Potential lockdowns = Bad for markets

U.S 10-Y yields ticking down = Bad for markets

U.S 10-Y yields ticking up = Bad for markets

Inflation transitory = Bad for markets

Inflation not transitory = Bad for markets

Jerome Powell hinting they will do what's necessary to keep inflation under control = Bad for markets

Jerome Powell hinting they are a long way's away from raising rates = Bad for markets

You are starting to get my point, but I don't see many catalysts for the market until we get out of this current state of frothiness.

Personally, I do think inflation is transitory as there has been a shock to supply chains throughout covid. Last year during lockdowns demand went down greatly, which led to a decrease in supply for most goods. Now with everything re-opening we have supply chain issues that are being exacerbated by labor shortages, chip-shortages greatly affecting the auto-industry, and transportation/freight costs that have nearly tripled. Someone will need to pay for these added input costs, and usually that will be the consumer.

When people see the word "transitory" they assume that it will all be fixed within 3-6 months, but this could be something that lasts a year or two until we get back to what we used to remember as normal. Everyone is making a big deal about how used car prices have soared nearly 20-30% this year, but of all car brands Ford alone announced that due to chip-shortages they are producing 50% less cars in Q2 2021.

Following through from the last edition of Swaggy's Top Stonks I've put together the short interest report below.

... But first, a quick word from our sponsor...

Investing in Wine with Vinovest

Did you know fine-wine-related investments have outpaced the S&P 500 over the last twenty years? Now you can get away from the hustle and bustle of this volatile market by investing in blue-chip wines.

An activity that used to be reserved for only the elite has become a lot more accessible. With the technology platform Vinovest, anyone can now invest in fine and rare wines. Vinovest works like any other financial services platform, but instead of stocks, it’s all about wine. Check it out.

*This is an ad.

The Short Interest Report

Last week I went through some popular stocks that either have a high short-interest, or that tend to follow similar price action to the short-squeeze movement. Today I'm going to be breaking down a lot of the data and looking at the charts for these tickers. With short-interest stocks there are a few factors that are a potential driving force of the squeeze, these are:

Shares Float (how many shares are publicly available to trade). Lower = Better

Short Interest of Float. Higher = Better potential for a squeeze

Previous Social Popularity. Higher = Better as more and more people likely to get in, as well as media outlets picking up a story (click-bait headlines).

Many retail traders love FOMO-ing into these plays after they've already shot up 50% in two days, but why? When you see a stock that goes up by so much each day the fear of the "what could have been" trade can really hurt.

I'm not saying these are great investments for a long-term hold, after-all these stocks are heavily shorted for a reason. Funds (I would assume) have put a lot of research into these companies before initiating a short position. For someone looking to play the short-interest trade, why not get in during times when the hype has died off rather than buying at the top?

Remember, high short-interest stocks are extremely volatile, as always please do your own research before entering any positions.

There are a few categories of tickers I will be breaking down today, these are:

Main short-squeeze stocks

Alternative-squeeze stocks

Weed stocks that track the squeeze

Other popular short-squeeze stocks

Less popular short-squeeze stocks

The all-inclusive list of "high short-interest" stocks is pretty large so the current list of stocks below have been picked out based on their "popularity" with retail traders using historical SwaggyStocks social data. Thus, there might be some stocks with 40% short interest that do not make it to this list, mainly because they aren't popular among the retail crowd.

Let's begin.

*Short interest data has been taken from FinViz.com. Always double check short-interest data as it changes daily and most sites do not always have the most up-to-date data available.

