Swaggy’s Top Stonks. We compile and analyze data from multiple sources bringing you the top trending tickers from around the internet. If you haven’t subscribed already, please do so below.

Swaggy's Top Stonks

Together with... The Motley Fool

November 25, 2021

Welcome newcomers to Swaggy's Top Stonks and thank you for subscribing.

Hope everyone is having a great Thanksgiving and enjoy the shortened trading week.

Today's edition will have a bite-sized market break-down of everything relevant going into tomorrow and next week.

This is a new format and if you like it (or hate it) then shoot us a reply to this email!

Today's Letter

Market Break-down

U.S Equity Market

News Stories Moving Markets

Notable Market Movers

Analyst Downgrades/Upgrades

Crypto

Trending Tickers

U.S Equity Market

As a reminder, the market will reopen on Friday with a 1:00 p.m. ETclosure.

· S&P 500 +25.2% YTD

· Nasdaq Composite +22.9% YTD

· Russell 2000 +18.1% YTD

· Dow Jones Industrial Average +17.0% YTD

The S&P 500 gained 0.2% on Wednesday, overcoming an early 0.7% decline, as the market adjusted to the thought of the Fed tightening policy more aggressively. The S&P was up 29bps from the European close to finish ¼ % higher on the day (4,701). The index shrugged off early losses and rallied closing at the intraday highs after a lower PCE and hawkish Fed minutes.

The Nasdaq Composite (+0.4%) and Russell 2000 (+0.2%) also completed their own comebacks, while the Dow Jones Industrial Average (-0.03%) closed fractionally lower.

Six of the 11 S&P 500 sectors closed lower while five closed higher. The real estate (+1.3%) and energy (+1.0%) sectors outperformed in positive territory. The materials (-0.7%) and consumer staples (-0.3%) sectors underperformed with modest declines.

Expectations for a more aggressive Fed were corroborated by the latest economic data and Fed commentary: the FOMC Minutes from the November meeting noted that "some participants preferred a somewhat faster pace of reductions that would result in an earlier conclusion to net purchases." Weekly initial claims (199,000) fell to their lowest level since Nov. 15, 1969. The Fed's preferred inflation gauge in the PCE Price Index was up 5.0% yr/yr in October.

The market had already been pricing in this thinking, but it's worth noting that the probability for a rate hike in May 2022 increased to 54.9%, versus 45.4% yesterday, according to the CME FedWatch Tool. The fed-funds-sensitive 2-yr yield rose three basis points to 0.64%, leaving it up 13 basis points since Friday.

The 10-yr yield declined two basis points to 1.65% after brushing up against 1.70% in the morning. The turnaround in the 10-yr yield was cited as a supportive factor for the rebound in the growth stocks, after the tumultuous start to the week for growth stocks as long term rates rose 9bps on Mondaypost Fed chair Powell’s nomination for second term.

Tech rebounded, ending in positive territory after languishing in negative territory for much of the day. Services the leader today and Software the laggard, weighed down by ADSK (15.5%) on below-consensus guidance.

Overnight USD has drifted, treasuries are unchanged and commodities are mixed. WTI crude futures were unchanged at $78.37/bbl.

Initial jobless claims hit a 52 year low and fell 71K w/w to 199K, beating estimates for 265K and lowest since 1969. However some early reads pointed to impact of seasonal adjustments (claims were up 18K w/w excluding seasonal adjustments)

New home sales increased 0.4% month-over-month in October to a seasonally adjusted annual rate of 745,000 from a downwardly revised 742,000 (from 800,000) in September. On a year-over-year basis, new home sales were down 23.1%.

(Source: FinViz)

5 Stocks in an Opportunity That Could Be 23X Bigger than Netflix

The impact of streaming has hit the economy with such force that it’s simply too big to ignore and as the industry continues to evolve, more and more companies are looking to cash in.

The Motley Fool has a knack for seeing the real story behind stocks. And it’s led to:

Investing in Amazon in 1997 before ecommerce took off

Investing in Netflix in 2003 before streaming media was even a thing

Investing in Apple in 2008 before the iPhone revolutionized the telephone

With the rise of these alternative media opportunities, we’ve come up with our top five stocks that we think are battling Netflix for entertainment dominance.

*This is promoted content.

