Swaggy's Top Stonks

Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

July 11, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing. If you are on Gmail, please "star" the email or move from the spam to your inbox folder. I've had some reports of people not receiving their emails and this helps A LOT.

This Week's Letter

Market Update

How I Find High-Confidence Plays

IPO Briefing

Robinhood S-1 Breakdown

The Swaggy Terminal

Trending Tickers

Quick Survey - Content Preferences

If you love the content of this newsletter then skip this section. If you have a preference of which kind of content you like to see MORE (ie: Short-Interest list, sentiment reports, IPO brief, due-diligence snippets), then here's a quick 5-question survey you can take to put in a request for content that is more specific to your wants and needs. SwaggyStocks is always trying to improve so your feedback is important.

Market Update

Stocks traded mixed this week as Covid-19 Delta strain fears kicked in and Japan went into state of emergency over a surge in cases.

What else was happening in the markets? Chinese tech stocks are taking a tumble after China President Xi Jinping banned the Didi app (Uber for China) from all app stores. Didi was violating laws in the way they were collecting and using personal information. This comes only days after Didi IPO'd in U.S markets which is now seeing class action lawsuits spring up against the company. This was a huge risk that should have been declared in Didi's S-1 filing.

Following this news, China is now cracking down on all domestic companies that file for public listing on U.S exchanges. Here's a snapshot of what I think really went down.

There's a new kid on the block when it comes to greatest investors of all time. Step aside Warren Buffet, Nancy Pelosi is in the house. According to this Bloomberg article Nancy Pelosi's husband, Paul Pelosi, made a bullish bet on Google, Microsoft, and Apple back in June that netted him roughly 5 million in profit. According to the article, the trades came "just a week before the House Judiciary Committee advanced six bipartisan antitrust bills, four of which take aim at Google, Amazon, Apple and Facebook. Market reaction was muted, suggesting that investors don’t see the House proposals as a real threat to the companies."

This begs to ask if Congress should be allowed to trade stocks in individual names? Nancy Pelosi is officially the 2021 version of the Wolf of Wall Street.

How I Find High-Confidence Plays

Since Swaggy deals with trending stocks and sentiment quite often I get asked a lot "What's going to be the next stock to take off?". The truth is, it's next to impossible to predict which stock will land on the moon next. What we can control is looking for set-ups and opportunities where the probability of something good happening to the stock is in our favor versus FOMOing into the trade after an 80% short-squeeze just happened.

One platform that I recently adopted into my daily investing regime is the amazing VigTec platform (I am an affiliate). They offer a wide variety of tools for every craftsman (and crafts-woman) looking to improve their investing. The ones I use the most are the live charting with volume profile and gamma exposure, and the almost infinite unusual options activity scans.

I'll plug my affiliate code here, but VigTec just recently changed their pricing model to be ultra-competitive for this industry. They've dropped the premium price from $75/month to $50/month. They have a 7-day free trial so give that a go, when signing up on the web-app version you can also apply the code SWAGGY10 to receive $10 off per month, forever. I've tried every Unusual Options Activity service and VigTec's advanced analytics and data-streaming literally eats their competitor's lunch. They also have an awesome mobile app, but the discount MUST be applied on the web-app version first.

Everyone's investing style is different. Some people chase momo (momentum), some swing and day trade, and some (like myself) patiently wait for high-confidence setups. Here's an example I posted to Reddit 1 month ago (I also shared this in the newsletter for those that remember) where I entered AMD at $80 and I just recently sold last week at $95 per share. I have about 250 stocks on my watchlist that I monitor frequently. If I see something I like, I'll enter the trade otherwise I simply wait patiently. I'll go through how I find my setups.

For those wondering what's on my watchlist. Around 40% are high-growth tech stocks, the rest are the top of their class for their industry or category (banks, cloud/data-processing, e-commerce, inflation hedges, healthcare and tele-health, China stocks, content streaming, retail, semis, Fintech, the list goes on).