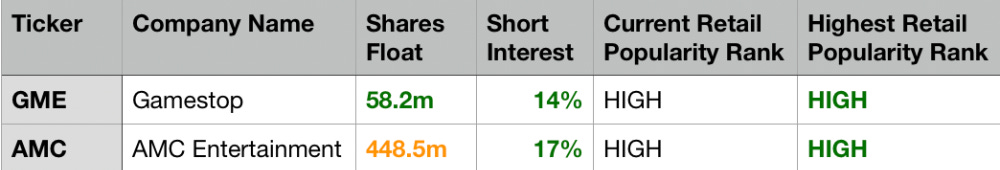

Main Short-Squeeze Stocks

Tickers on the list:

Gamestop (GME)

AMC Entertainment (AMC)

The Data

Their Charts

Alternative Squeeze Stocks

What are these stocks? These are names that join in the short-squeeze fun with similar price action, although they have rather low short-interest. Why has this happened both times in the past? I'm not quite sure.

Tickers on the list:

Palantir (PLTR)

BlackBerry (BB)

Nokia (NOK)

The Data

Their Charts

Weed Stocks

Another odd event that happened both in January/February, and recently in June was that popular "weed stocks" also took off. The most popular names were Tilray and Sundial Growers (SNDL), but I've included an additional ticker I found that has a medium level of short interest, extremely low float, and has some popularity among sources that discuss weed stocks. The ticker is VFF.

Tickers on this list:

Tilray (TLRY)

Sundial Growers (SNDL)

Village Farms (VFF)

The Data

Their Charts

Other Popular Short Interest Stocks

These tickers are all classified as "high short-interest" and are also popular among social sentiment (although less popular than GME and AMC). This would be like "tier 2" of short-squeeze stocks.

Tickers on this list:

Clover Health (CLOV)

ContextLogic (WISH)

Workhorse (WKHS)

Petco Health (WOOF)

Academy Sports (ASO)

FuboTV (FUBO)

Ocugen (OCGN)

The Data

Their Charts

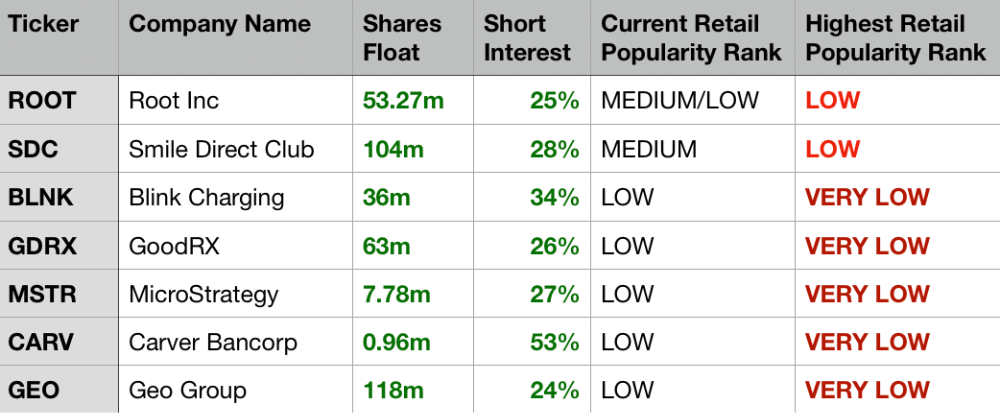

Less Popular Short Interest Stocks

These names are high short-interest, but talked about the least around socials and WallStreetBets. This would be like a "tier 3" of short-squeeze stocks.

Tickers on this list:

Root Inc (ROOT)

SmileDirectClub (SDC)

Blink Charging (BLNK)

GoodRX (GDRX)

MicroStrategy (MSTR)

Carver Bancorp (CARV)

Geo Group (GEO)

The Data

Their Charts

Closing Thoughts

Any play that is based on the sole analysis of being "high short-interest" will be a risky play. However, this new "asset class" has been somewhat of a trend so far in 2021. Looking at the charts and hype around social media it is quite evident that many retail traders only begin joining the action on day 3, 4, and 5 after the squeeze has already begun. The best risk to reward would most likely be at some point between the end of one squeeze and before the next (thanks captain obvious). Browsing the charts it seems like it's quite possible we are in that area right now. The only problem is we don't know when or even if another squeeze is coming, but at least we can be somewhat prepared.

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.