News Stories Moving Markets

Pinterest to spend $50M to settle discrimination suit filed by holders - Business Insider

Citing terms of the settlement announced post-close by Rhode Island Treasurer SethMagaziner, Business Insider reports that the company is committing $50M to diversity, equity, and inclusion reforms, and it won't enforce NDAs for ex-employees speaking out about mistreatment or harassment in the workplace

Apple: UBS analyst noted modest improvement in wait times for iPhone 13 Pro Max in all key regions. A positive data point for Apple in China with implied shipments for October +85% y/y to the highest total since 2014, from the China

ByteDance is seeking capital to build China's answer to Zillow. - Bloomberg

Twitter updates iOS app to stop tweets disappearing mid-read. - The Verge

Bank regulators will team up to develop crypto rules next year. - Washington Post

Jack Ma's Ant rebrands some credit offerings as part of overhaul. - WSJ

JP Morgan analysts estimate that Amazon will surpass Walmart as the largest retailer in 2022

Stripe ‘Happy’ to Stay Private After Reaching $95 Billion Value -Bloomberg

Notable Market Movers

Notable Gainers

+15.8% ~GLBE~ (Global-e Online): acquiring Flow Commerce, technology based cross-border e-commerce software solutions company, for up to ~$500M. Company will issue to Shopify a warrant for ~$70M in Global-e shares.

+13.5% ~PSTG~ (Pure Storage): 3Q revenue and EPS were above consensus. 4Q revenue guidance was above consensus. Management raised FY22 revenue and operating income guidance

+10.1% ~HPQ~ (HP, Inc.): 4Q revenue and EPS were above consensus. 1Q and FY22 EPS guidance were ahead of consensus

+8.0% ~NTNX~ (Nutanix): 1Q revenue and EPS were above consensus. 2Q revenue and ACV billings guidance was above consensus. FY22 revenue guidance was ahead of consensus.

+4.8% ~DELL~ (Dell Technologies): 3Q revenue and EPS were above consensus. 4Q revenue and EPS guidance were ahead of consensus

+2.7% ~SPOT~ (Spotify Technology): initiated at buy at Benchmark, $300 target.

Notable Decliners

-15.5% ~ADSK~ (Autodesk): 3Q revenue and EPS were above consensus. 4Q revenue and EPS were below consensus. Management narrowed FY22 revenue guidance and raised EPS guidance.

-15.1% ~PLAN~ (Anaplan): 3Q revenue and EPS were above consensus. 4Q revenue guidance was ahead of consensus. Management raised FY22 revenue guidance. Downgraded to neutral from overweight at Piper Sandler.

-24.1% GPS (Gap): significantly lagging a weaker softline retail segment after reporting earnings, revenue, and comps below consensus while lowering FY22 below given continued supply/inventory constraints. Commentary mostly negative including a downgrade to neutral from overweight at JPMorgan, noting the path to 10% operating margins by FY23 appears more challenging.

Analyst Downgrades/Upgrades

Initiations

Spotify initiated at Buy at Benchmark with $300 price target

Upgrades

Nutanix price target raised to $71 from $64 at Needham. Reiterates Buy

Etsy price target raised to $310 from $264 atWedbush. Outperfrom rating maintained

Etsy price target raised to $320 from $245 at Citi. Buy rating maintained

Autodesk price raised to $344 from $324 at Morgan Stanley. Maintains Neutral

ZScaler price target raised too $400 from $325 at Deutsche Bank

Salesforce price target raise to $360 from $330 at Bank of America. Reiterates Buy

Matterport price target raised to $34 from $25 at Credit Suisse. Maintains Outperform rating

Downgrades

Anaplan downgraded to neutral from overweight at Piper Sandler, target to $48 from $77, 8% downside. Cites lower growth estimates for company.

Anaplan price target lowered to $70 from $80 at Canaccord. Maintains Buy

Anaplan price target lowered to $75 from $85 at Wells Fargo. Maintains Outperform

Anaplan price target lowered to $58 from $67 at Goldman Sachs. Maintains Neutral

Anaplan price target lowered to $73 from $80 at Morgan Stanley. Maintains Overweight

Autodesk price target lowered to $310 from $365 at Stifel. Maintains Buy rating

Autodesk price target lowered to $350 from $365 at KeyBanc. Maintains Buy rating

Autodesk price target lowered to $440 from $450 at Credit Suisse. Maintains Outperform