Technical Setup + The "Launchpad"

I previously commented on both of these stocks where I pointed out a nice setup, BABA and Palantir (PLTR). Palantir has been trading at a critical level I like to call the "launchpad". The launchpad is when a ticker has been consolidating in one zone for some time and is nearing an area where the trading volume is beginning to thin out. Check out this chart.

From this chart we see two things. First, Palantir has traded at the $22-25 range for about 4 months (consolidation). Second, the right side of the chart shows the volume of shares traded at each price of the stock. Several weeks ago I commented that PLTR was nearing the "top" of the volume profile where the lines were still quite thick. I call this the launchpad because anything above or below the thicker area of lines inside the yellow box will sometimes provide a break-out in that direction (less volume of shares traded in that area). This is of course until a new volume profile naturally develops. Last week Palantir hit $27 and was quickly rejected back down. The stock is still above the "bullish" trend line ($22 roughly) so personally I will not jump ship just yet.

Gamme Exposure (GEX)

Those of you not familiar with Gamma Exposure, simply put it is a force similar to a short squeeze where market makers are buying shares in order to maintain neutral positions on options they sold to big players or retail traders. This is one of my favorite indicators to watch. Here are two examples for PLTR and BABA that are quite different from each other.

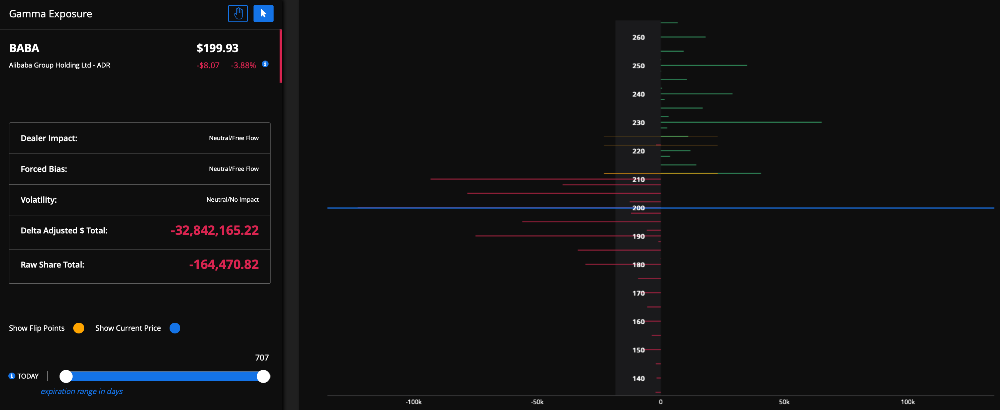

BABA - GEX

The right side of the chart shows the blue line (current stock price) with the gamma exposure at each level of stock price. BABA is in somewhat of muddy water right now and GEX doesn't show any upside repositioning by the dealer (market makers). Bullish GEX exposure = very low

Lets take a look at Palantir (PLTR) this time. I use these tickers only because they are familiar and I've mentioned them in previous newsletter editions.

Palantir (PLTR) - GEX

Right from the get-go we can see much more orderly gamma exposure to the upside at stock prices relatively close to the current level. On the left side the "Forced Bias" is describing upside repositioning which means as the stock price climbs the dealer will need to purchase shares to remain neutral on their positions. As the stock price climbs into higher levels of the green GEX, there will be more pressure on dealers to purchase shares of the stock.

So what does all this mean?

Finally, how I use these charts is to find tickers with a risk-profile that suits my investment strategy. There's always a time to chase momentum stocks on lotto plays, but personally I only have a small allotment for those kinds of trades. Remember, everyone invests and trades differently, so it's important to find something that works for your style. In the following weeks I'll go through how Gamma Exposure (GEX) can actually build up over time as big players accumulate positions in call options.

If you want to take a look at these charts for yourself, give the VigTec 7-day free trial a go. I highly recommend it.

*I am an affiliate for VigTec

Disclosure: I am long BABA and PLTR shares.