Autodesk price target lowered to $343 from $363 at RBC. Maintains Outperform

Zoom downgraded to Neutral from Buy at Bank of America. Price target down from $385 to $270

Zoom price target lowered to $245 from $275 at Wells Fargo. Maintains Equal Weight

Zoom price target lowered to $235 from $255 at Evercore ISI. Maintains Equal Weight

Zoom price target lowered to $300 from $275 at Stifel Maintains Hold rating

Agora target lowered to $27 from $44 at Needham

CrowdStrike price target lowered to $300 from $320 at Deutsche Bank. Maintains Buy rating

Adidas price target lowered to EUR294 from EUR300 at Credit Suisse. Maintains Neutral rating

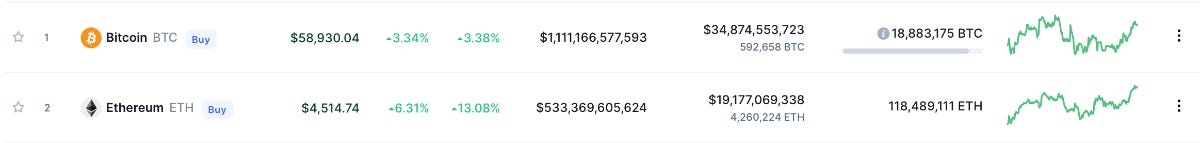

Crypto

Bitcoin trading at below its 50day MA

Ethereum bounced off the 50day MA on Wednesday

Image Source: CoinMarketCap

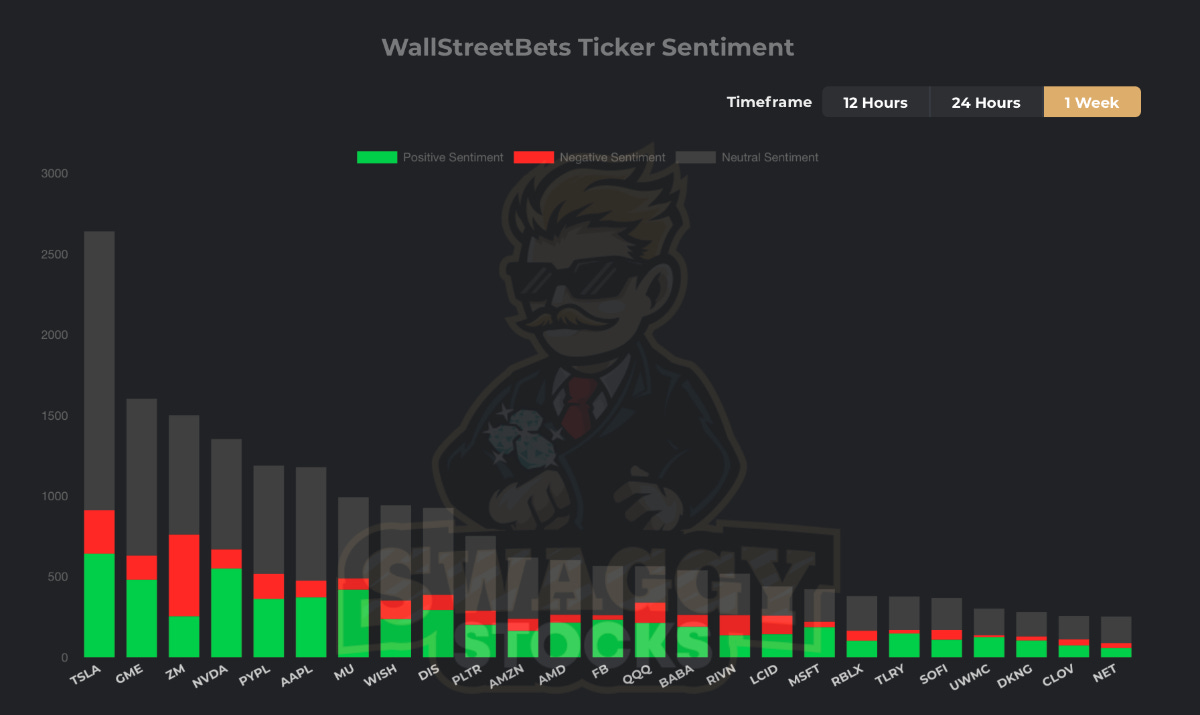

WallStreetBets - Most Mentioned Equities

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.