IPO Briefing

We have quite a few IPO's taking off next week. What's on Swaggy's radar? Let's take a look at these 2 hot IPOs: BlendLabs (BLND) and Sera Prognostics (SERA).

BlendLabs (BLND) - Financial Services

IPO Date: July 16, 2021

Company Overview: BlendLabs offers digital banking products that include deposit accounts, vehicle & personal loans, credit cards, home equity, and mortgages.

Business Model: Blend provides white-label financial products through software-as-a-service (SaaS) agreements and collects commissions and transactional fees on those products.

Key Metrics: Blend processes more than $5b in loan volume per day for leading financial firms. They serve:

31 of the top 100 U.S financial services firms.

24 of the top 100 U.S non-bank mortgage lenders.

1.4 million banking transactions in 2020, 190% growth from 2019.

162% dollar-based net retention rate in 2020.

98% pro-forma revenue growth

33 billion serviceable addressable market

As of March 31, 2021 the number of participants in the Blend ecosystem has grown 1,300% YoY from the year prior.

Similar Companies: Meridien Link (Private), Figure (Private), LendingTree (TREE), SoFi (SOFI), Upstart (UPST)

Financials:

2019 revenue: 50.7 million

2020 revenue: 96 million

Growth: 90% YoY growth rate.

Offering: 20 million shares priced between $16-18 seeking to raise up to $360 million.

Valuation: With this offering Blend will be valued at roughly 4 billion, giving it a price to sales ratio of 10x (based on expected 2021 revenues).

Underwriters: Goldman Sachs, Allen & Company, Wells Fargo, and others.

Sera Prognostics (SERA) - Healthcare (Pregnancy)

IPO Date: July 15, 2021

Company Overview: Sera operates a woman’s healthcare diagnostics services company that utilizes proprietary solutions to discover, develop, and commercialize clinically meaningful biomarker tests (blood tests finding abnormal conditions) with a focus on improving pregnancy outcomes. They use a large survey of blood samples combined with machine learning and AI to provide advanced statistical analysis. Their vision is to provide actionable information to pregnant women that will improve neonatal health while reducing healthcare costs.

Business Model: At the moment the company does not generate material revenues from the commercial sale of tests. They have recently signed the Anthem agreement for the sale of their tests and are continuing to negotiate private payer insurance contracts that could eventually result in revenues.

Key Metrics:

Partnered with Anthem, who covers more than 10% of U.S pregnancies, to make Sera’s PreTRM test available to clients as part of their contract.

Expects to incur significant net losses over at least the next year, mainly as a result of commercialization of their PreTRM test and to support additional research and clinical studies.

Sera currently does not generate any significant revenue.

Financials: Incurring net losses of $(19.8) million in 2020 and a net loss of $(16.5) million in 2019.

Offering: 4.7 million shares priced between $15-17 seeking to raise up to $75 million.

Underwriters: Citigroup, Cowen and Company, William Blair

Deep Dive into the Robinhood S-1

Our partner site, TheStonksHub, did a deep dive analysis on the Robinhood (ticker at IPO will be HOOD) S-1 last week. The conclusion? Over 75% of ALL their revenue comes from payment for order flow (PFOF). Their largest source of revenue? Citadel. Interesting indeud.

Read the complete S-1 breakdown for free.

The Swaggy Terminal

In the last edition I highlighted a new feature added to the SwaggyStocks website, The Swaggy Terminal. The "Terminal" is a one-stop shop for correlating any kind of social sentiment to a trending ticker. It tracks WSB hype, social popularity, as well as news sentiment to see how coverage on a ticker changes with hype. It's interesting to see that there are many correlations between all the data-sets. Here's a news sentiment chart for Virgin Galactic (SPCE).

News coverage and volume of news articles seems to increase as the stock price goes through larger swings. Is the news reactive or predictive? Hmmm.

SwaggyStocks will always do our best to remain completely free for our users. If you'd like to support our servers and the cause, here's a link to our Patreon.

If you enjoyed this read, why not share it?

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.